Current dynamics

Published today at 11:30 (GMT + 3), the Purchasing Managers Index (PMI) for the UK service sector for March came out at 55 (the forecast was 53.5). The publication of the index caused a sharp rise in the pound on the market. The pair GBP / USD jumped as the index was published to the level of 1.2489.

Last week, a revised report on UK GDP for the fourth quarter (+ 1.9% in annual terms against + 2.0% on updated data) was presented. As a result, the pound reacted to the publication of the report on GDP decline. The two previous sessions of the GBP / USD pair were actively declining. Today's publication of the index (PMI) for the services sector may have a short-term impact on the GBP / USD pair.

The pound is under pressure on the background of the beginning of negotiations on Brexit. Last week, British Prime Minister Theresa May signed a decree on the beginning of the British divorce proceedings with the European Union. The beginning of the two-year period of Brexit negotiations on the basis of Article 50 of the Lisbon Agreement is laid. Negotiations should begin within a few weeks. Nevertheless, positive macroeconomic reports from the last weeks coming from the UK indicate that the economy of the country did not collapse after the referendum on Brexit. However, the referendum hit hard on the pound's positions, which lost nearly 20% paired with the dollar to date. The pressure on the pound and the GBP / USD pair is maintained.

The focus of investors' attention on Wednesday will be the publication (at 18:00 GMT) of the minutes from the March FOMC meeting, at which the Fed raised the rate by 0.25% to a level of 1.0%. If the FOMC protocols contain signals for the possibility of three or four rate increases, the dollar can receive significant support.

Also worth paying attention to the publication at 13:45, 14:00 (GMT) of business activity indexes in the US services sector for March and ADP report on employment in the private sector of the US economy. Many market participants consider it a harbinger of the official report on the labor market, which is published this Friday. Therefore, the reaction to the publication of the ADP report is also expected to be high.

Support and resistance levels

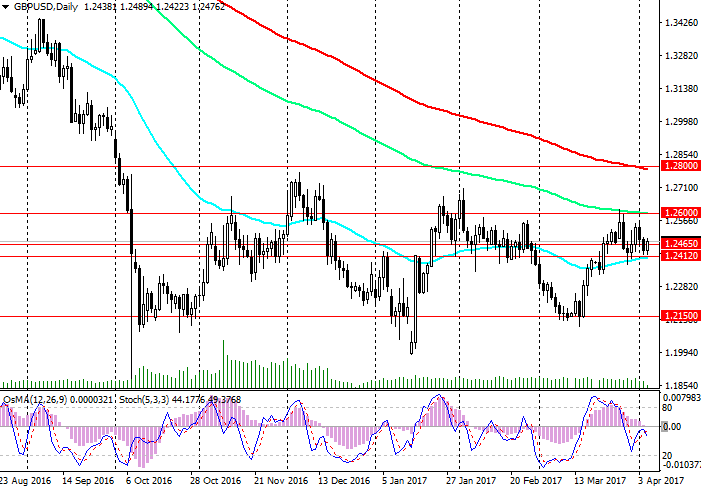

The pound continues to remain under pressure, and the GBP / USD pair is in a long-term downtrend since July 2014. Despite the fact that positive short-term dynamics predominate, in the medium term, the pressure on the GBP / USD pair will continue as long as the pair is below resistance level 1.2600 (EMA144 on the daily chart).

The indicators OsMA and Stochastic on the daily chart continue to remain on the side of sellers.

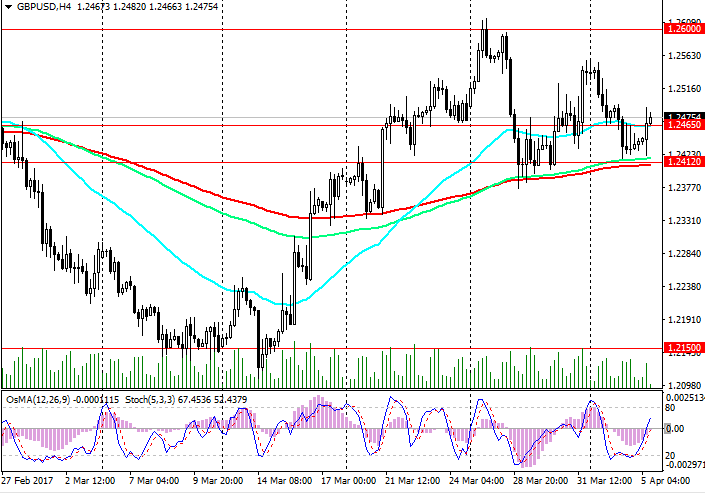

If the GBP / USD pair returns to the zone below the level of 1.2465 (EMA200 on the 1-hour chart), its decline may resume.

The reverse scenario is related with the growth above the level of 1.2465 and further growth to the level of 1.2600.

The different focus of monetary policies in the US and the UK, the exit from the EU are powerful fundamental factors that prevent the GBP / USD pair from recovering significantly. Negative fundamental background creates prerequisites for further decline in the pair GBP / USD, the negative dynamics of the pair GBP / USD is still predominant.

Support levels: 1.2465, 1.2412, 1.2390, 1.2340, 1.2150, 1.2000

Resistance levels: 1.2490, 1.2600, 1.2700, 1.2800

Trading Scenarios

Sell Stop 1.2455. Stop-Loss 1.2495. Take-Profit 1.2412, 1.2390, 1.2340, 1.2150

Buy Stop 1.2495. Stop-Loss 1.2455. Take-Profit 1.2535, 1.2600, 1.2700, 1.2800