Fibonnacci Trading

Fibonacci tools in practice

In this article i would like to write something about fibonacci tools

and probably to show you how to use them in very effective way.

All of us know what are fibonacci numbers so i wont explain

the principle how they work in general meaning but in forex they can be

very usefull. Generaly we can get them by dividing a fibonacci numbers

with another so we get the ratios like this ones :

13/21 = 0.618 * 100 = 61.8%

34/21 = 1,618 * 100 =161,8%

21/88 = 0,382 * 100 = 32,8%

We get these numbers by dividing of many numbers with each other so there are many ways how to get them.

In forex for us are important only some of them. We need some key levels , some key fibonacci ratios :

38.2% , 50% , 61.8% , 78.6% , 127% , 161,8% , 261,8%

Actually the trading with fibonacci numbers is very interesting cause

we can use them alone or with the combination of other indicators or

candles or chart patterns.

For me personally when i use them im using them with the combination

of indicators. Buuuut i will show you both examples . That mean with

usage of formations and with the usage of indicators.

Fibonacci Retracement

We have many fibonacci tools ,... really . In this article i will try

to show them all but for now i would like to discuss ( in my opinion

the most important) fibonacci retracement.

Here we should watch these main levels : 38.2% , 50% , 61.8% and 76.4% of Fibonacci retracemnet. ( if you dont know how to add a new level in Metatrader see the picture 1.)

Picture N1 : Adding of new level in properties of Fibonacci tools

After we have made this adding we should realize one thing . The market

is never going in one direction permanently and after each radical

movement it must typically retrace. Yes you are right the market will

NEVER hit these levels exactly and sometimes it happens that the prize

finish somewhere between them.

How to draw fibonacci retracement CORRECTLY !

Well i think this one is very clear but sometimes we are confused „how to draw the fibonacci retracement. ( Look on the Picture N2 and N3)

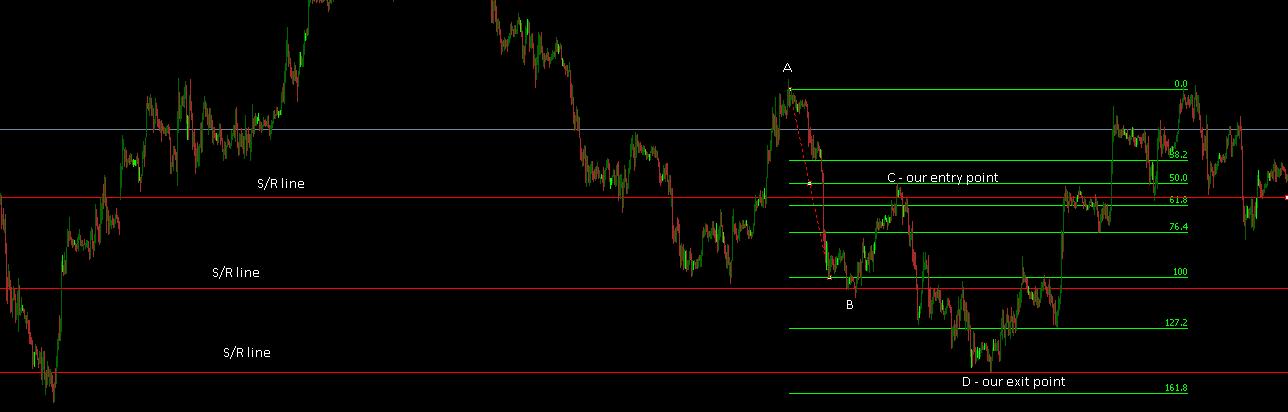

So here on Picture N2 we can see a SELL setup where price is moving from the point A (0.0%) to a swing low at a point B (100,0%) and retrace to point C (61.8%)

So here on Picture N3 we can see a BUY setup where price is moving from a swing low at point A (0.0%)

to s swing high at point B(100%) and retrace to point C (61.8%)

I would say that drawing of fibonacci retracement should be clear for everyone a trader must be familiar with drawing of them.

What is the meaning of fibonacci retracement for target point ?

Lets say that the target point is point D so according to our previous points there are known general formulas for counting point D . So the retracement point C can be calculated by measuring the number of pips from point A to point B and after that by multiplying by factors like on the table:

Fibonacci Target and formula points C or D

38.2% - (B-A) x 0.382 – B = C

50% - (B-A) x 0.5 –B = C

61.8% - (B-A) x 0.618 – B = C

78.6% - (B-A) x 0.786 – B = C

100% - (B-A) x A +A = D

127% - (B-A) x 1.27 + A = D

161.8% - (B-A) x 1.618 + A = D

200% - (B-A) x B + A = D

261.8% - (B –A) x 2.618 +A = D

But nowadays many trading softwares these extensions have so the

calculations are not needed. But for better understading it was

necessary to show how it could be calculated.

The best way how to know if the price is moving in the direction of the main trend . If the price is moving against the main trend we should watch levels like 38.2% ,50% , 61.8% or 78.6% .

Support and Ressistance lines with the usage of Fibonacci retracement.

The trading with fibonacci tools is very effective but not as

accurate asi t could be with the usage of another instruments. The first

type of combination is trading with S/R lines with the combination of

fibonacci tools (retracement).

The general definition of S/R lines is very easy. They are lines or prices where could be a possible turn of the trend .

So lets put this together . We have S/R lines and Fibo retrecament .

These two instruments will give us an apropriate information for our

decision .

Trading with fibonacci retracement.

Step N1. : Setting of S/R lines:

At the beginning we must decide what sort of trade we are going to

make . That means , long term , mid-term , or short term trading.

According to this we should choose a proper timeframe :

Long term trading : 4H ,D1

Mid term trading : M30 , H1

Short term trading / scalping: M5 , M15

(this division is according to ME and it is my opinion!)

So lets choose the Mid term trading - we must have a general view on the graph .So we must zoom out the graph so we should see something like this

I fully understand that there can be drawn more then these S/R line. think the S/R lines from the Picture are very clear. We can say that

the places where the price hit the S/R line is a place where a

potentional change of trend could happen or already have happened.

When we have set our S/R lines now we can combine them with our fibonacci retrecament

So as we can see we have the same S/R line (the red lines) and have inserted the fibonacci retracement (the green one) . As we will study the Picture more properly we will see that basic formation of fibonacci retracement is clear. But there is another beatifull point to mention. The levels 61.8% and 161,8% are NEARLY the same as these two levels . Now how can we use this information for u.

The basic sequence ABCD is clear and it always work for us. We have set

two swings A and B from point B we can make one trade ( if you don’t want

just don’t do that) to the point C which the top SHOULD be logicaly on

the level of 61.8% fibo retre. BUT as we know the market NEVER hit the

levels exactly so what we will do is that we will set our TP on the

level of the S/R line(the red line) which will give us a safe place for

exiting from the trade. After that the market will PROBABLY move

downwars . So we will check the lower time frames to be sure that the

market will fall down and we can prepare for the trade number 2. ( Sometimes it is also good to set trailing stop or moving your SL to secure your profit).

Again the entry point wont be the S/R line because we still

dont know (or we are not still sure ) if the line will act as

a Resistance for the EUR and the price will not continue upwards. That

is why we will set our entry point BELOW the S/R line that means on the

level of 61.8% fibo retre. After that we will watch another levels. It

is up to each trader if he will set the TP on the level 127.2% fibo

retre or lower 161.8%.

But again lets think about it little bit. If we want to set our TP

lower we must set it above the levev of 161.8% . So the value will be

the same as the value of S/R line. As we can see on the picture our TP

would be hit.

Target point and trailing stops

The setting of target point is I think clear . We must always set the TP

also with the help of S/R lines as we can see on the picture. But there

is a still question which levels we should set as our main target

point. Mmmh well each of Fibonacci retracement is in some way important

and also it is very risky to set it higher or deeper as it is a

formation ABCD , because we also have ABCDEF , ABCDEFG etc.

For me personally I have defined all the Fibonacci levels till the

level 261,8% but my decision are dynamic. That means that im deciding

during the trading if I just let it go or will just simply close it. But

lets make a basic and the most safe conclusion from this . USE TRAILING

STOP !

I would say that the usage of trailing stop is very easy. In the case

if you are full time trader and you have the possibility to control and

observe your position you can just set the stop loss and move it as the

position is developing .

That means if our trade is in + pips for example + 50 pips we can secure

with SL the profit of about 25 pips so if there will be some unexpected

huge movement we will still have a profit of about 25 pips.

The combination of S/R lines Fibonacci retracement is very usefull

and effective. I can show you the effectives again on another two

examples

Example of a trade with Fibo retrecament

So we have got here such a situation on EUR/USD M30 graph . As what we have written we will set our S/R lines at first.

We are analyzing the last situation that means tha last downtrend followed by little uptrend and we need to know what will happen next.So the next step is to draw our Fibonacci retracement.

So nice as we can see we have defined S/R lines and fibo retre .

According to this we can see that relevant lines are 50% of fiboretre

where is totally the same our first S/R line and where will be our entry

point to the SELL trade.

The second relevant fibo line is 127.2% where will be our main. TP. Lets see what happened.

So as we can see the price hit our 50% and we have entered to trade. Our TP is clear which is set according to fibo retre and S/R line.

So as you can see our TP has been hit and we take profit. Don’t forget

to set your trailing stop or just move your Stop loss to secure your

profit.

This is only one example so that means you must train and trade a lot

on your demo account. You wont get this to your blood after 5 trades on

demo . We cant say that this method is on 100% reliable but

we can say that from 10 trades 8 will be profitable if and only if your

dedications will be according to some steps .

The success in this case is based on hours of trading on demo account

. After that you will be able to make constant results.

Wish you many green pips !