Factory orders and a speech from Dudley later

It's always nice to return from a long weekend to a light economic calendar. The market is trying to find its legs as cable takes a fresh beating. There were worries about Carney and the services PMI but the news was ho-hum. That gave GBP/USD a bit of a bounce but it's fallen right back to the lows of the day as broad risk aversion hits.

There was a divergence yesterday with commodity currencies rallying despite worries in stock markets. Stock markets have continued to fall and commodity FX has crumbled.

The economic calendar is unlikely to change the theme. Up first is the ISM New York report at 1345 GMT and IBD/TIPP at 1400 GMT. Those aren't market movers.

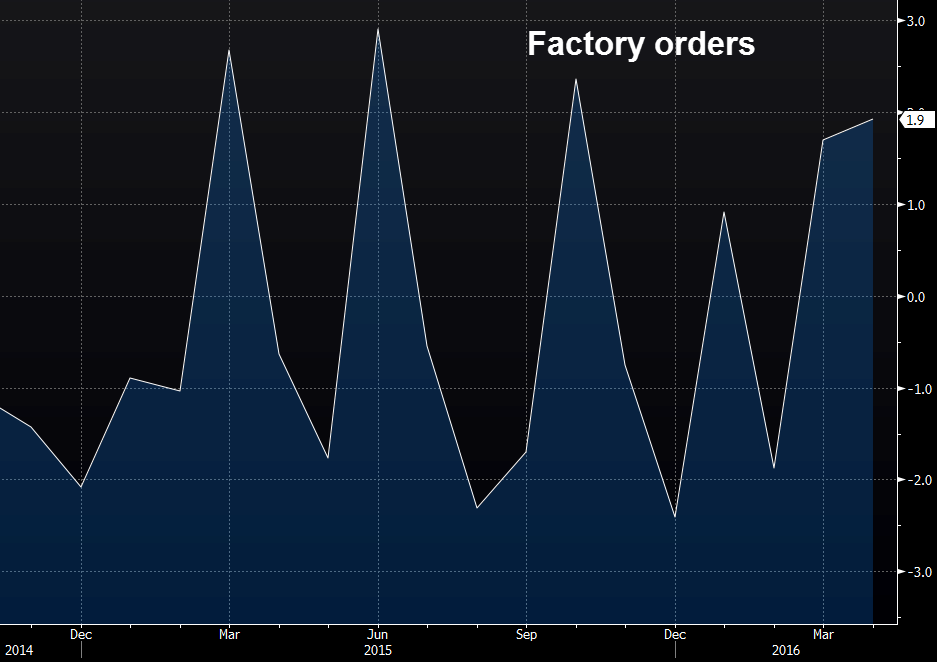

The one to watch is the factory orders report, which is also at 1400 GMT (10 am ET). The consensus is for a 0.8% m/m decline in May. Watch the revisions to durable goods orders as well.

The calendar is quiet afterwards until 1700 GMT when ECB hawk Lautenschlaeger speaks in Frankfurt. Then at 1830 GMT, it's the Fed's Dudley. He's speaking at a roundtable in Binghamton, NY, which usually wouldn't point to anything notable but he's usually not shy to voice an opinion.