FOMC preview from Bank of America Merrill Lynch

Between weaker May jobs data and uncertainty ahead of the UK referendum on EU membership, the markets have completely priced out any chance of a June rate hike. We concur, as this will give the Federal Open Market Committee (FOMC) more time to reassess global risks and incoming US data. While we cannot completely rule out a July hike, the hurdle for a quick improvement in the data and supportive financial conditions is relatively high. Our base case remains a September rate hike.

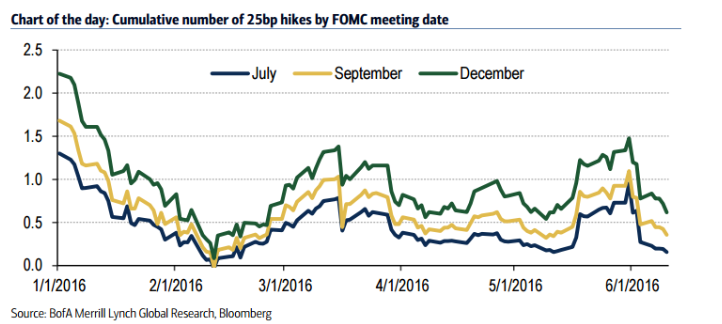

Because this meeting represents a tactical delay by a data-dependent Fed, we do not expect a fundamental shift in the Fed's outlook. As a result, the statement language and Summary of Economic Projections (SEP) are likely to see relatively few and mostly minor changes, other than marking to market as needed. In particular, despite the market continuing to further reduce the likelihood of a rate hike at subsequent meetings (Chart of the day), we think it is not all that likely the median dot will shift down for this year or the next two.

In addition, while Fed Chair Janet Yellen is unlikely to offer any explicit signals on the timing of the next rate hike, we anticipate she will likely affirm that the FOMC expects it will be appropriate to raise rates later this year.

As such, the market may view the outcome of the June meeting as slightly hawkish.