Daily Analysis of Major Pairs for April 18, 2016

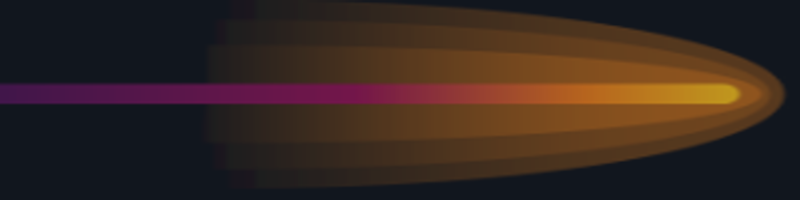

EUR/USD: The bias on this market is getting neutral owing to the consolidation that was witnessed in the last two weeks. Even last week, the price merely corrected a bit lower. This week, the support lines at 1.1250 and 1.1200 should prevent further southwards movement, as the bulls effect a nice rally, which would take the price towards the resistance lines at 1.1400 and 1.1450. Some EUR pairs could also rally this week.

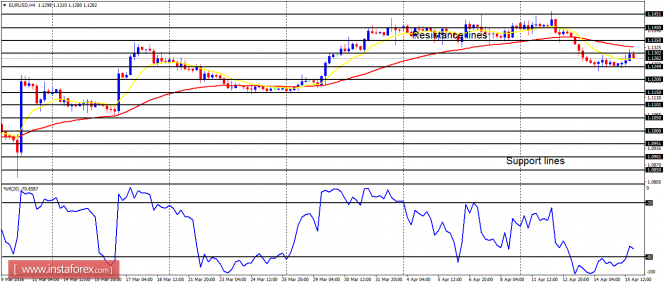

USD/CHF: Although this pair trended upwardly last week in the context of a downtrend, there is not yet a Bullish Confirmation Pattern in the chart. In case the price moves further upwards by 150 pips, there would be a confirmed bullish signal in the market. Nonetheless, there is going to be a bearish journey this week, which would strengthen the recent bearish outlook and enable the price to reach the support levels at 0.9600, 0.9650, and 0.9500.

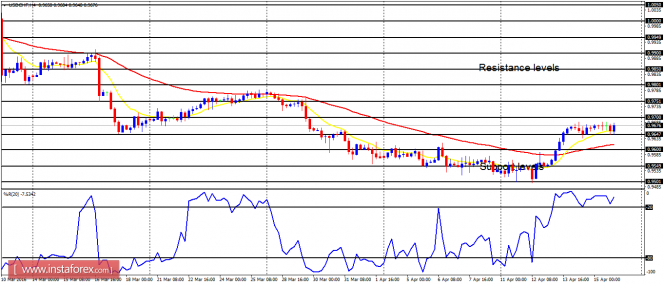

GBP/USD: The Cable was very volatile last week, with no clear victory between bulls and bears. There should be a directional movement this week, which would most probably favor bulls. A wave of rally should carry the price to the distribution territories at 1.4300 and 1.4350 this week. Stamina should also be witnessed on other GBP pairs this week, like GBP/CAD.

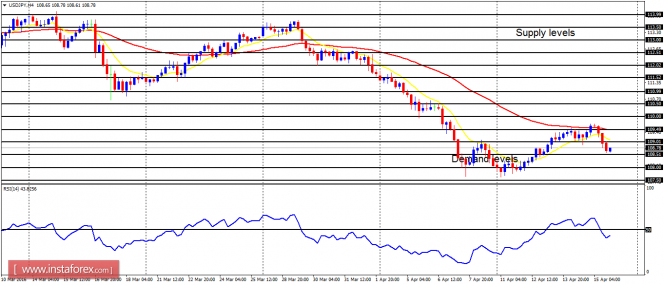

USD/JPY: This currency trading instrument moved upwards by 190 pips between Monday and Thursday last week. On Friday, the price, however, corrected lower in solidarity with an extent bearish bias in the market. Rallies should be seen as short-selling opportunities because the price is expected to trend lower this week.

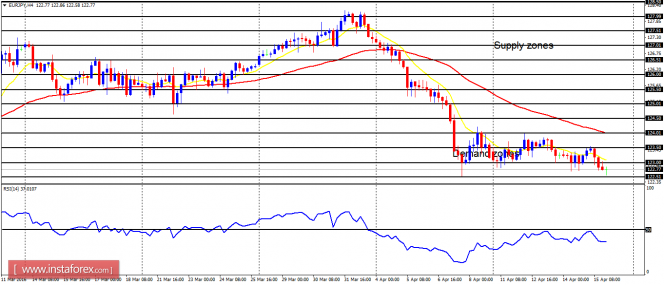

EUR/JPY: The EUR/JPY pair went sideways throughout last week. The market was caught in an equilibrium phase, but there would be a breakout this week. The EUR/JPY cross, which closed below the supply zone at 123.00 on Friday, is expected to trend lower this week, reaching the demand zones at 122.00 and 121.50.

The material has been provided by InstaForex Company - www.instaforex.com