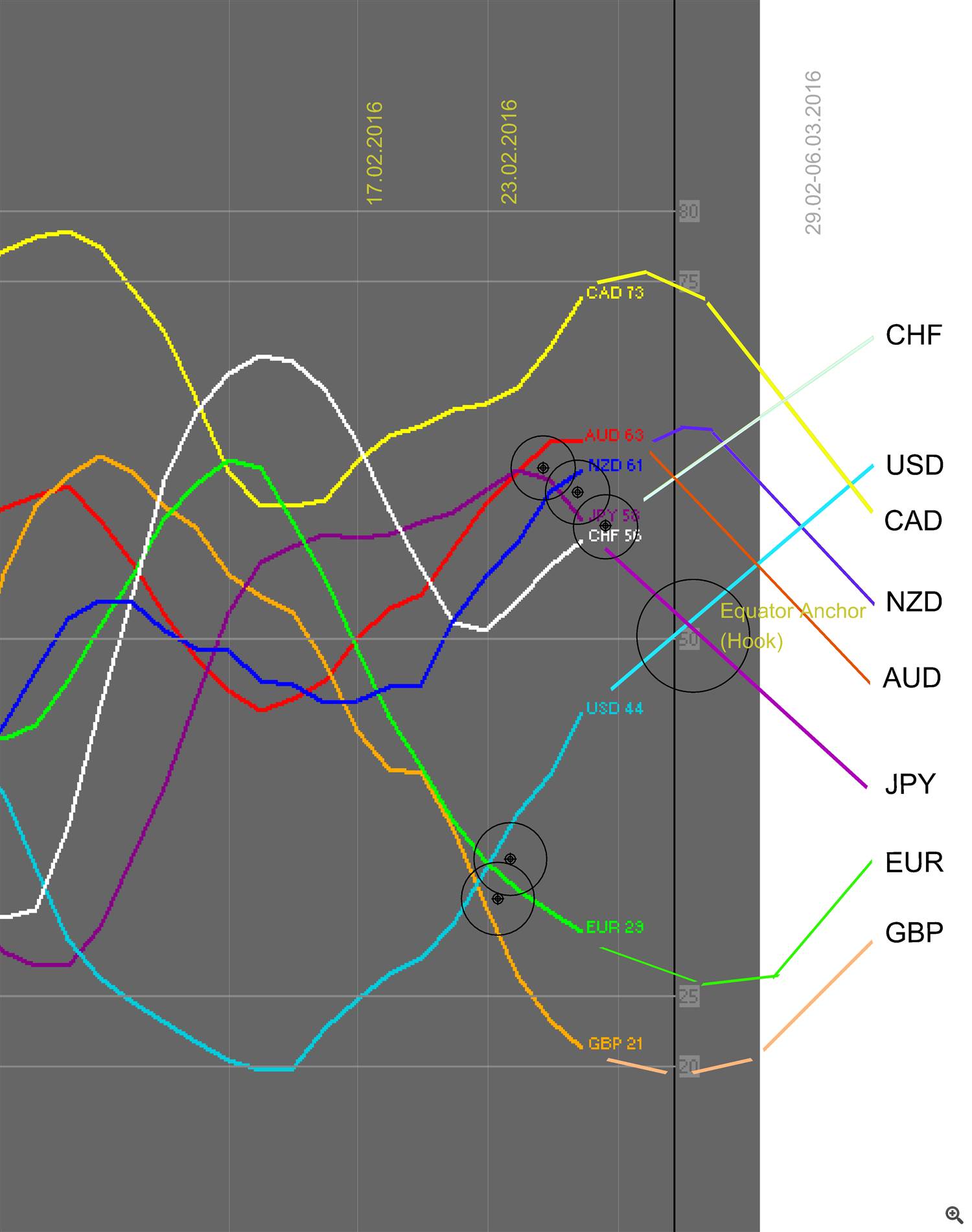

Forecast movement of currency indexes next week 29.02 -06.03.2016.

27 February 2016, 10:22

0

146

Forecast movement of currency indexes next week 29.02 -06.03.2016.

This week, there were the following breakdowns day D1 range of currencies:

1. The US dollar strengthened and USD index broke GBP, EUR.

The dollar index has reached 44,

and this is not the limit, the trend will continue further and the dollar will be released in the middle of the graph -fully foothold on the equator 50,

with the prospect of a hike up to the north.

2. Japanese JPY began to weaken - as evidenced by the overhanging edge of the parabola

multi-currency strength indicator timeframe D1.

The Japanese fell is not much - up to 58 index marks,

with the prospect of a further hike to the equator 50 and further down to the south.

3. Pound GBP dropped significantly this week, and can be said to hit bottom Friday's close, the index of 21 pounds.

4. Canadian CAD to continue its efforts, and today is the most expensive currency, has the index 73.

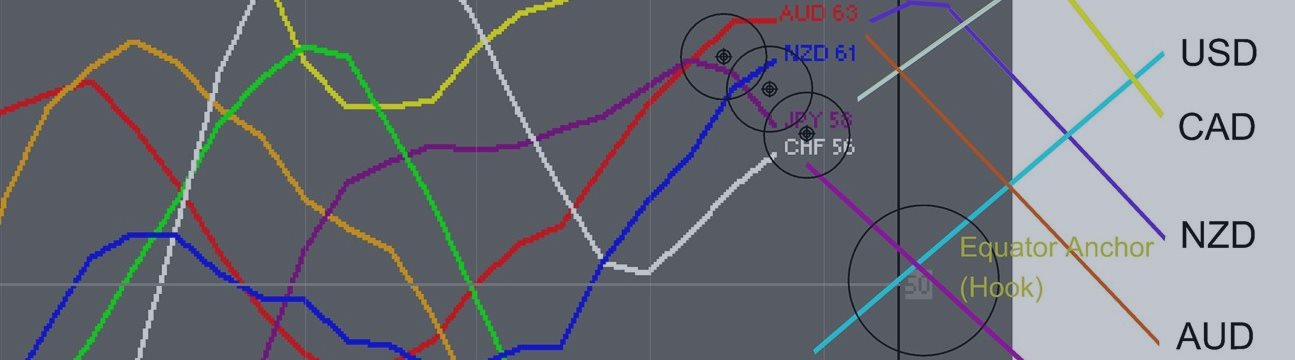

5. Pacific Fleet AUD, NZD strengthened - codes 63 and 61, struck the Japanese index of 58.

6. Swiss CHF increased to 56, although in the last forecast I talked about what the Swiss will fall along with the euro.

But things happened - the Swiss broke the correlation with the single currency, the euro - and went up, throwing his older brother, a European index EUR 28.

while EURCHF formed bag.

What will happen:

The next week, it seems the time when there will be some reversals.

This is evidenced by the overhanging edges parabolas strong currency,

and wrapped up the parabola of weak currencies - which generally form the boxer design Parabolic D1 around a central axis.

This moment is favorable for gradual buying this boxer design for long: a basket of currencies.

A trading plan for the next week - next.

1. It is very likely that amplifies the falling USD and JPY will meet at the equator, the cross formed on Monday s.

Since this event does not happen often on the center line 50 - the mandatory need to buy trend H4 USDJPY buy range.

The pair will serve as a central anchor - anchor the basket, which will gain further.

The second anchor will be the trend, CHFJPY buy

2. Once the anchor purchased by USD, CHF, JPY:

open positions in currencies, which will go on turning.

Turns up to be weaker: GBP pound and the euro EUR,

and down the strong: the Canadian Pacific Fleet, and two CAD AUD NZD.

GBPCAD buy, GBPAUD buy, GBPNZD buy

EURCAD buy, EURAUD buy, EURAUD buy

3. In order for our basket of currencies is not has left a large drawdown -

to associate the anchor currency USD, CHF, JPY on equator,

currencies, which will unfold

GBP, EUR and CAD, AUD, NZD.

this

USDCAD buy, AUDUSD sell, NZDUSD sell

AUDCHF sell, NZDCHF sell, CADCHF sell

GBPJPY buy, EURJPY buy.

I recommend to open buying signals as they become available

Fibo levels at 100, 161, 261 H4 range

and to form the size of lots in proportion ADR.

Four indices that will intensify GBP, EUR, USD, CHF

Files:

index28_27022016.jpg

2048 kb