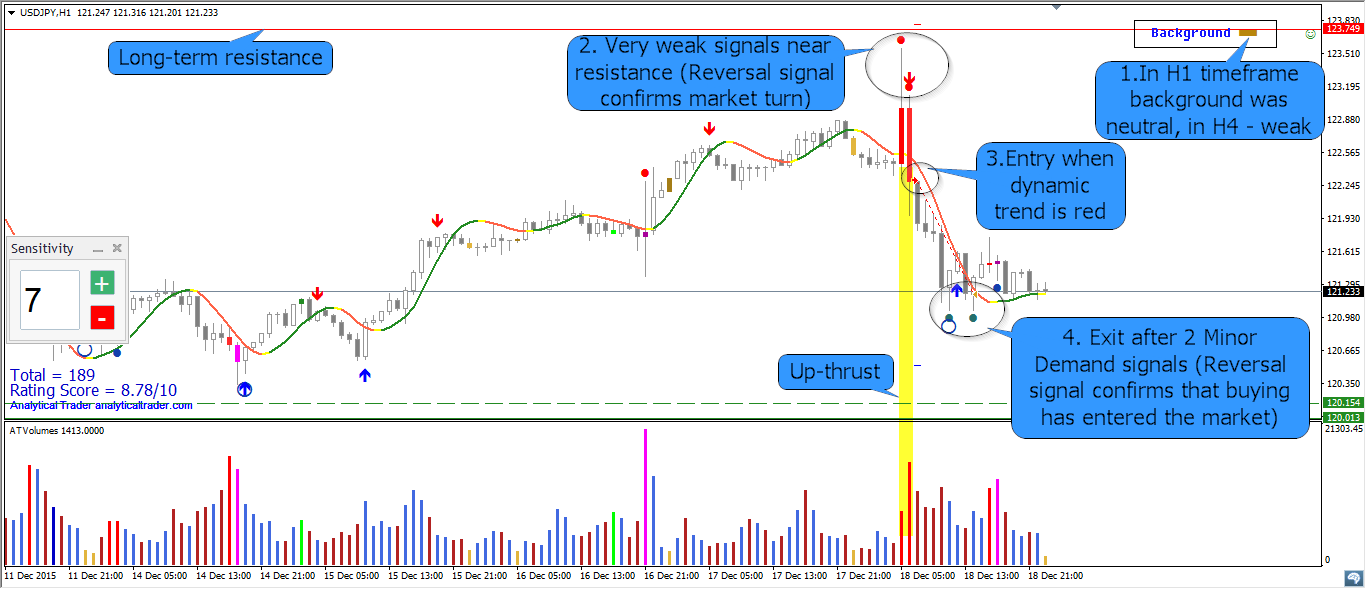

This is a near resistance trade which was opened after up-thrust in USDJPY.

In this chart we have long-term resistance which was created by previous high. At first market was rising, than we had an up-thrust (2 wide spread bars with high volume).

Up-thrusts can be recognized as a wide spread up-bar, accompanied by high volume, to then close in the middle or on the low. Up-thrusts are usually seen after a rise in the market, where the market has now become overbought and there is weakness in the background.

High of the first bar has almost reached the resistance level but closed in the middle. Further weakness showed in the second bar which closed on the low. VSA indicator detected 2 very weak signals here (Major Supply). Reversal indicator also suggested that market can turn in this place.

- In H1 timeframe background was neutral. In this case you should check above timeframe. H4 was weak, so it is o’k for a short trade.

- Several very weak signals (Major Supply). Reversal indicator also confirms market reversal in this place.

- Entry was made when dynamic trend was red.

- Exit after 2 Minor Demand signals (Reversal signal also confirms the exit)

Total: + 110 Pips