There are risks to delaying the start of rate hikes - Fed Chair Janet Yellen

Federal Reserve Chair Janet Yellen is going to be a slightly more optimistic about the U.S. economy added that there are risk of delaying the start of rate hikes as she said at the Economic Club of Washington: the U.S. economy is improving over the few years pushing the inflation to the target of 2%. Besides, Yellen appeared to be supporting a rate hike in December by noting that there are risks if the central bank delays the normalization of monetary policy but, anyway - monetary policy is still likely to remain 'accomodative.'

Yellen also provided her optimistic outlook by acknowledging continued

weakness in the labor market and low inflation which are two major risks to the

current economy recovery for now. She said that although the labor market has

improved - we can not declare that the labor

market has reached full employment.

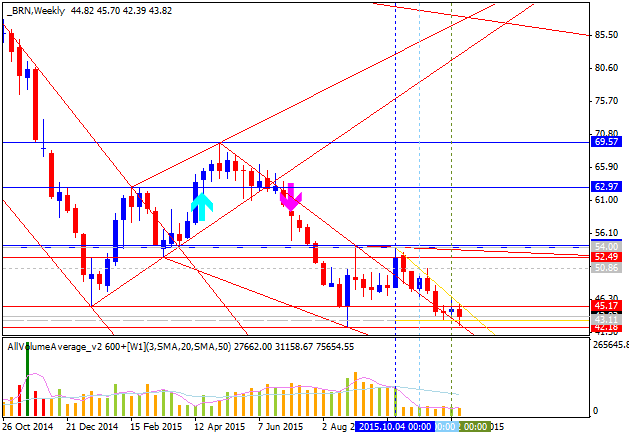

Concerning the inflation, Federal Reserve Chair Janet Yellen stated that the strong U.S. dollar and low energy prices are pushing down consumer inflation.

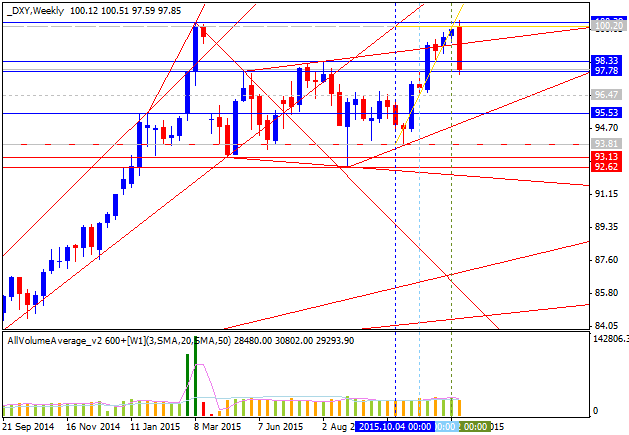

By the way, the key psy resistance level at 100.00 is going to be broken by Dollar Index soon or later: the price is on primary bullish market condition. And there are 2 main scenarios for the movement from right now: less bullish or more bullish. As to Crude Oil prices so 10 month low at 42.18 is going to be broken by the price soon as well. And in this case - the main question is the following: are very strong dollar with very low oil prices the really good for the economy for 2016 for example?