Hi guys,

we were often asked how to trade with our Blueball PRO series trading tools.

So let's explain our trade selection at a trading example on CADJPY of the last week.

General rule:

Don't trade pairs where both currencies are from the same continent.

Their economic areas and currencies are usually closely linked.

So we are just looking for "cross-continent" pairs.

click here to get your professional trading toolset

Let's start with our in-depth market analysis:

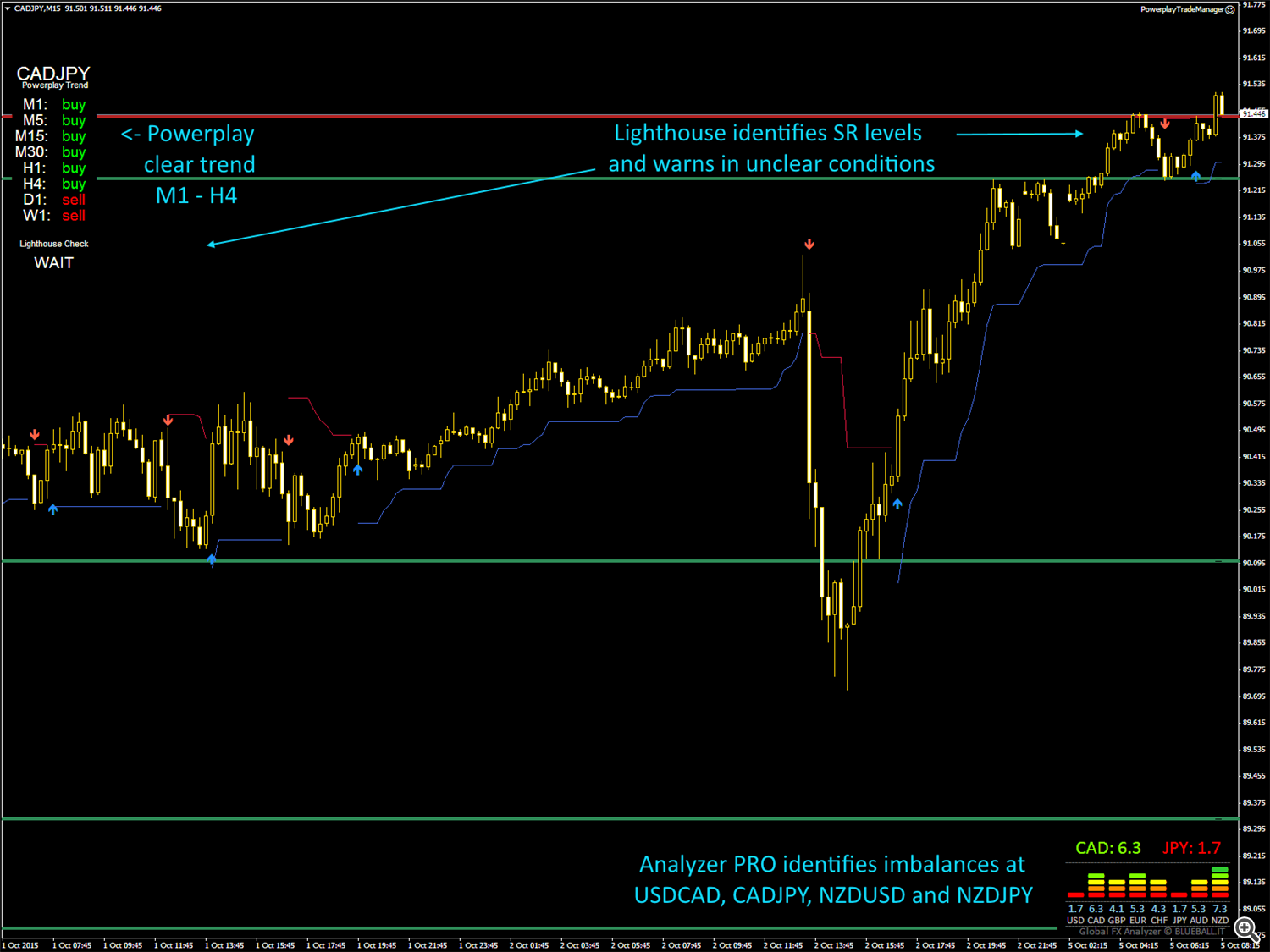

With the Analyzer PRO we analyze the imbalances in the FX market and identify the most interesting trading symbols.

As you can see at screenshot one it identifies imbalances at USDCAD, CADJPY, NZDUSD and NZDJPY.

Following our "cross-continent" rule above there are only NZDUSD and CADJPY left.

With Powerplay you'll get the big trend picture and see at a glance if we see a clear trending or undecided ranging market.

The NZDUSD trend analysis led to a undecided ranging market state. So we continue with CADJPY.

In our CADJPY example we see that all trends from M1 until H4 are BUY.

With the given strength we have a clear trend market.

Lighthouse is a brilliant support and resistance indicator which includes a automated distance warning if the price is close to an important SR level.

The closest SR level was broken and is currently retested by the price as you can see in the first screenshot.

Screenshot STEP 1:

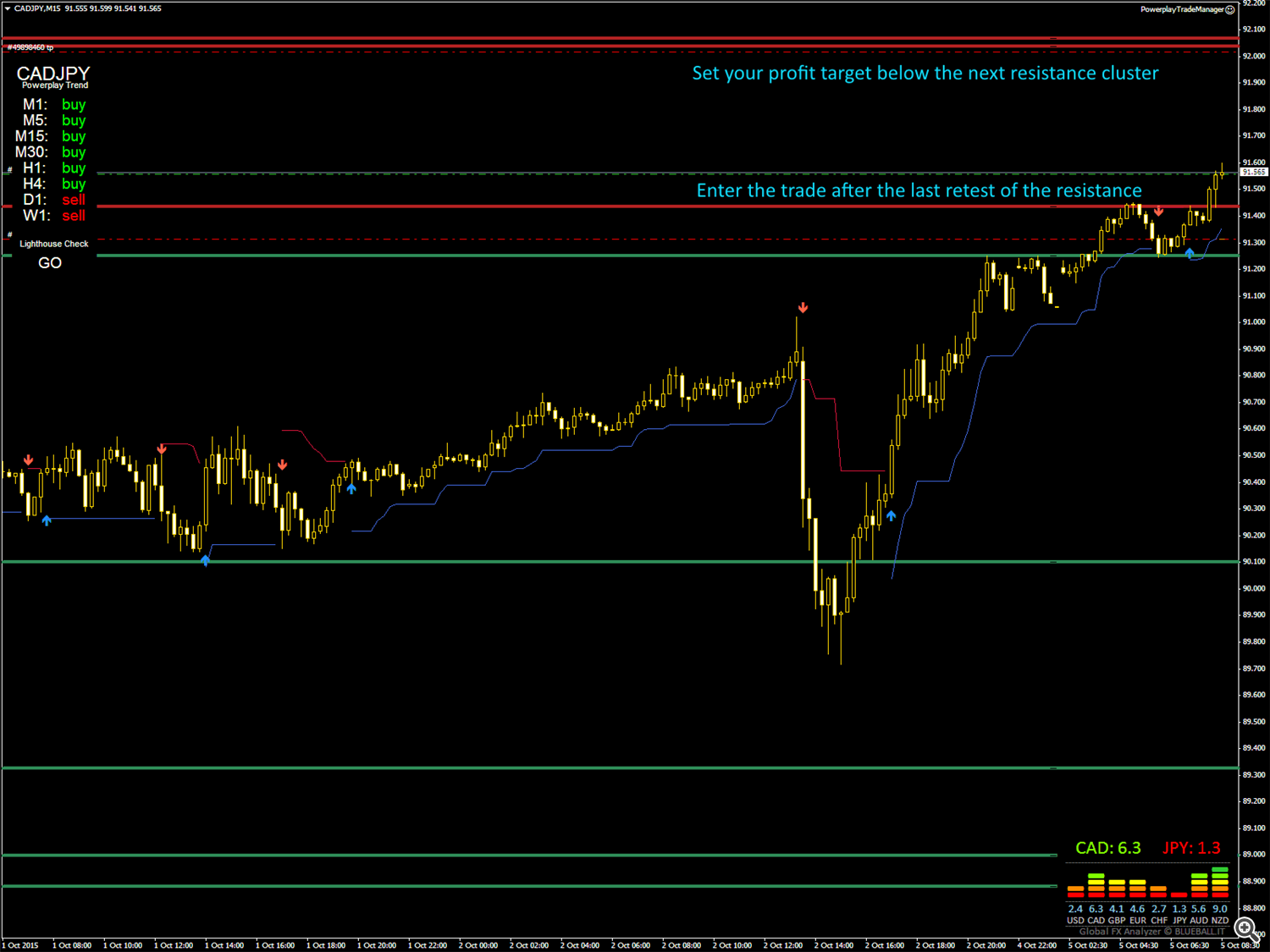

Screenshot Step 2:

Once the retest is finished (open and close of the M15 candle is above the last level) we enter our trade and set the next important resistance level as profit target.

Screenshot Step 3:

click here to get your professional trading toolset