Fundamental Weekly Forecasts for US Dollar, GBPUSD, USDJPY, AUDUSD, USDCAD and GOLD

US Dollar - "The S&P 500 marked a meaningful rebound that puts it well off the year’s lows. For the Greenback, a modest retreat does not meet the exceptional drive necessary to reactivate the currency’s liquidity haven status. We haven’t seen this particular fundamental face for the Dollar appear in years. That said, this too is an inevitable reinforcement. A meaningful and lasting rebound in risk appetite is unlikely as the market’s recent bounce as founded in response to an expected extension of policy accommodation - not exactly the conditions that rally the value investors. If growth did start to take off, it would spur a normalization of policy and necessitate a repricing of leveraged risk taking. Risk ebalancing will eventually lift the Dollar, but it may take longer than bulls would hope for."

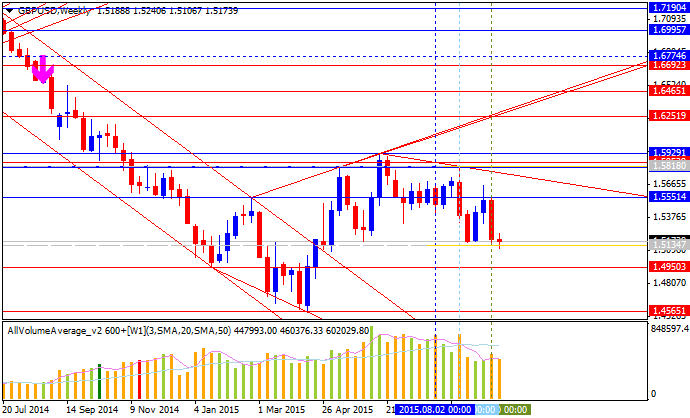

GBPUSD - "At this meeting on Thursday, the Bank of England has a prime opportunity to dampen rate expectations by indicating that the wage growth that stoked inflationary hopes earlier in September isn’t being considered as strongly as this multitude of spiraling economic forces. This could lead to a break of the 1.5100 support level that’s held GBP/USD, perhaps even yielding the 1.5000 spot should risk-aversion increase enough. But if we do get a second dissenter, or if we hear more from Mr. Carney to the tune of what he was saying towards the middle of September, we could see a strong reaction off of this 1.5100 support level that’s contained the bottom in GBP/USD for the past three trading days, and provided a fairly attractive morning-star formation on the Daily chart to close out the week."

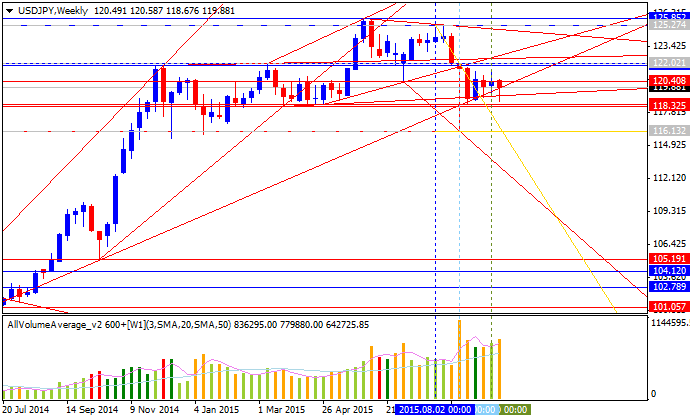

USDJPY - "Risk trends may heavily impact USD/JPY ahead of the key event risks next week as global investors treat the Japanese Yen as a ‘funding-currency,’ and the pair may threaten the range-bound price action carried over from September should we see a material shift in the policy outlook surrounding the Fed & BoJ."

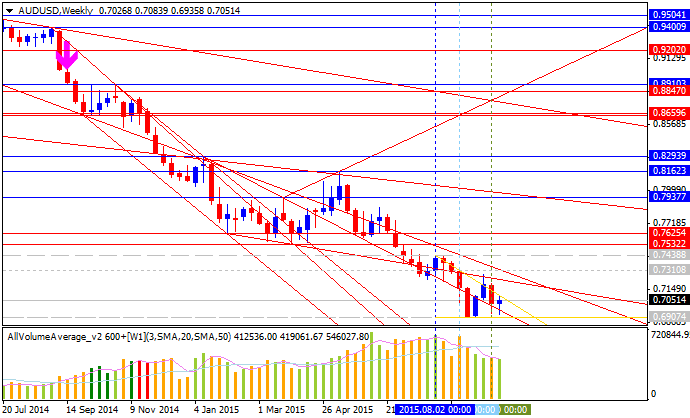

AUDUSD - "A possible shutdown of the US government represents a wild card as lawmakers remain at loggerheads over budgeting beyond the third quarter. Absent an agreement, traders may become concerned that another prolonged period of downtime similar to that of 2013 will exact a stiff toll on economic growth. This seems likely to push against Fed tightening bets as well as undermine global performance bets at large, triggering a broad-based deterioration in sentiment and sending the Aussie downward alongside the spectrum of high-yielding and cycle-sensitive assets."

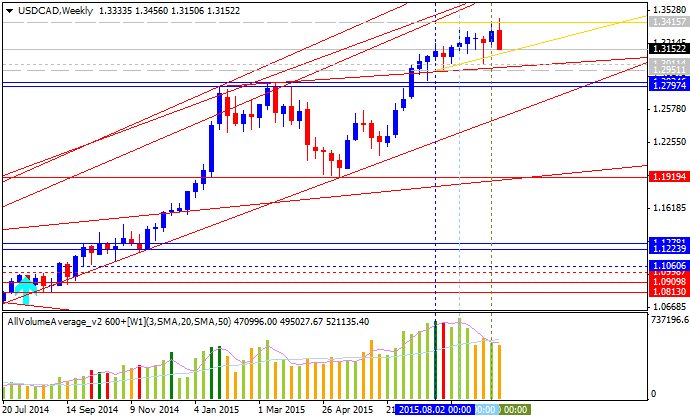

USDCAD - "Currently, the correlation of commodity influenced currencies continues to drag down the entire bunch, which could continue to spell trouble for the Canadian dollar. Per the Bloomberg Commodity index, last quarter saw a 14% drop, the biggest since 2008 global financial crisis, and now eyes turned to a hawkish Federal Reserve that could further exasperate the move. Lastly, there is continued risk for political stalemates after next month’s national election that limits the fiscal stimulus to support the company aligning with an overreliance on oil for near-term direction."

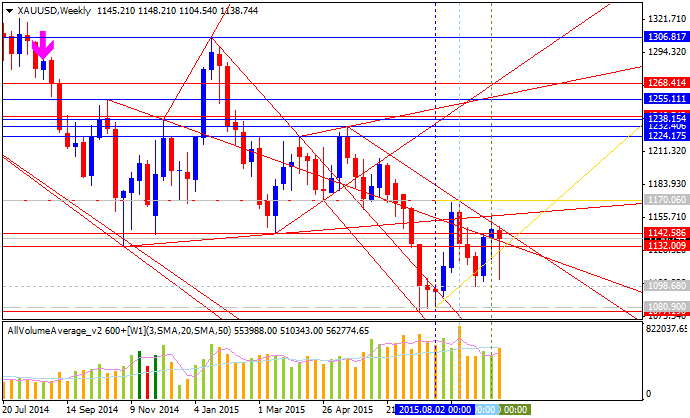

GOLD - "The ‘bigger picture’ trend in Gold is still to the down-side, and that will be the case until Gold prices clear the $1,170 swing high that was set on China’s ‘Black Monday’ of August 24th. Key Fibonacci resistance at $1,155 could provide an attractive long-term short-side entry should resistance develop in this region again, as this is the September high as well as 61.8% of the ‘secondary move’ in Gold (using the 2008 low to the 2011 high)."