Sterling advances despite U.K. PMI report; Overall eurozone PMI disappoints

On Thursday the pound was higher against the U.S. dollar, even

after data signaled that manufacturing activity in the U.K. expanded at

the slowest rate in three months in September, as investors awaited the

release of U.S. economic reports later in the day.

GBP/USD hit 1.5151 during European morning trade, the session high; the pair subsequently consolidated at 1.5146, adding 0.12%.

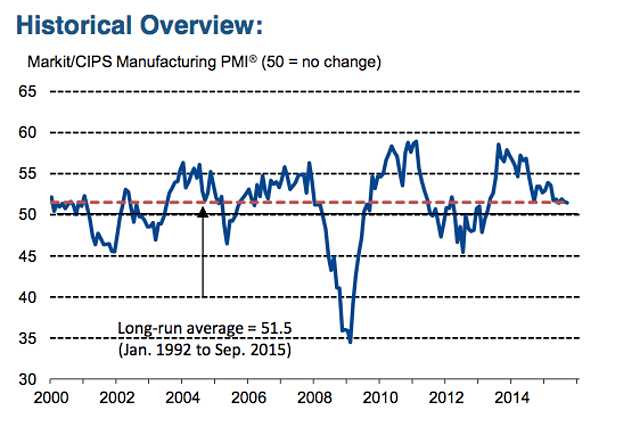

Data firm Markit reported earlier that output growth hit a three-month low in September, with the manufacturing PMI falling to 51.5 from 51.6 in August.

That’s a “lacklustre” performance, it says, partly due to a “marginal decrease in employment” for the first time in two years.

David Noble, CEO at the Chartered Institute of Procurement & Supply, explained that

“The domestic market continued to be the main contributor to any growth, though the export market showed a flicker of life as order levels improved marginally. The bigger worry is in staffing levels and it was not a good month for the intermediate goods producers on that score with that sector showing the biggest fall in employment. The overall employment index is now hovering just below the no-change mark, its lowest level for two-and-a-half years.”

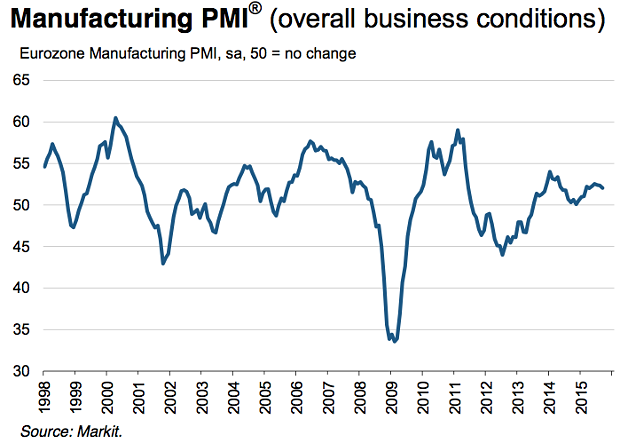

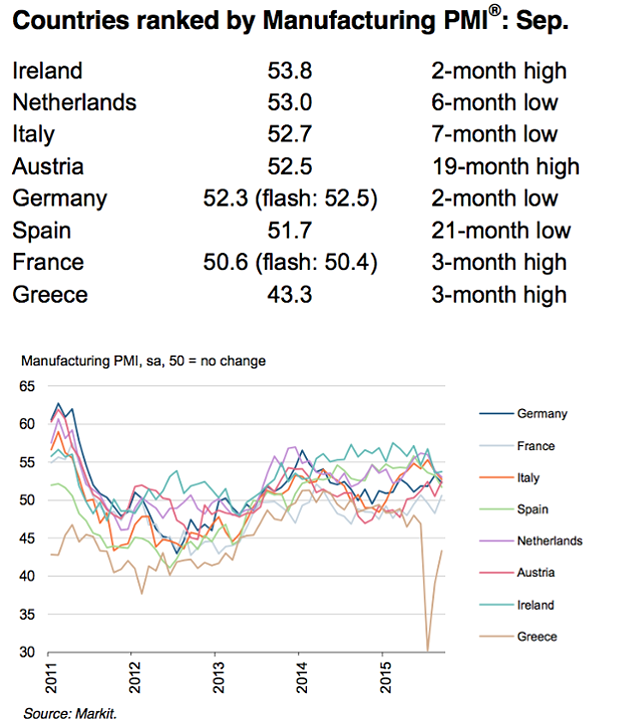

Elsewhere, euro area factory growth has hit five-month low.

The overall eurozone manufacturing PMI, based in data from thousands of firms, has just come in at 52.0, down from 52.3 in August. That shows another month of growth, but not enough to tackle Europe’s economic problems.

Meanwhile, demand for the dollar continued to be underpinned after data on Wednesday showed that the U.S. private sector added 200,000 jobs last month.

Investors were turning their attention to Friday’s U.S. jobs report for September, which could help to provide clarity on the likelihood of a near-term interest rate hike by the Federal Reserve.

EUR/USD was last down 0.21% to trade at 1.1153.