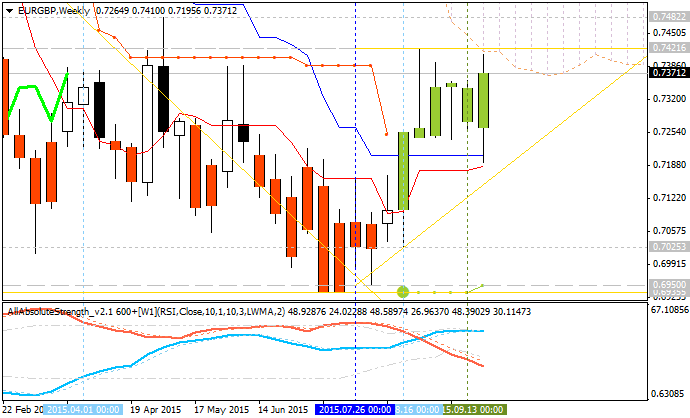

Forecast for the Week - levels for EUR/GBP: breaking Ichimoku cloud for the bullish reversal

Fundamentals for EUR/GBP: neutral. "We like buying EURGBP as the pair will be supported in times of risk-off. The trade does well for three reasons. First, the current account deficit works against GBP in times of risk-off. Second, UK data have weakened relative to EMU recently. Finally the UK runs a high fiscal multiplier, suggesting the proposed austerity plans could weaken economic prospects and so inherently the GBP outlook."

Technicals for EUR/GBP: breaking Ichimoku cloud for bullish reversal. This pair is on bear market rally since the middle of August this year: price broke some intermediate resistance levels for local uptrend to came to be in very close way to Ichimoku cloud and 'reversal' Senkou Span line. The price is trying to break Ichimoku cloud from below to above for the reversal from the primary bearish to the primary bullish market condition with the secondary ranging. The key support/resistance levels for this pair are the following:

- 0.7421 resistance level located on the border between the primary bearish and the primary bullish on the chart;

- 0.7873 resistance located in the primary bullish area of the chart;

- 0.6959 support level located in the bearish area of the chart.

If the price will break 0.6959

support level on close W1 bar so the primary bearish will be continuing.

If W1 price will break 0.7421 resistance level so the reversal to the primary bullish

condition may be started with the secondary ranging (the price will be inside Ichimoku cloud/kumo in this case).

If W1 price will break 0.7873 resistance level so the price will be fully reversed to the bullish condition.

If not so the price will be ranging within the levels

| Resistance | Support |

|---|---|

| 0.7421 | 0.6959 |

| 0.7873 | N/A |