Fundamental Weekly Forecasts for US Dollar, USDJPY, AUDUSD, USDCAD, NZDUSD and GOLD

US Dollar - "While it will be easier to keep tabs on the progress of monetary policy speculation, the greatest potential for Dollar movement resides with sentiment trends. The Dollar is a haven when risk aversion devolves into a need for liquidity. We have only seen a glimpse of that level of fear in the capital during mid-August’s fireworks. Yet, the Greenback also generates more heat from FX-centric volatility as well. With Emerging Market exchange rates building momentum and various risk-leading benchmarks (like high-yield fixed income and biotech equities) threatening a more systemic slide in sentiment, the risk of a blow up is significant."

USDJPY - "Market sentiment may continue to play a key role in dictating price ahead of the key interest rate decisions as global investors treat the Japanese Yen as a ‘funding-currency,’ and shifts in risk trends may largely accompany turns in USD/JPY as market participants weigh the outlook for monetary policy. Until then, the near-term consolidation in the dollar-yen may persist going into the end of September as the pair largely retains the opening range from the beginning of the month."

AUDUSD - "A possible shutdown of the US government represents a wild card as lawmakers remain at loggerheads over budgeting beyond the third quarter. Absent an agreement, traders may become concerned that another prolonged period of downtime similar to that of 2013 will exact a stiff toll on economic growth. This seems likely to push against Fed tightening bets as well as undermine global performance bets at large, triggering a broad-based deterioration in sentiment and sending the Aussie downward alongside the spectrum of high-yielding and cycle-sensitive assets."

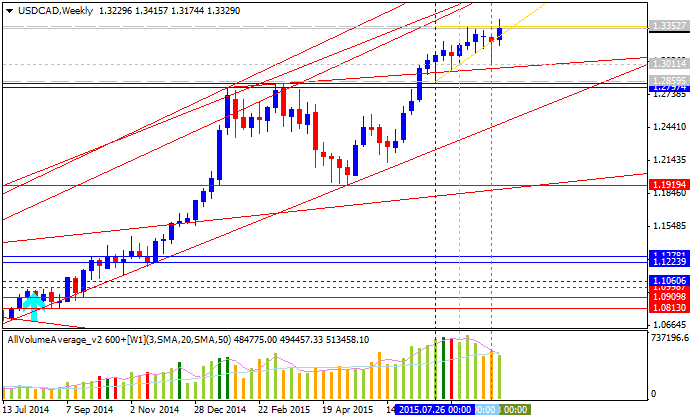

USDCAD - "July GDP numbers are released for Canada on Wednesday, and in this report we’ll see how much the continued slowdown in oil has impacted Canadian economic growth. Earlier in September, 2nd quarter GDP data showed the second consecutive quarter of negative growth, putting the economy in a ‘technical recession’ marked by two consecutive quarters of declining GDP growth. But even with this disappointing print, there was hope for a return to growth, as the final month of the quarter, June, had shown an encouraging uptick in economic activity."

NZDUSD - "The markets have Building Permits for August as well as the ANZ Business Confidence report this week. Building permits will be gauged vs the prior reading of 20.4% and the Business Confidence index will look to rise from the dismal -29.1 reading last month. A tick up in either readings could carry the New Zealand dollar higher in a continuation of how it closed out last week."

GOLD - "the advance off the monthly low continues to trade within a clean ascending median-line formation with the near-term bias weighted to the topside while above the September open at 1134/32 (bullish invalidation). A break below this week’s low at 1121 is needed to put the short-side back into focus. Bottom line: the trade remains constructive while within this formation with a breach of key resistance targeting resistance objectives at 1164 & 1170. Look for the NFP release on Friday to offer guidance as the October opening range takes shape."