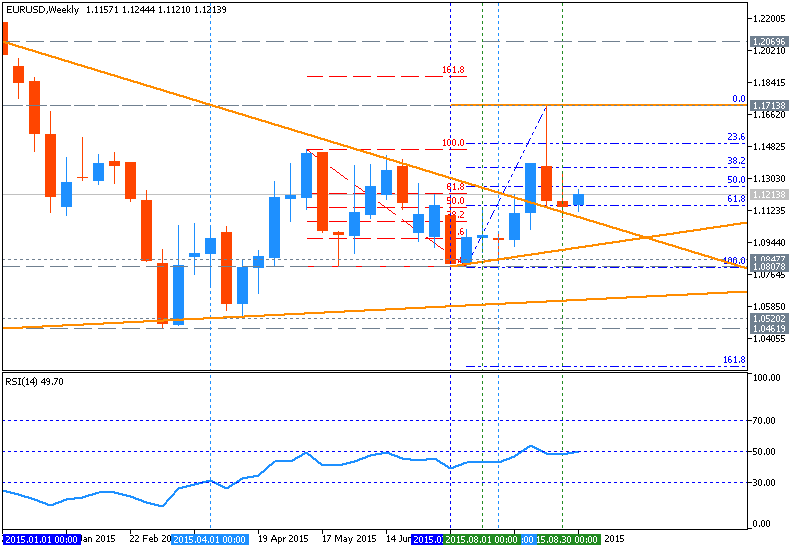

Credit Agricole for EUR/USD: 1.12 by the end of Q3, 1.06 by the end of the year, and 1.04 by the end of Q1 of 2016

Credit Agricole made an other forecast for EUR/USD: 1.12 by the end of Q3, 1.06 by the end of the year, and 1.04 by the end of Q1 of 2016. It means that old forecast (made few day ago) was updated for 1.12 target for this pair by the end of September. This correction was made because of fundamental factors changed: Credit Agricole is expecting dovish ECB (ECB Meetings) and

hawkish Fed (FOMC).

Just to remind the general rules for fundamental news events concerning the speeches:

- EUR: if dovish > expected = good for currency (for USD in our case).

- USD: if hawkish > expected = good for currency (for USD in our case).

That means that Credit Agricole is expecting more bearish for EUR/USD in the medium term forecast:

- "We revise our near-term forecasts for EUR to the upside to account for the latest China-induced risk selloff. We expect the positive correlation between risk aversion and EUR to keep the single currency supported in the near term."

- "The resilience should be evident against USD given that the Crédit Agricole CIB economists have pushed their Fed lift-off call from September to October 2015. Going into year-end and into 2016 we expect the policy divergence trade to reinstate itself, however."

- "Strong EUR coupled with slowing global growth and lower commodity prices should increase the risk that the ECB QE will continue beyond September 2016, making the EUR an even more attractive funding currency."

- "All that should bring EUR NEER back down to its recent lows over the forecast horizon. We lower our medium-term outlook for EUR/USD in view of the persistent policy divergence between the dovish ECB and hawkish Fed."

- "We now target EUR/USD at 1.12 by the end of Q3, 1.06 by the end of the year, and 1.04 by the end of Q1 of 2016."