Current trend

On Friday, the price of Brent crude oil continued falling and reached the level of $50.00 per barrel. The price started the fall after the ECB revised it economic forecasts for the eurozone. According to the regulator, problems in China and in other developing economies may have a significant negative effect on the European economy. Thus, the GDP growth forecast for the year was revised from 1.5% to 1.4%.

At present, the price of oil remains under pressure due to excess supply on the markets.

Despite the latest data for the US labour market came out rather mixed, the expectations of the first interest rate hike in the US remain unchanged. Markets expect the rates to be increased not later than in December this year, which also pressures the price of oil.

Support and resistance

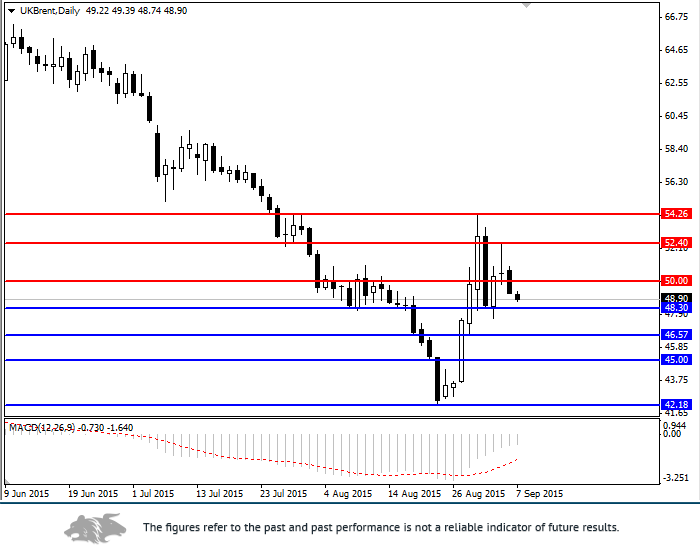

MACD histogram remains above its signal line, but the K% line crosses the D% line from top to bottom. The indicator does not give a clear trading signal.

Support levels: 48.30 (local lows), 46.57 (30 August low), 45.00 (psychologically important level).

Resistance levels: 50.00 (psychologically important level), 52.40 (3 September high), 54.26 (31 August high).

Trading tips

Short positions can be opened from the level of 48.30 with targets at 46.60, 45.00 and stop-loss at 48.70.

Long positions can be opened above the level of 50.00 with targets at 52.00, 54.00 and stop-loss at 49.50.