Morgan Stanley is continuing weekly forecast for the pairs based on fundamental analysis related to the direction of the trading.

USD: Bullish.

"We see scope for USD strength to continue. However, we distinguish

between the performance of USD against low yielding funding currencies,

where we see less scope for depreciation, and against commodity

currencies and EM, where we expect strength to be focused. Even the

risks of a more dovish Fed are unlikely to drive USD to depreciate

against this latter group of currencies, as growth prospects in the rest

of the world remain below those of the US."

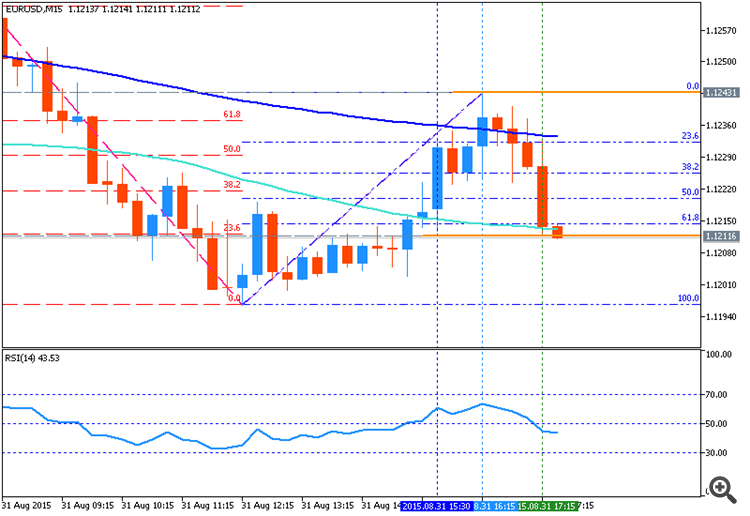

EUR: Bullish.

"We see scope for EUR to make further gains over the next few weeks as

risk remains bid amidst an environment of uncertainty. EUR was used as a

funding currency for many risk-on trades; as these are unwound the

currency should see support. The main risk from our bullish EUR view

stems from the upcoming ECB meeting, where there is a risk of a more

dovish tone from the central bank in light of recent currency

depreciation."

CAD: Bearish.

"Bearish CAD is one of our higher conviction trades in G10. We believe

that there is a risk the central bank will need to take a more dovish

tone, weighing on the currency. Latest comments from the BoC that

macroprudential tools are addressing financial instability suggest that

monetary policy will be free to focus on low growth and inflation. An

environment of weak oil prices is unlikely to offer support to CAD as

well."

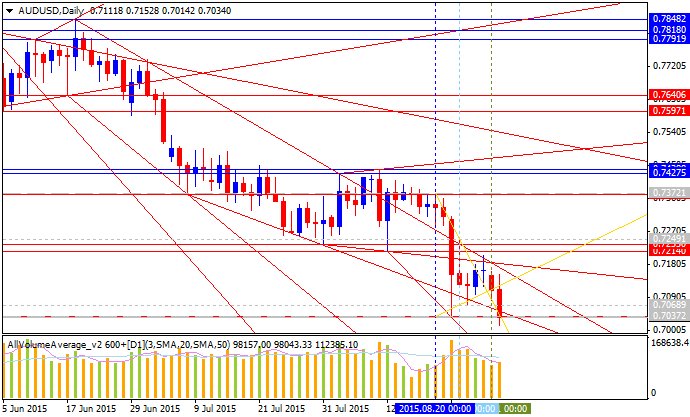

AUD: Bearish.

"A weak commodity picture and concerns about growth in Asia are likely

to weigh on AUD in the near term, and we would expect it to continue to

underperform. Ongoing weakness in capex highlights the risks surrounding

the currency. The main upside risks stem from the central bank, which

has been more hawkish, most recently highlighting the risks of running

easy monetary policy for too long. We will watch the upcoming RBA

meeting closely."

NZD: Bearish.

"With macro prudential measures expected to further reduce heightened

financial system risk and help moderate the Auckland housing market, the

RBNZ has left the door open for more significant easing. Weak

commodities prices, a struggling dairy sector, and soft global demand

should weigh on the small, open New Zealand economy. We expect NZD to

continue depreciating as both growth and rate differentials move against

the Kiwi."