Morgan Stanley is making the forecast for USD for the current week telling about bullish market condition:

"With the Fed minutes leaving the option of a September rate hike open, the USD will be extremely data sensitive. Weak global demand is likely to continue weighing on manufacturing figures. Slightly lower-than-expected July CPI figures support our economists’ view of a December rate hike. With the rate hike having negative second-round effects on EM, we remain bullish on the USD against EM and commodity currencies."

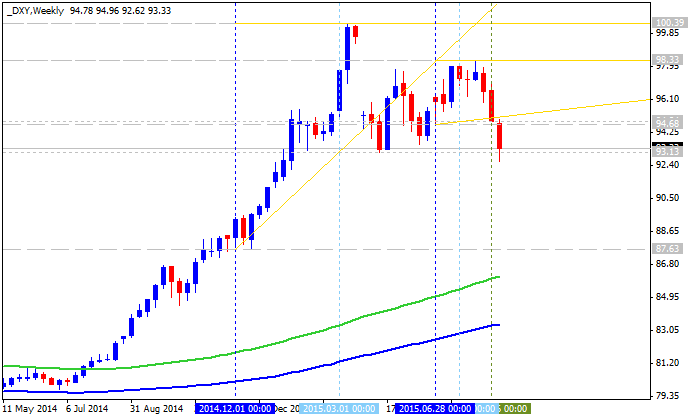

Morgan Stanley believe in bullish USD but the situation will depend on the data of economic news events. So, let's vierw this situation based on technical point: USD (DXY) is on primary bullish condition with the secondary cirrection - nearest support levels are 93.81, 93.13 and 87.63, and nearest resistance levels are 98.33 and 100.39. So, we can really speak about bullish condition to be continuing only if the price will break 98.33 with 100.39 as the next target.

We think that USD will be moved in secondary ranging market condition for the current week for example, but 93.81 and 93.13 as the current bearish targets will be broken anyway in the near future.