Some time ago I have published the multi-currency WPR indicator. This is exactly multi-currency, not multi-instrument tool, because it shows oversold and overbought states for relative strengths of plain currencies extracted from a given set of Forex symbols. Strictly speaking it is capable of processing an arbitrary set of tickers such as indices, commodities, futures, CFDs and any other stuff which may form a sub-system of the market, but it would be strange to use a name like multi-everything. Besides Forex trading is commonly used as a clear example for general purpose trading strategies.

The idea of the indicator is simple. While standard WPR is calculated on quotes of specific symbol, the same formula can be applied for changes in value of the currencies constituting this symbol. Of course, it may seem not so obvious how to get these values or strengths of the plain currencies, but this is a different question which does already have many answers. For example, one may use a cluster indicator, such as CCFpExtra or CCFpExtraValue. Most important that we can compute a value for every currency and then apply WPR on its history.

The benefit of using multi-currency WPR is also simple: when you see "overbought" and "oversold" signals for two currencies separately you better understand entire situation and can filter out false signals. When two currencies are merged into a single pair, standard WPR may alert spurious signals based on only one currency of the two, whereas if divided into 2 parts it waits for confirmation from both currencies. Also it's obvious that if 2 currencies occur to be in "opposite" states, better chances are that the pair will move in the expected direction.

Of course, every indicator is evaluated on practice, and most formal way of testing implies automatic trading with an expert adviser built on top of the indicator. And I have made one for the multi-currency WPR.

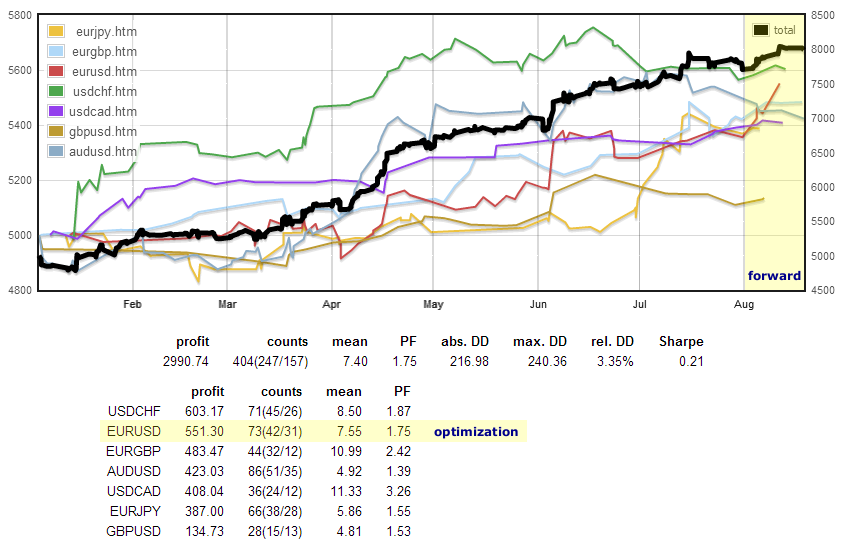

It uses conventional WPR strategy: buy "oversold" and sell "overbought" currency, if these states happen at the same time. All 8 Forex majors were taken into account. The expert has been optimized for the single pair EURUSD, using M15 timeframe, on the period January - August (exclusively) 2015, then validated on August 2015, and cross-validated on other symbols. Some symbols, such as NZDUSD and AUDJPY demonstrated moderate outcome, while USDJPY was even in loss. But most of symbols showed great performance (see the figure below). It seems to be an effect of the multi-currency nature of the indicator, and also it provides confirmation of the strategy's stability. Here is the graph of balance for every symbol and total amount, as well as key performance metrics.

The expert is still under development and is not publicly available, yet I find these results interesting enough for sharing them in the context of the multi-currency WPR.