Majors, USD JPY Forecast, Weekly Forex Forecasts

USD/JPY pushed above the 125 line for the first time since June, but then retracted and was unchanged at the end of the week. This week has six events. Here is an outlook on the major events moving the yen and an updated technical analysis for USD/JPY.

In the US, NFP was slightly below expectations, leaving analysts divided on the timing of a Fed rate hike. There were no key numbers out of Japan and the BOJ policy statement didn’t show any change in the Bank’s extreme easing stance.

* All times are GMT

USD/JPY Technical Analysis

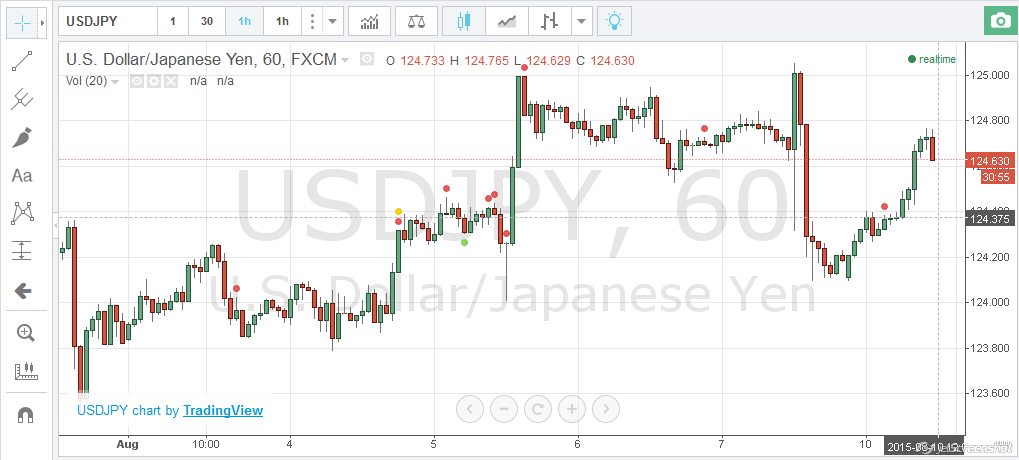

USD/JPY opened the week at 124.04 and quickly slipped to a low of 123.79. The pair then reversed directions and climbed to a high of 125.07. USD/JPY retracted late in the week, closing at 1.2416.

Technical lines from top to bottom:

We start with resistance at 1.2878. This marked the start of a yen rally in May 2002, which saw USD/JPY fall below the 116 line.

127.74 is the next line of resistance.

126.59 has remained intact since May 2002.

125.86 continues to be a strong resistance line.

124.16 continues to be busy and the pair closed the week at this line.

123.18 remains an immediate support line.

122.01 is the next support level.

121.39 was breached in early July as the dollar started its current rally.

120.65 is protecting the symbolic 120 level.

119.65 was a key support line in April.

118.68 is the final support line for now.

I am bullish on USD/JPY

The pair flirted with the symbolic 125 level, as the yen is not getting any support from a weak Japanese economy. In the US, speculation will continue about a rate hike, and Q2 numbers are expected to improve compared to the previous quarter. https://www.mql5.com/en/signals/120434#!tab=history

USD/JPY pushed above the 125 line for the first time since June, but then retracted and was unchanged at the end of the week. This week has six events. Here is an outlook on the major events moving the yen and an updated technical analysis for USD/JPY.

In the US, NFP was slightly below expectations, leaving analysts divided on the timing of a Fed rate hike. There were no key numbers out of Japan and the BOJ policy statement didn’t show any change in the Bank’s extreme easing stance.

- Current Account: Sunday, 23:50. Current Account is closely connected to currency demand, as foreigners must buy Japanese yen in order to purchase Japanese exports. The current account surplus jumped to 1.64 trillion yen in May, well above the forecast of 1.39 trillion. However, the markets are expecting a softer reading in June, with an estimate of 1.41 trillion yen.

- BOJ Monthly Report: Monday, 5:00. This minor report provides statistical data used by the BOJ when it made its most recent interest rate decision as well as the Bank’s view of current and future economic conditions.

- M2 Money Stock: Monday, 23:50. The indicator dipped to 3.8% in June, within expectations. Little change is expected in the July release.

- 30-year Bond Auction: Tuesday, 3:45. The yield was down slightly in the July release, coming in at 1.43%. Little change is expected in the upcoming release.

- Preliminary Machine Tool Orders: Tuesday, 6:00. This manufacturing indicator tends to show strong fluctuation, and came in at 6.6% in June, well off the huge gain of 15.0% a month earlier.

- Monetary Policy Meeting Minutes: Tuesday, 23:50. The markets will be carefully combing through the BOJ minutes, but no surprises are expected in the BOJ’s extreme easing policy, as the Japanese economy continues to muddle along, hampered by very low inflation levels.

- Revised Industrial Production: Wednesday, 4:30. This indicator has struggled, with three declines in four readings. The May release posted a decline of 2.1%, matching the forecast. The markets are expecting a strong turnaround in June, with an estimate of a 0.8% gain.

- Core Machinery Tools: Wednesday, 23:50. This manufacturing indicator tends to show strong fluctuations, making accurate estimates a tricky task. The May release came in at +0.6%, much stronger than the forecast of -4.8%. The markets are bracing for a weak reading in June, with a forecast of -4.9%.

* All times are GMT

USD/JPY Technical Analysis

USD/JPY opened the week at 124.04 and quickly slipped to a low of 123.79. The pair then reversed directions and climbed to a high of 125.07. USD/JPY retracted late in the week, closing at 1.2416.

Live chart of USD/JPY: https://www.mql5.com/en/signals/120434#!tab=history

Technical lines from top to bottom:

We start with resistance at 1.2878. This marked the start of a yen rally in May 2002, which saw USD/JPY fall below the 116 line.

127.74 is the next line of resistance.

126.59 has remained intact since May 2002.

125.86 continues to be a strong resistance line.

124.16 continues to be busy and the pair closed the week at this line.

123.18 remains an immediate support line.

122.01 is the next support level.

121.39 was breached in early July as the dollar started its current rally.

120.65 is protecting the symbolic 120 level.

119.65 was a key support line in April.

118.68 is the final support line for now.

I am bullish on USD/JPY

The pair flirted with the symbolic 125 level, as the yen is not getting any support from a weak Japanese economy. In the US, speculation will continue about a rate hike, and Q2 numbers are expected to improve compared to the previous quarter. https://www.mql5.com/en/signals/120434#!tab=history