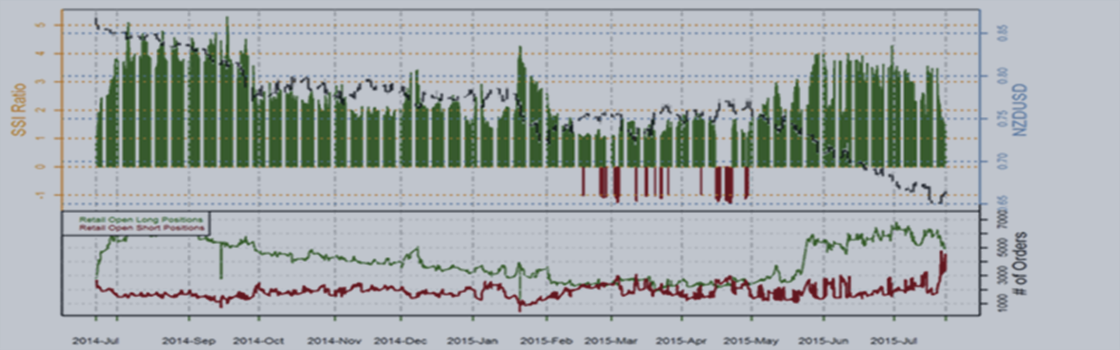

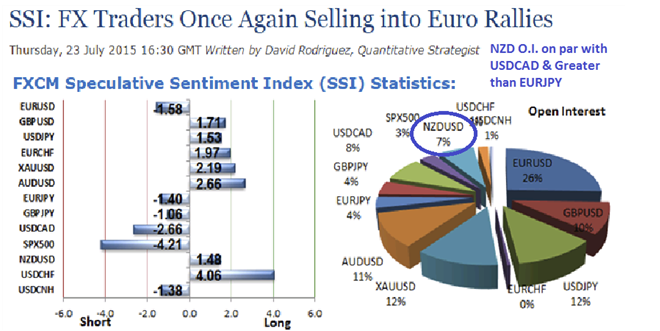

All through 2015, enthusiasm for NZDUSD has soar. This phenomena is seen plainly through the FXCM open enthusiasm according to the twice per day upgrades in DailyFX's SSI report, which imagines retail assessment through open positions. This year, we've seen NZDUSD open interest rival other real coinage like the CAD and surpass long-lasting top choices like EURJPY & GBPJPY as far as retail open-interest.

Screenshot from David Rodriguez,SSI: FX Traders Once Again Selling into Euro Rallies

While the open interest story from retail brokers is amazing, we've additionally seen institutional interest hop. In front of Thursday's RBNZ meeting, Speculative Short positions from Non-Commercials according to the CFTC Commitment of Traders reports demonstrated the biggest net presentation on short NZD fates contracts following Feb 2009.

Learn FX: Institutional Short Sellers are loading into NZDUSD

This constructs together motivation to keep NZDUSD on your radar. Open enthusiasm on retail and establishments are building. In a broad sense, the pitch is appealing for offering NZDUSD. The Fed is hoping to raise premium rates this fall, while the Reserve Bank of New Zealand is hoping to keep cutting into one year from now. Recently, they dropped their advantage rate by 25bp for the second time in 6 months and is broadly to chop another 75bp down to 2.25% by mid-2016.

On the off chance that you are new to assumption and volume here is a fast clarification on how this article will take a gander at these circumstances pair advancing.

Bear Channel from April High is Key

Value channels are an extraordinary approach to rearrange value activity investigation. Essentially, value channels help you to casing a pattern. Value diverts take a line off the higher lows in an uptrend and duplicate that pattern line, Click + control on Marketscope 2.0 to duplicate pattern lines, then take the replicated pattern line to the higher highs of the value development. Regularly, the nature of the pattern will have the majority of the highs peaking along the trendline permitting value activity to be confined, but directionally one-sided.

NZDUSD is in an in number downtrend. Truth be told, one of the most grounded managed downtrends of 2015. Above, you can see a sort of value activity that is perfect for a bearish channel, lower lows and lower highs. The straightforward standards for exchanging value channels is to start with, exchange the heading of the pattern or the directional predisposition of the channel. Second, predisposition your entrance focuses so that in an uptrend you are purchasing close backing or the rising lower trendline, and in a downtrend you are offering your resistance or the falling higher trendline. This methodology permits you to exchange such a route, to the point that your danger to compensate proportion is advanced. The third manage for exchanging channels is that you ought not exchange against the course of the pattern until and unless cost is plainly softened out from the channel up the other way.

As should be obvious beneath, cost is conclusively in the falling channel, as pictured with red lines above, and purchase exchanges ought not happen until value reliably indicates higher lows and higher highs out of the falling red channel. Despite the fact that little moves higher can happen inside of the channel, as surrounded by blue lines on the base right of the diagram, until a bigger channel breaks it is best to support passages toward the bigger pattern for higher likelihood exchanging.

This EA is a Multi-Timeframe, Multi-Symbol robot which plays Donchian Channel breakouts.

https://www.mql5.com/en/market/product/2753?p=6bsr