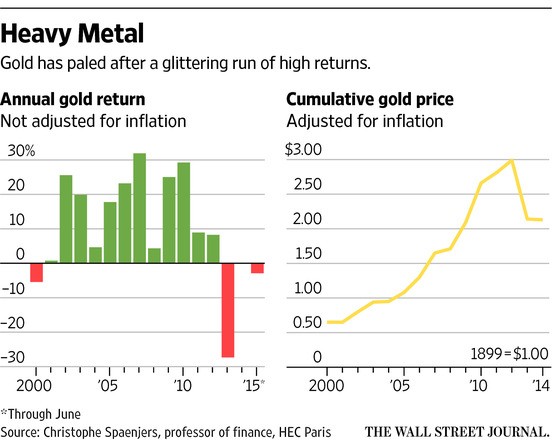

Gold has been referred to a shelter amid hard times and soft money. So why, even amid Greek turmoil, China collapse and when the euro has sunk against the dollar gold has been so muted?

According to Morningstar estimates, since June 2014, investors have gripped $3 billion out of funds investing in precious metals; total assets at precious-metal funds have shrunk 20% in 12 months, says Jason Zweig, the Wall Street Journal columnist.

Many people may have bought gold for the wrong reasons:

1) because of

its glittering 18.7% average annual return between 2002 and 2011,

2) because of its purportedly magical inflation-fighting properties,

3) because it is supposed to shine in the darkest of days.

But gold is not a panacea for inflation. It does well in response to unexpected crises, but not long-simmering troubles like the Greek one.

When the gold bulls began to understand it, the price has already been tarnished.

An act of faith - this is how owning of gold is now called, Zweig says. “Faith is the substance of things hoped for, the evidence of things not seen,” as the Epistle to the Hebrews defined it. You can own gold if you feel you should, but admit honestly that you are relying on hope and imagination.

Unlike stocks, bonds, real estate and other financial

assets, gold generates no income, and thus valuing it is all but impossible.

“It’s

intrinsically worthless or intrinsically priceless,” says Paul Brodsky, a

former hedge-fund manager who now is a strategist at Macro Allocation,

an investment-research and consulting firm in New York.

“You can build a financial model to value it, but every input is going to be your imagination.”

Gold represents two things - a commodity and a currency. Neither of them is easy to price.

First, the commodity: As prices plunge, mining companies are losing money on more than an eighth of the gold they dig out of the ground, says Suki Cooper, head of metals research at Barclays in New York.

That could lead to a decline in supply. And if demand, e.g. from consumers in China or India, surprisingly rises, there might not be enough gold to go around.

William Rhind, chief executive of World Gold Trust Services, also expects something like “a continuing shift in demand from West to East, and from investors to consumers.”

Those factors, Ms. Cooper says, suggest that gold is unlikely to slide much lower and could eventually go even higher. But when will it happen and how much will gold add?

As a currency, gold has an indeterminate value, Mr. Brodsky says. You would not bring gold bullions to the supermarket in exchange for canned goods. But you might purchase the provision with dollars that are backed with gold, as they used to be until 1971.

The metal is barbaric and burdensome, Mr. Brodsky says, “but it remains a store of value, and gold might be called upon again to be the basis for money, as a real backing of currency.”

In his opinion, basing the value of currency on what is in short supply, rather than the unlimited right to printing, would allow central banks to back their currency. It would also create a demand for the yellow metal.

Gold is often considered to be a hedge against inflation, and it has outpaced rises in the cost of living - but not as strongly as the alternatives, says the WSJ columnist.

According to Christophe Spaenjers, a finance professor at HEC Paris business school, since 1975 - when private ownership of gold has become legal in the U.S., it has returned an average of 0.8% annually after inflation, compared with 5% for bonds, 8.3% for stocks and even 1.1% for cash.

It is very hard to rationalize the price movements of the metal, even with the benefit of a significant hindsight.

So, if purchasing gold is an act of faith, how much money would you put at stake?

Laurens Swinkels, a senior researcher at Norges Bank Investment

Management in Oslo, suggests that the total market value of the world’s

financial assets at the end of 2014 was about $102.7 trillion.

The World

Gold Council gauges that the world’s total quantity of gold held for

investment was about $1.4 trillion as of late 2014.

Therefore, as Zweig puts it, if you held the

same proportion of gold as the world’s investors as a whole, you would

allocate 1.3% of your investment portfolio to it. Anything much above that is more than an act of faith - it is a jump in the dark.