Current trend

Chinese stock market is falling while the government is trying to stop the panic and prevent further fall. Chinese regulator asked state owned companies to avoid selling their own shares to stabilise the market. Despite their attempts, Shanghai Composite fell by 5.9% and Japanese Nikkei Stock Average fell by 3.1%.

Amid Chinese problems and Greek crisis in the Eurozone, the safe-haven Yen is strengthening. The pair USD/JPY lost more than 100 points since opening today.

However, the pair’s fall is restricted by two fundamental factors: monetary policy tightening that is expected to happen soon in the US and extra soft monetary policy by the Bank of Japan. Therefore, fundamentally the pair is set to grow so any local declines can be considered as an opportunity to open long positions.

Today, FOMC Minutes are due at 9 pm (GMT +3) in the US. The report may shed some light on Fed’s plans regarding interest rate hikes and thus clarify the USD medium-term dynamics.

Support and resistance

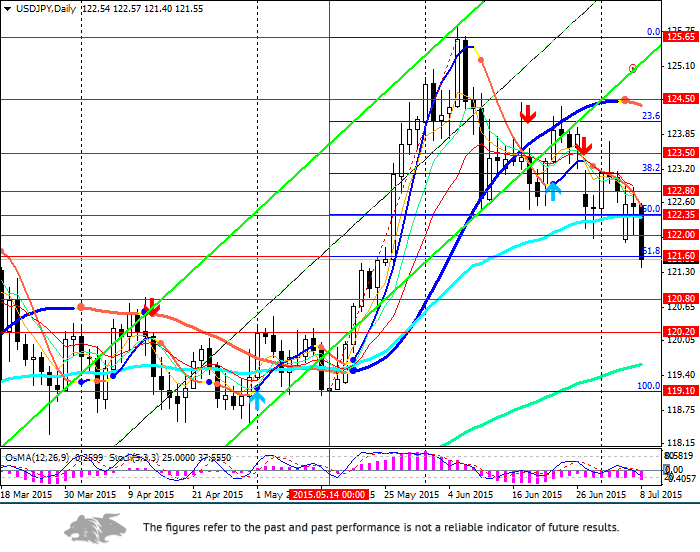

The pair broke down the support level at 122.80 (EMA200 on the 4-hour chart) and reached 121.60 (61.8% Fibonacci).

OsMA and Stochastic on the 4-hour and daily charts give sell signals.

The pair return to the level of 120.00 is possible from the technical analysis point of view but is unlikely from the fundamental perspective.

It is recommended to stay away from trading until FOMC Minutes are out and the Eurozone situation is clarified.

Support levels: 121.60, 120.80, 120.20.

Resistance levels: 122.35, 122.80, 123.50.

Trading tips

The price consolidation below 121.60 (as soon as the indicators give appropriate signals) would allow to open short positions with targets at 120.80, 120.20.

The pair rebound above 122.80 would allow to open long positions with targets at 123.15, 123.50, 124.00.