On Sunday Greeks voted against creditors' demands for further austerity, leaving Europe’s leaders to determine if the nation can remain in the euro currency union.

German Chancellor Angela Merkel and French President Francois Hollande will meet later today, and European Union President Donald Tusk called a euro-area summit for Tuesday.

The ECB Governing Council is due to talk on Monday on whether to

keep supporting the country’s banks.

While the euro plunged, it only touched a one-week low. According to Standard Chartered Plc., price movements have been muted with most people awaiting to see how the European authorities will respond. And according to SMBC Nikko Securities Inc., the referendum will not have any long-term impact on financial markets, it hardly resembles the bankruptcy of Lehman Brothers Holdings Inc. in 2008.

While negotiations between Greece and its creditors were suspended after Prime Minister Alexis Tsipras announced the referendum last weekend, Tsipras said following the vote that his country will return to the negotiating table on Monday.

Finance Minister Yanis Varoufakis quitted, claiming his presence would complicate the aid talks.

“We need to take seriously the contention of leaders that a ‘no’ vote

in the referendum doesn’t mean negotiations are dead,” said Daisuke

Karakama, chief market economist at Mizuho Bank in Tokyo.

“The euro hasn’t fallen as much as we might have thought, so we want to just watch and wait.”

According to other analysts, there is uncertainty.

“Until we see what the inclination, particularly for the German side, is when they meet tomorrow, that’s just making people hesitant to jump in with both feet and sell the euro,” said Ray Attrill, global co-head of currency strategy at National Australia Bank Ltd. in Sydney.

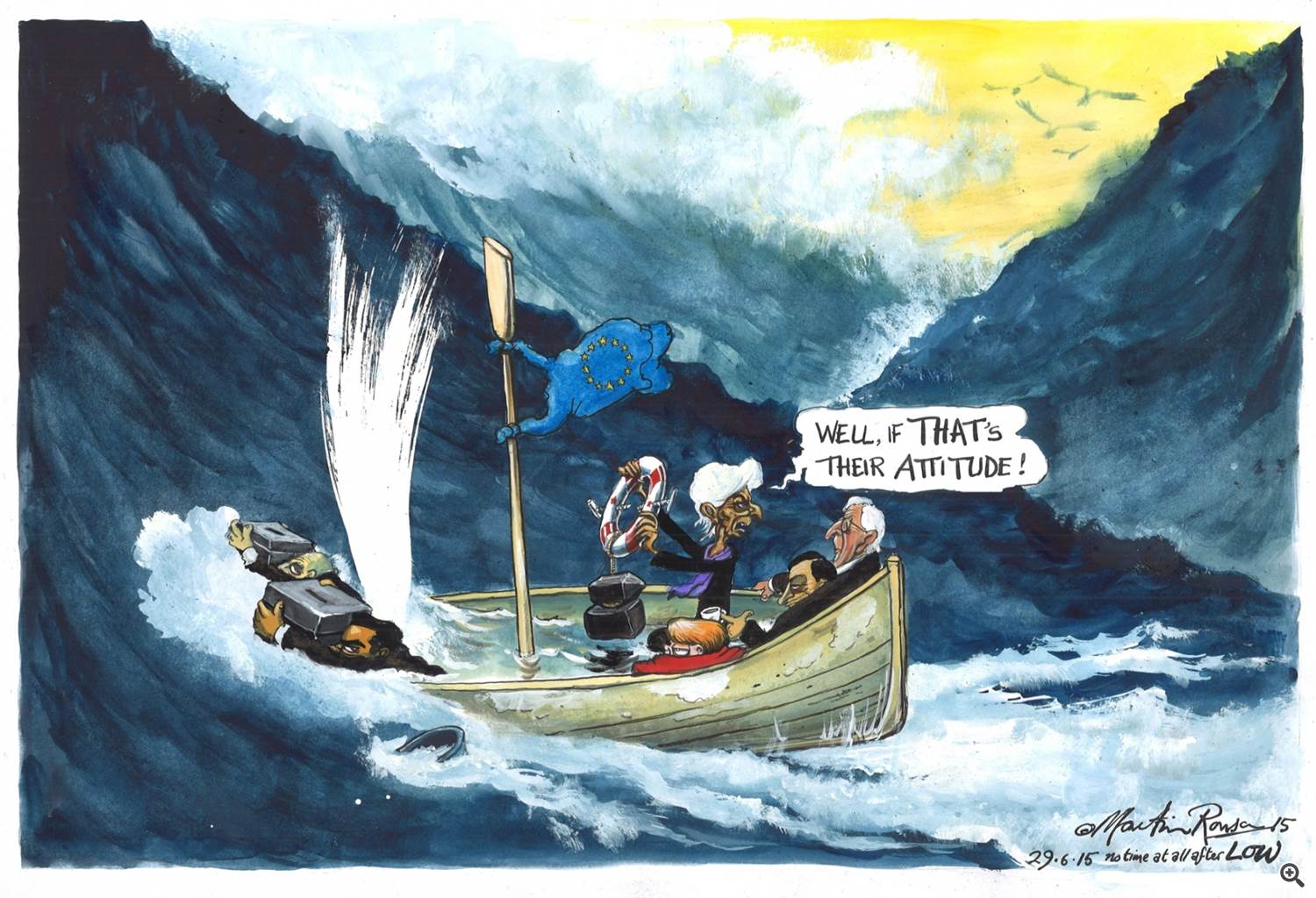

Martin Rowson on the Greek financial crisis for The Guardian

The ECB is meeting later in the day to discuss whether to continue providing Emergency Liquidity Assistance to Greece's lenders or not. Unless the 88.6 billion-euro ($97.5 billion) ceiling on ELA is increased, lenders may have to restrict cash withdrawals further.

Given the risk of splintering

the euro, ECB President Mario Draghi and his colleagues have so far

said they’ll take their lead from elected representatives, Bloomberg says.

“In the current circumstances of great uncertainty in Europe and the world, the ECB has been clear that if we need to do more we will do more,” Executive Board member Benoit Coeure said in Aix-en-Provence, France, on Sunday.

“Our will to act in this matter should not be doubted.”

The urgency is more intense for the Governing Council, as another deadline looms. On July 20, Greece is due to pay 3.5 billion euros

back to the ECB as bonds bought under an earlier crisis rescue mature, says Bloomberg.

That’s the “most important” date, ECB Governing Council member Ewald

Nowotny said on June 30. Bound by European law that forbids the

financing of governments by central banks, the ECB couldn’t consent to a

non-payment and may be compelled to take drastic steps if it happens, pushing Greece closer to Grexit.