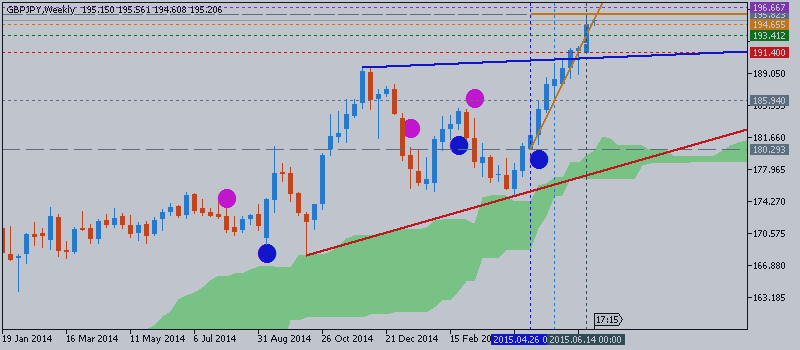

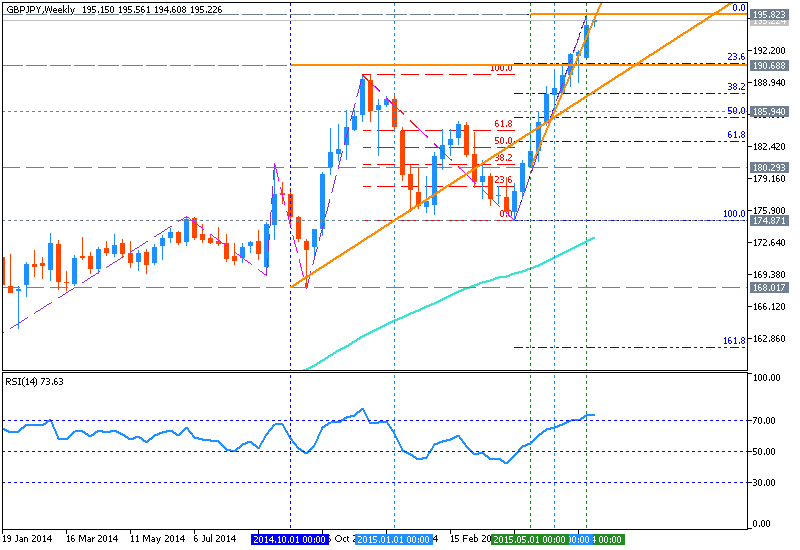

W1 price is located above 200 period SMA and 100 period SMA for the primary bullish with secondary ranging between 190.68 support level and 195.82 Fibo resistance level:

- 23.6% Fibo level at 190.87 was broken by price from below to above for the bullish trend to be continuing;

- the price was stopped by 195.82 Fibo resistance level and it is ranging between 190.68 and 195.82 levels for now;

- if 195.82 Fibo resistance level will be broken so the primary bullish will be continuing with good breakout possibilities; if 190.68 support

level will be broken by price from above to below so we may see the seco0ndary correction within the bullish trend; otherwise the price will be ranging within familiar levels;

- D1: 'near-term resistance is at 195.48, the 38.2% Fibonacci expansion, with a break above that on a daily closing basis exposing the 50% level at 197.50';

- D1: 'risk/reward considerations argue against entering long with prices in close proximity to resistance. On the other hand, the absence of a defined bearish reversal signal suggests taking up the short side is premature. We will remain flat for now, waiting for an actionable opportunity to present itself'.

Trend:

- H4 - ranging bullish

- D1 - bullish

- W1 - bullish

- MN1 - bullish