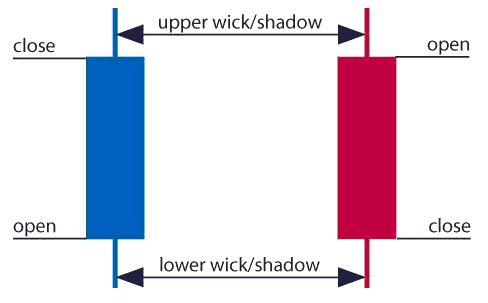

Like other formations on the candlestick patterns, patterns or formations Harami describes real time price sentiment that exists in the market. Once you see the pattern there by covering the candle, you can look to the next candle to identify bias and point the obvious risks.

First known candlestick and candlestick charts not surprisingly became quite popular. If you already understand the candlestick charting, you have mastered the technique which is great for learning the market visually.

Candlestick trading signals are usually divided into pattern reversal or pattern continues. The pattern continued beneficial when market sentiment is likely to maintain an ongoing trend. Instead, the reversal pattern is useful when market sentiment that drives the trend could potentially stop before eventually turning direction.

When you begin learning the candlestick to determine a turning point in the market, you know what is called Doji. The general principle that applies when looking at Candlestick Doji is you have to be alert because candlestick reversal shows that it's often too late.

Even so, the Doji can confirm the next candle depicting trading interest in the market. Similarly to confirm a Doji, you can use indicators oscillators.

Harami is the most powerful Doji pattern because it is always visible on every candle, exactly on both sides of the Doji, so it can give you an idea of the complete. First candle, before the observable Doji red, the upper part must be the same with trend direction that his body is larger than the body of the Doji.

The third candle, after the Doji reversal will confirm if the move against first candle or cancel the signal directly if the trend continues Harami after the Doji. This pattern is called Harami because it has the appearance of such a woman is pregnant. First candle is a great candle that continue the ongoing trends and Doji is a small candle stands out like a pregnant woman. Through the second candle, we can find out whether the Doji reversal would indicate or precisely follow the trend with the opening of the next candle.

Another reason for applying patterns and Harami candlestick is because both were able to recognize reversals at the most appropriate time in the trading risk is large enough. With these two patterns you'll profit to develop accounts