It is the interaction of the current account and the capital account that measures this, and when combined these make up a country's balance of payments. The balance of payments is very simply the total transactions by a country with all other countries in the world, or in other words the combination of both trade flows and capital flows into one report. By following a country's balance of payments and its related indicators, an FX trader can gain great insight into the potential future direction of a country's currency.

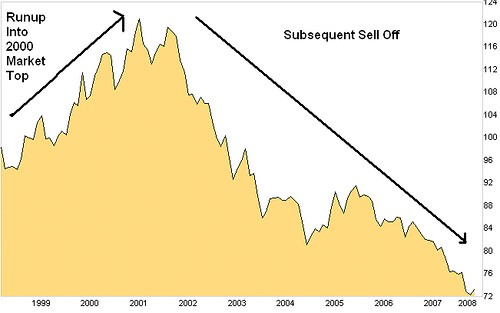

To help understand this better lets look at the example of the US Dollar. As we've discussed in previous lessons, the United States has run a very large current account deficit for quite some time, meaning that the country has imported many more goods and services than it has exported. As this chart of the US Dollar Index shows however, for a number of years the US Dollar continued to strengthen, despite this large current account deficit.

As you can see here going up into 2000 although the US ran a persistent current account deficit, the currency overall continued to strengthen before starting to sell off from late 2000 forward.

what you do need to understand is that in order to have a feel for the long term fundamentals of a currency, it is important to have a general understanding of what is happening from both a trade flows and a capital flows standpoint, and how these two things interact with one another.