The trend is classified into three categories namely: the major, intermediate (secondary) and the near term (short term) trend.

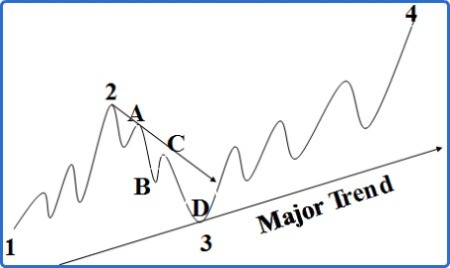

In the above figure, swing 1-2-3-4 represents the major trend. Swing 1-2-3 represents the intermediate trend. And swing A-B-C-D within swing 1-2-3 represent the short term or the near term trend.

According to the Dow Theory the major trend lasts longer than a year. The intermediate or secondary trend lasts anywhere between three weeks to few months. And finally, the near term trend lasts less than three weeks. Depending on the financial market sector, the time length for each category of trend may vary.

For example, in the case of foreign exchange, any trend longer than six months could as well be considered as the major trend as forex traders operate in a shorter time dimension. On the other hand, in the case of stock market, any trend longer than a year is considered as the major trend.

Quite a bit of ambiguity arises among traders as a result of time length variation to classify three different trends. So depending on the financial market sector, its all upto an individual trader to decide for themselves to determine time length for the mjaor, intermediate and the near term trend.

Understand though that the Dow Theory identified the three classification of trend primarily for timing purpose. The major trend is used to identify the overall market trend. The intermediate trend identifies the trading direction and the near term trend can be used to initiate market entry.

Market trend comes in series. That being said, each trend becomes a portion of its next larger trend.