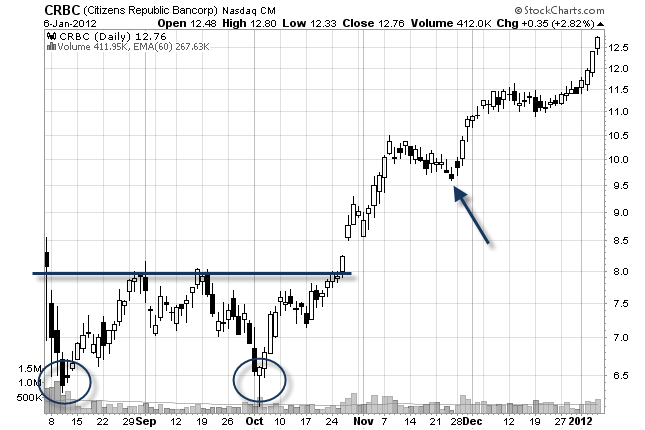

This is a no brainer. Identifying support and resistance levels is one of the first things you learn in technical analysis. It is the most important aspect of chart reading. But, how many traders really pay attention to it? Not many. Most are too busy looking at Stochastics, MACD, and other nonsense.

Tip #2. Analyze swing points

Swing points (some call them "pivot points") are those areas on a stock chart where important short term reversals take place. But not all swing points are created equal. If fact, your decision to buy a pullback will depend upon the prior swing point. Here is an example:

Look at the area that I have highlighted in green. You may have

considered buying this pullback. Now look at the prior swing point high

(yellow highlighted). There are two problems with buying this pullback.

First, there isn't much room to work with! The distance between the

pullback and the prior high is too small. You need more room to run so

that you can at least get your stop to break even.

Tip #3. Look for wide range candles

Wide range candles mark important changes in sentiment on every chart - in every time frame.

Tip #4. Narrow range candles lead to explosive moves

Narrow range candles can also tell you that a reversal is imminent. This low volatility environment can lead to explosive moves.

Tip #5. Find rejected price levels

On candlestick charts, lower or upper shadows on candles usually means

that there is a hammer candlestick pattern or a shooting star

candlestick pattern (if the shadow is long enough).

Tip #6. Learn the 50% rule

How can you tell if a candle is significant? Easy. Look to see how far

it has moved into the prior days range. If it moves at least 50% into

the prior days range, then it is significant. And, it is especially

significant if it closes at least 50% into the prior days range. This

usually shows up on the stock chart as a piercing candlestick pattern or

an engulfing candlestick pattern.

Here is an example:

All of the important reversals in this stock happened only after a

candle moved at least 50% into the prior days range (some moved much

more than 50%).

Tip #7. The gap and trap price pattern

Tip #8. Measure the depth of a swing

Tip #9. Consecutive up days and consecutive down days

Stocks will reverse direction after consecutive up days or down days. So, it pays to keep this in mind when you are looking to buy or short a stock. Here is an example:

Tip #10. Location of price in a trend

So, there you have it. These price action tips and tricks will make you money in the stock market.