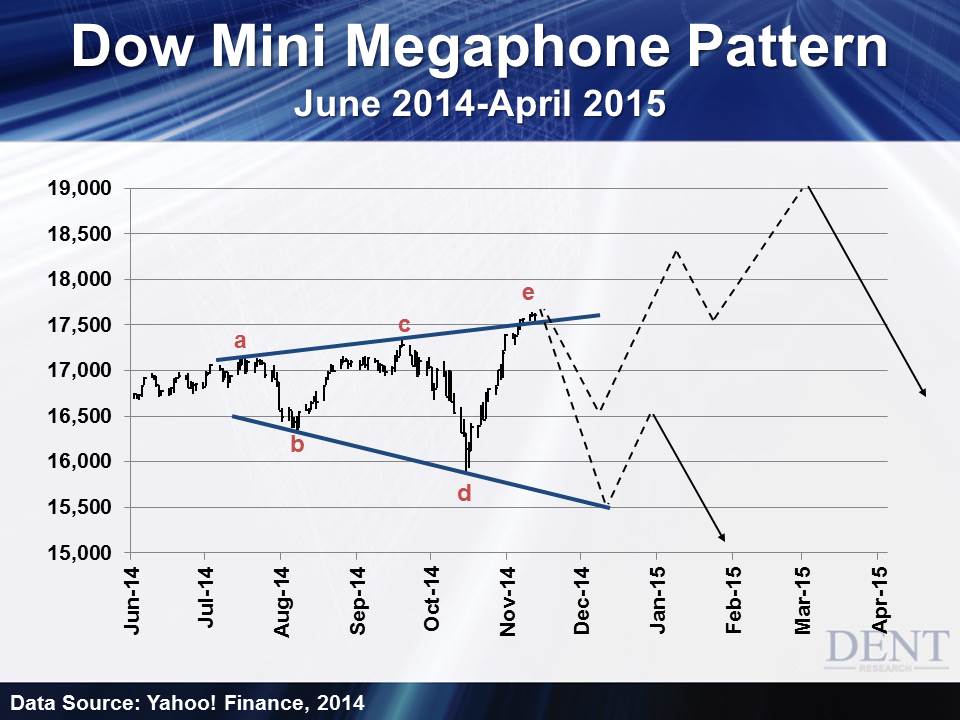

- The megaphone pattern, also known as the broadening top pattern, involves price

making higher highs AND higher lows.

- As such, it is indicative of greater

volatility and instability in the market.

- Specifically, traders should

look for five points: a high (point A), a low (point B), a high that is higher

than point A (this is point C), a low that is lower than point B (this is point

D), and a high that is higher than point C (this is point E).

- Typically, the pattern emerges at the end of an uptrend and is a sign that the market is headed down.

The target price provides an important indication about the potential price move that this pattern indicates. Consider whether the target price for this pattern is sufficient to provide adequate returns after your costs (such as commissions) have been taken into account. A good rule of thumb is that the target price must indicate a potential return of greater than 5% before a pattern should be considered useful, however you must consider the current price and the volume of shares you intend to trade.