The word “leverage” is often associated with trading, and this magic word is more hyped up in the world of Forex trading compared to the trading of other financial instruments. Many people, especially those who are new to Forex and those who don’t really have an idea of how it works, perceive Forex trading to be extremely risky because Forex can be a highly leveraged instrument.

What Is Leverage?

First of all, let me define the basic concept of leverage. Leverage involves borrowing a certain amount of the money needed to invest in something. In the case of forex, that money is usually borrowed from a broker. Forex trading does offer high leverage in the sense that for an initial margin requirement, an investor can build up, and control a huge amount of money.

To calculate the leverage you are currently using, simply divide the total face value of your open positions by your trading capital (See Figure 1). For example, if you have $10,000 in your account, and you open a $100,000 position (which is equivalent to 1 standard lot), you will be trading with a 10 times leverage on your account (100,000/10,000). If you trade 2 standard lots which is worth $200,000 in face value with $10,000 in your account, then your leverage on account is 20 times (200,000/10,000).

Is Leverage Necessary In Forex?

In trading, we monitor the currency movements in pips, which is the smallest change in currency price, and that could be in the second or fourth decimal place of a price, depending on the currency pair. However, currency exchange rates move very little on the surface as their movements are merely fractions of a cent. That is why currency transactions must be carried out in big amounts so that these minute price movements can be translated into decent profits when magnified through the use of leverage. When you deal with a large amount like $100,000, small changes in the price of the currency can result in decent-sized profits or losses.

Many retail Forex brokers offer a sizeable amount of leverage to their customers. Some offer 50 times leverage, while a increasing amount of them even allow up to 400 times leverage for standard-sized or mini-sized accounts. The good thing is that you, the customer, are often given the flexibility to select your leverage amount based on your trading style, personality and money management preferences.

Higher Leverage Equals More Risk

I must emphasize that leverage can be your best friend or your worst foe. Leverage can either magnify your profits or magnify your losses. You can stand to make a huge profit if the trade goes your way, but if the trade ends up going against you, you can equally stand to lose a huge amount. That said, the higher the amount of leverage on capital that you use, the higher the risk that you will assume.

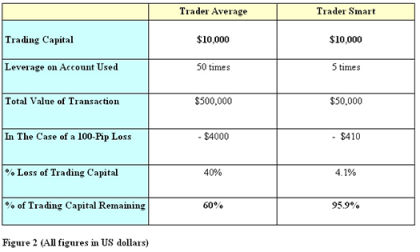

Let me illustrate this point with an example (See Figure 2).

Both Trader Average and Trader Smart have a trading capital of $10,000, and they trade with a broker that requires a 1% margin deposit. After doing some trade analysis, both of them come to the conclusion that USD/CHF is hitting a top, and should be declining in value. Therefore, both of them short the USD/CHF at 1.2200.

Trader Average, feeling quite aggressive, decides to apply 50 times leverage on this trade by shorting $500,000 worth of USD/CHF (50 x $10,000) based on his $10,000 trading account. That $500,000 worth of USD/CHF equals to 5 standard lots (since 1 standard lot is $100,000). His margin deposit for this trade is $5000 (which is 1% of $500,000). At the time when USD/CHF stands at 1.2200, 1 pip of USD/CHF for 1 standard lot is worth approximately $8.20, so 1 pip of USD/CHF for 5 standard lots is worth approximately $40. If USD/CHF goes up instead to 1.2300, Trader Average will lose 100 pips on this trade, which is equivalent to a loss of $4000. This single loss represents 40% of his total trading capital.

Trader Smart, being a more conservative trader, decides to apply a 5 times leverage on this trade by shorting $50,000 worth of USD/CHF (5 x $10,000) based on his $10,000 trading account. That $50,000 worth of USD/CHF equals to just 0.5 standard lot (since 1 standard lot is $100,000). His margin deposit for this trade is $500 (which is 1% of $50,000). If USD/CHF goes up instead to 1.9600, Trader Smart will lose 100 pips on this trade, which is equivalent to a loss of $410. This single loss represents 4.1% of his total trading capital.

Both Trader Average and Trader Smart have set their stop-loss at 100 pips for this trade, but look what happens to Trader Average’s trading account? His account equity is reduced by half based on this one trade. If he applies the same amount of leverage and sets the same stop-loss in pips for the next trade, and again loses, his entire trading account will be wiped out.

On the other hand, Trader Smart, simply by using less leverage, has managed to preserve almost 96% of his trading capital, even though he has also set a 100-pip loss for this trade.

Many trading accounts have been wiped clean from traders who have applied a large amount of leverage on their trades. Either they do not know that excessive leverage can completely destroy one’s trading capital in a blink or they flatly ignore that.

My Broker Offers 400 Times Leverage. Should I Seize That Opportunity?

No. No. And no – at least if you have no intention of losing your hard-earned money in quadruple-quick time. Let me illustrate with some figures.

Let’s say you have a trading account size of $10,000.

A 400 times leverage would mean that you can open a position that is worth 400 times of your trading account. If you are thinking of trading USD/JPY, a 400 times leverage allows you to trade $4,000,000 worth of USD/JPY, which is equivalent to a whopping 40 standard lots.

At the time of writing, 1 pip of USD/JPY for 1 standard lot costs $8.47. Therefore, 1 pip of USD/JPY for 40 standard lots will cost $338.80. Based on an account size of $10,000, it will take a mere 30-pip loss for you to see nothing left in the account. Of course, if the trade does go your way, and you manage a 30-pip gain, your profit will amount to about $10,100.

Novice traders will think about the potentially large profit, whereas experienced traders will see the potentially large loss as a bright red warning sign. Most experienced traders do not use more than 10 times leverage in their trading, and even that is more than what most fund managers are allowed to use.

The question is not how much your forex broker allows you to leverage, but how much you should leverage.

Know The Risks Of Excessive Leverage

While I do appreciate a small amount of leverage in Forex trading, I feel that traders should not be tempted by the high degree of leverage offered by some brokers. It is not uncommon for brokers to offer 100, or 200 or even 400 times leverage to their customers in a bid to attract the largest amount of customers. Do not choose a broker simply based on the highest leverage allowed or the tightest spreads or the lowest margin required.

With a smaller amount of leverage used on each trade, you can afford to give your trade more breathing space by setting a wider but reasonable stop. A highly leveraged trade can quickly deplete your trading account if it turns out to be against you as you would be trading more lots, hence racking up larger amounts of dollar losses. Also, if you employ higher leverage on a trade, but still want to risk not more than your pre-determined certain percentage of your trading capital, your stops must be tighter than usual in order to compensate the risk of trading more lots. Then again, having unreasonably tight stops is suicidal to your trade as you are not giving the currency pair much moving room.

Keep in mind that leverage is totally flexible and customizable to each trader’s needs. Having an aim of trading profitably is not about making your millions by the end of this month or even this year. The means of using high leverage is there; it is just as easily available to you as credit cards are. The thing is, the mere availability of these “perks” should not mean that you should take full advantage of it. Make smart trading decisions by considering the worst-case scenario. If you are not careful, you could end up like the majority – broke and scarred.

Author : Grace Cheng