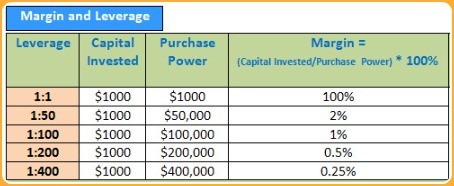

So in any event, the minimum margin requirement amount is all a trader is risking at any event. This guarantees that a trader will never pay a debit balance in the event of loss as a result of trading.

Balance refers to the value of funds in the account. It excludes profits and losses

made on any open positions. In the figure above, the balance is at $1085.94

Equity refers to the "floating" value of funds in the account. It includes profits and losses on

any open positions. In another words, equity reflects to me the real time true value of my account.

Margin account refers to an account that allows a trader to borrow money from a forex broker. In any event of losing trade, the maximum amount any trader can lose at any given time can not

exceed the margin account amount.