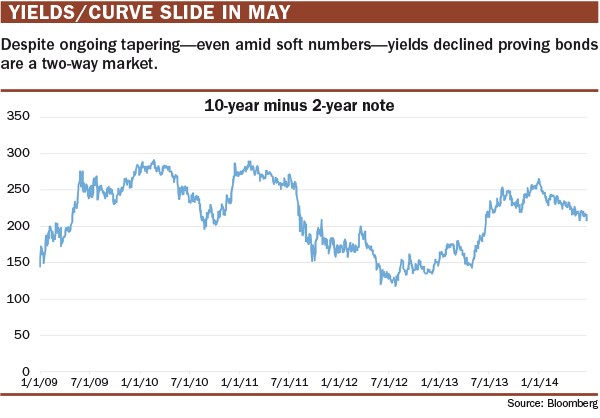

By the end of May, the decline in the benchmark 10-year U.S. government note yield to 2.40% marked its lowest reading since July 2013.

The topic du jour on most financial media talk shows immediately became why bond yields were seemingly responding more to the earth’s gravitational pull and ignoring the imminent monetary tightening that the Federal Reserve was clearly embarking upon.

Meanwhile, stocks continue to enjoy the summer heat and appear unflustered by a slew of nasty geopolitical risks in the background.

Investors continue to be convinced that equity prices are not overvalued even at record highs. In addition, they are also starting to better understand the interplay between stock prices and bond yields. Perhaps one year ago it used to be the case that the Fed could prepare to make its exit as the economy flourished under a period of easy money. Logic stated that beyond its bond purchase period the economy would be well enough primed to withstand a normalization of borrowing costs. The Fed, however, continues to pour cold water on that argument, leading investors to believe that interest rates will be lower than usual for longer, and that post-tapering will not guarantee that the economy is ready for policy increases.

Yields and prices move inversely. Rarely have bond prices correlated

with those of stocks, except during the unprecedented era of

quantitative easing at the Fed, and even then the relationship is hit

and miss. Typically bonds go up in price when a recession is on the

horizon. When the economic engines are finally ignited by loose monetary

policy, stocks jump the gun and are quick to discount the more

optimistic outlook, signaling a death-knell for bonds as yields are

driven higher.