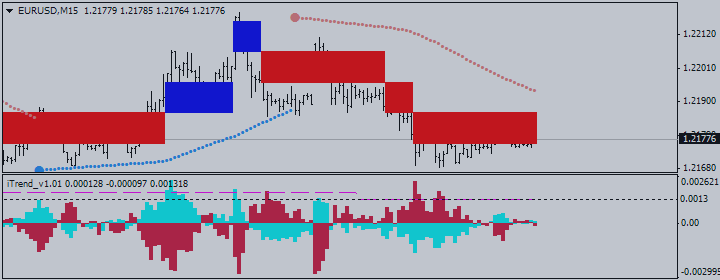

Euro Forecast 2015: EUR/USD Exchange Rate Could Slump to 1.22 Warn Analysts - Exchange rate forecasts for 2015 from research house TD Securities

Exchange rate forecasts for 2015 from research house TD Securities have confirmed a bearish slant regarding the euro dollar exchange rate (EUR/USD) pairing.

However - be aware that the potential for a near-term slump in the US Dollar is possible as a sharp climb in the currency is due to run out of momentum and dollar-buyers become harder to find.

"The contrast with a growing US economy (tracking north of 3% growth for Q3) and the Federal Reserve's tentative steps away from extraordinary policy settings could not be starker," say TD Securities."We continue to target 1.29 by year end. Considering the risks of a

short-term correction in the USD rally that we perceive currently, we

are reluctant to adjust our USD forecasts at this point.

"But we expect EURUSD losses to extend towards 1.22 through the end

of 2015 something the ECB would find helpful to achieve its inflation

target in the longer run, though earlier and/or more pronounced weakness

through the year seems to be the main risk at this point."

Minor EURUSD corrections in the next few weeks will provide good entry points for short positions suggest analysts.

The Canadian bank confirm they sit with the majority of analysts in remaining bullish on the USD outlook in the medium to longer term."We continue to believe that USD-supportive fundamental, structural

and technical factors are aligned in a way that suggests the trend

appreciation in the USD is likely to extend broadly into 2015.

"More so now that the latest FOMC meeting, whilst acknowledging soft

inflation and persistent labour market under-utilisation, persuaded

market participants that rates may rise slightly more quickly than

previously expected.

"The outlook contrasts with sluggish growth and relative easy or easier monetary conditions in much of the rest of the G-10 space (and increasing focus on fragilities exposed in developing markets by the prospect of US monetary tightening). We think the DXY will end this year a little above 86 and rise another 4.5% roughly in the coming year."

There is a caveat to that generally constructive view, however. USD's broader bull-run has extended for ten weeks now."This is an unusually lengthy period of uninterrupted gains, which, based on the history the DXY index movement since the late 1970s, is liable to end soon, though perhaps with a whimper rather than a bang," say TD Securities.

Meanwhile Omer Esiner at Commonwealth Foreign Exchange points out

that the rising dollar could soon prove a headache to US policy makers:

"This marks the 11th-straight week of gains for the greenback, a

trend that is unmatched in the dollar’s history since it was floated

from the gold standard in the early 1970’s.

"The historic rise in the greenback however is beginning to rattle

global markets, as evidenced by yesterday’s over 260-point drop in the

Dow Jones.

"A rising dollar not only makes U.S. exports more expensive, but it

undermines the value of overseas profits for multi-national companies.

It also puts downward pressure on the value of imported goods."