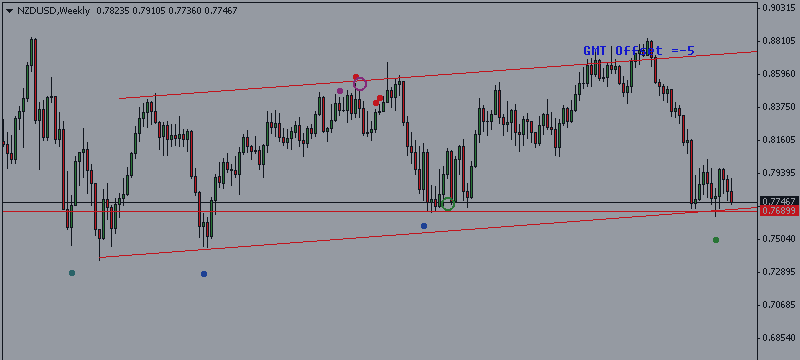

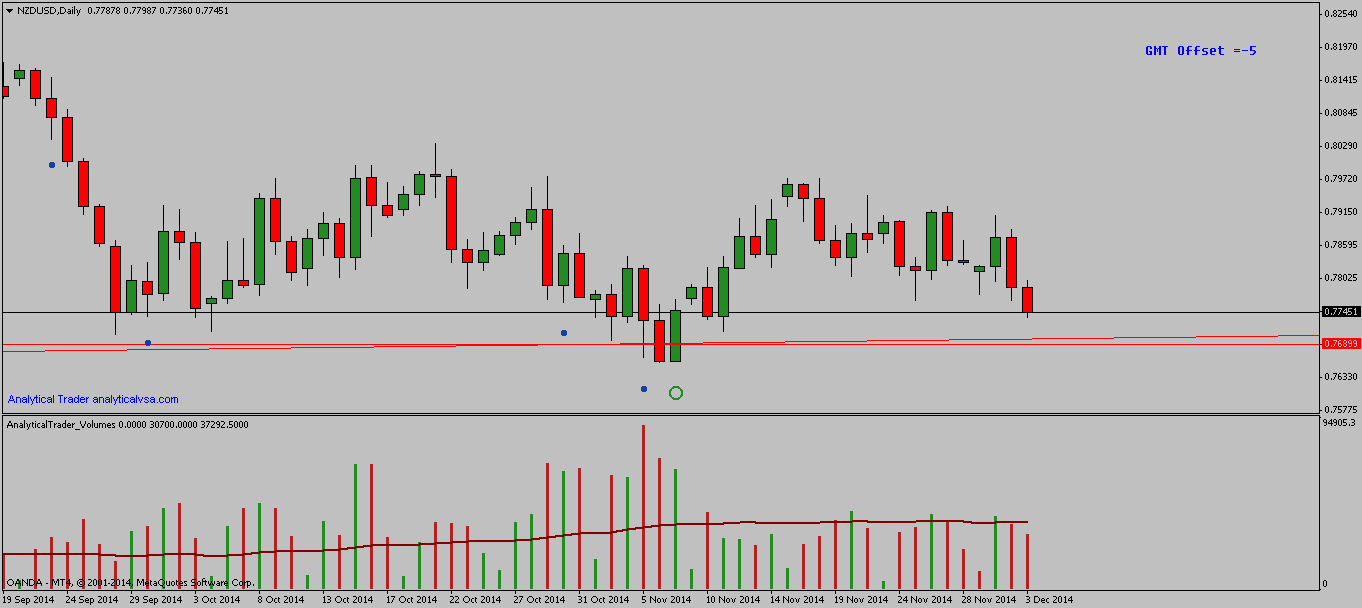

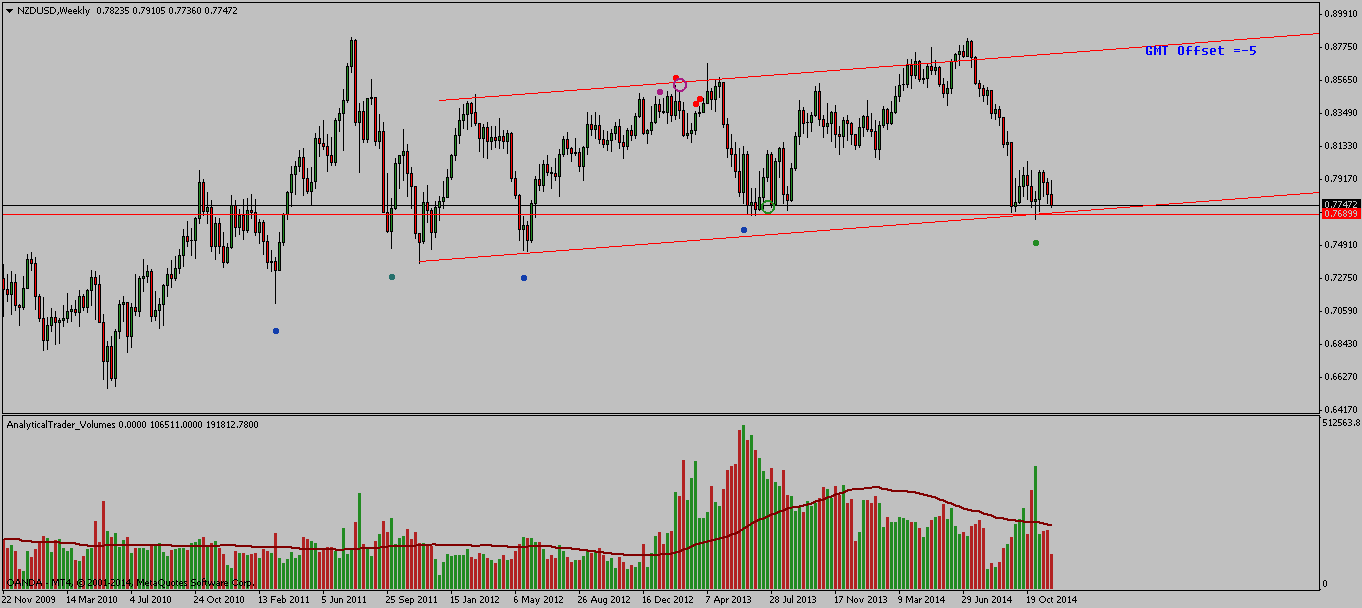

New Zealand Dollar/USD is right above a long-term up trendline and also above a support formed in June/2013. In terms of volume, in the daily, we got a big market shake-out on that blue signal with a very high volume, which also made a new low. This has shaken-out many long traders who hit their stop loss, who made possible for big investors to jump in long on the market without making the price go against them, so this is a very bullish signal.

The last 2 minor downtrends were on low volume, which means there isn’t much selling pressure in the market.

In the weekly chart, those dots below bars mark demand in those particular areas. We can see the professionals supported the market by buying in the dips, and thus the market made successive higher lows.

With all these signs, a long position with the stoploss below the most recent low, which is also below the support and the trendline, would be a nice low-risk/potential high-reward trade.