WEEKLY DIGEST 2014, November 23 - 30 for Quantitative Analysis, Trading and Development: “All models are wrong, but some are useful.”

4 December 2014, 06:11

0

273

WEEKLY DIGEST 2014, November 16 - 23 for Quantitative Analysis, Trading and Development

"Quantitative skills are now in high demand not only in the financial sector but also at consumer technology startups, as well as larger data-driven firms. Hence we are going to expand the topics discussed on QuantStart to include not only modern financial techniques, but also statistical learning as applied to other areas, in order to broaden your career prospects if you are quantitatively focused."

Steps To Becoming A Quant Trader

A lot of people from mathematical or statistical backgrounds aspire to be quant traders. But in the present era, the job description for a quant has expanded significantly, due to the advent of high frequency, algorithmic and automated trading. Jobs in these areas are quite demanding and they require more than just outstanding skills in data analysis. They also require a wider understanding, building and execution of automated trading systems.

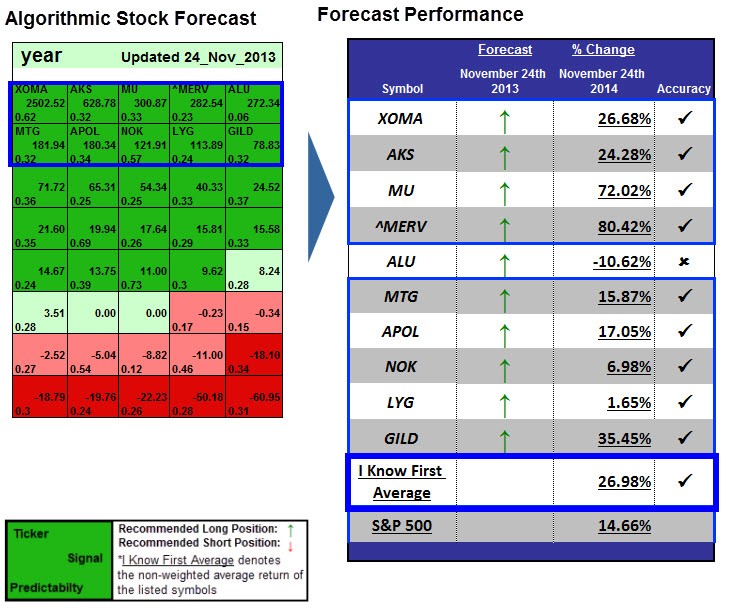

Quant Trading: 26.98% Average Return in 1 Year

Quantitative Trading : How to Build Your Own Algorithmic Trading Business book

book review

What Is the Future of Quantitative Analytics

Quantitative analytics have always been a front-runner of financial innovation and a key facilitator of new product development. But today, the demand for accurate quantitative analysis across the entire industry is steadily rising. Where will quantitative analytics go in the post-crisis period? And what will be quants’ most likely contribution?

mql5 review

Monte Carlo Simulations In CUDA - Barrier Option Pricing"In this article, I will talk about how to write Monte Carlo simulations in CUDA. More specifically, I will explain how to carry it out step-by -step while writing the code for pricing a down-and-out barrier option, as its path dependency will make it a perfect example for us to learn Monte Carlo in CUDA. Also, I will show you how to efficiently generate random numbers with CUDA and how to measure performance with just a few lines of code."

Bayesian Statistics: A Beginner's Guide"Quantitative skills are now in high demand not only in the financial sector but also at consumer technology startups, as well as larger data-driven firms. Hence we are going to expand the topics discussed on QuantStart to include not only modern financial techniques, but also statistical learning as applied to other areas, in order to broaden your career prospects if you are quantitatively focused."

Steps To Becoming A Quant Trader

A lot of people from mathematical or statistical backgrounds aspire to be quant traders. But in the present era, the job description for a quant has expanded significantly, due to the advent of high frequency, algorithmic and automated trading. Jobs in these areas are quite demanding and they require more than just outstanding skills in data analysis. They also require a wider understanding, building and execution of automated trading systems.

Quant Trading: 26.98% Average Return in 1 Year

Quantitative Trading : How to Build Your Own Algorithmic Trading Business book

book review

What Is the Future of Quantitative Analytics

Quantitative analytics have always been a front-runner of financial innovation and a key facilitator of new product development. But today, the demand for accurate quantitative analysis across the entire industry is steadily rising. Where will quantitative analytics go in the post-crisis period? And what will be quants’ most likely contribution?