Suvashish Halder / 프로필

- 정보

|

3 년도

경험

|

59

제품

|

34

데몬 버전

|

|

0

작업

|

1

거래 신호

|

0

구독자

|

Hello, I'm Suvashish Halder. A full-time trader and data analyst 📊.

Trading is a journey where you explore something new every single day, and patience, discipline, and risk management are the keys to success in this journey 🚀.

Apart from that, I publish tools that help traders improve their trading journey. Some tools could be helpful, and some tools may not. Let's explore this path together.

Wish you all the best and happy trading. Thank you! 🙏

Trading is a journey where you explore something new every single day, and patience, discipline, and risk management are the keys to success in this journey 🚀.

Apart from that, I publish tools that help traders improve their trading journey. Some tools could be helpful, and some tools may not. Let's explore this path together.

Wish you all the best and happy trading. Thank you! 🙏

Suvashish Halder

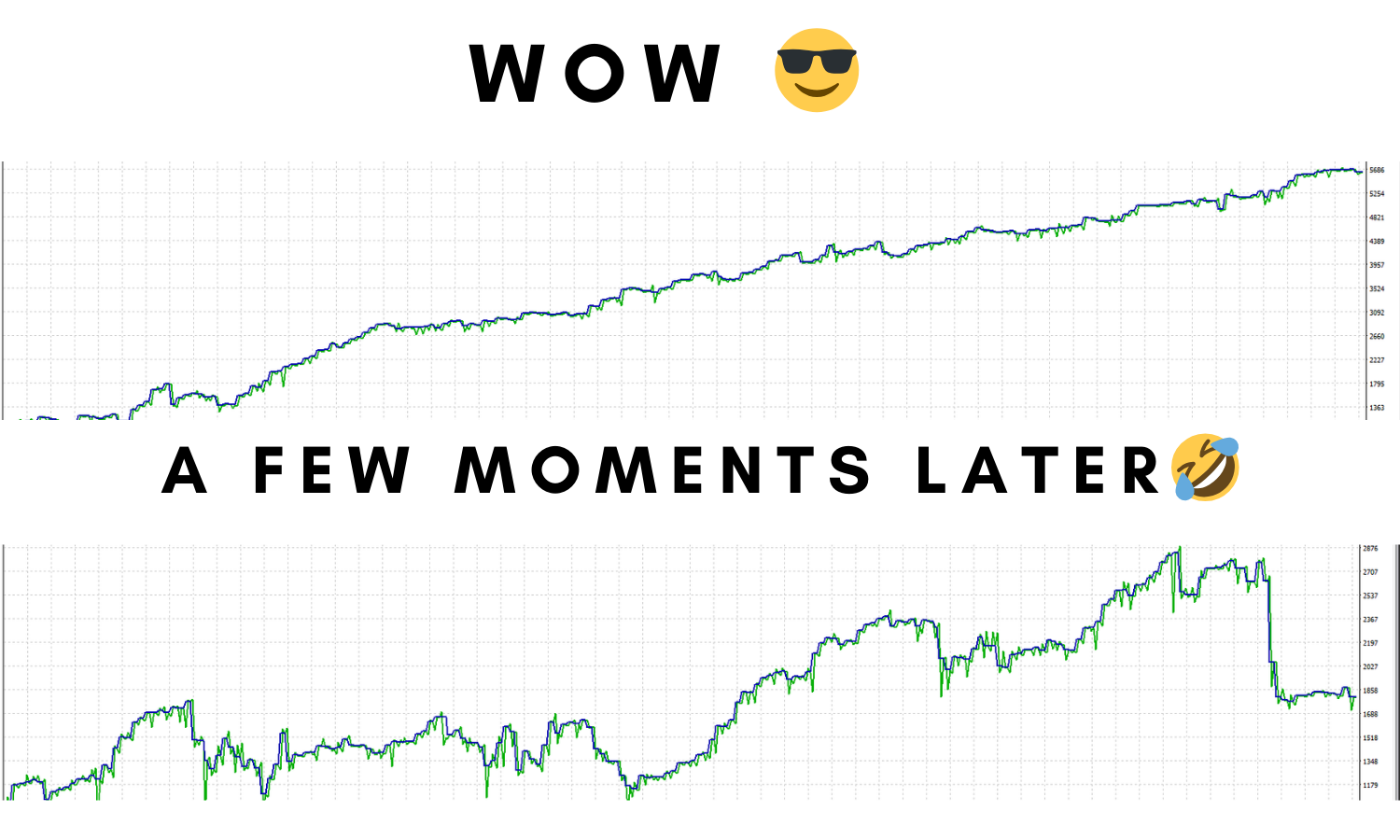

Hello traders, I’ve been working with an EA that follows a tight stop-loss strategy, and the results speak for themselves. But as traders, it’s crucial to understand that trading, no matter what technology you use, carries inherent risks. Whether it’s Machine Learning (ML) or Artificial Intelligence (AI), no system guarantees easy profits. If making money with technology were that simple, everyone would be rich. The reality is, an EA is not a magic solution.

Through my backtesting, I’ve noticed a common pattern, especially with new traders—they often abandon their strategy after encountering losses, believing it’s no longer effective. The same holds true for Expert Advisors (EAs). Not every trade will be a win, and you must accept losses as part of the process. Think of it as a business, where setbacks are inevitable, but long-term success depends on resilience.

I’ve also observed that many popular EAs can perform well for 3-4 years, only to eventually lead to account blowups. Many of these EAs rely on toxic strategies like recovery trades, opening multiple trades at once, or high-risk tactics. I’ve created similar EAs in the past, and while they worked for a while, they ultimately faced losses.

The strategy I’m currently testing has shown over a 70% win rate across 10 months in 2024, which I believe is promising. The reason I’m sharing this is to emphasize that while not every trade or EA will make money, consistent profit over time is achievable if you manage your risk well.

I hope this insight helps you better understand what I’m trying to convey. Trading is a journey, and I wish you all the best along the way. Stay focused, and happy trading!

Through my backtesting, I’ve noticed a common pattern, especially with new traders—they often abandon their strategy after encountering losses, believing it’s no longer effective. The same holds true for Expert Advisors (EAs). Not every trade will be a win, and you must accept losses as part of the process. Think of it as a business, where setbacks are inevitable, but long-term success depends on resilience.

I’ve also observed that many popular EAs can perform well for 3-4 years, only to eventually lead to account blowups. Many of these EAs rely on toxic strategies like recovery trades, opening multiple trades at once, or high-risk tactics. I’ve created similar EAs in the past, and while they worked for a while, they ultimately faced losses.

The strategy I’m currently testing has shown over a 70% win rate across 10 months in 2024, which I believe is promising. The reason I’m sharing this is to emphasize that while not every trade or EA will make money, consistent profit over time is achievable if you manage your risk well.

I hope this insight helps you better understand what I’m trying to convey. Trading is a journey, and I wish you all the best along the way. Stay focused, and happy trading!

소셜 네트워크에 공유 · 1

Suvashish Halder

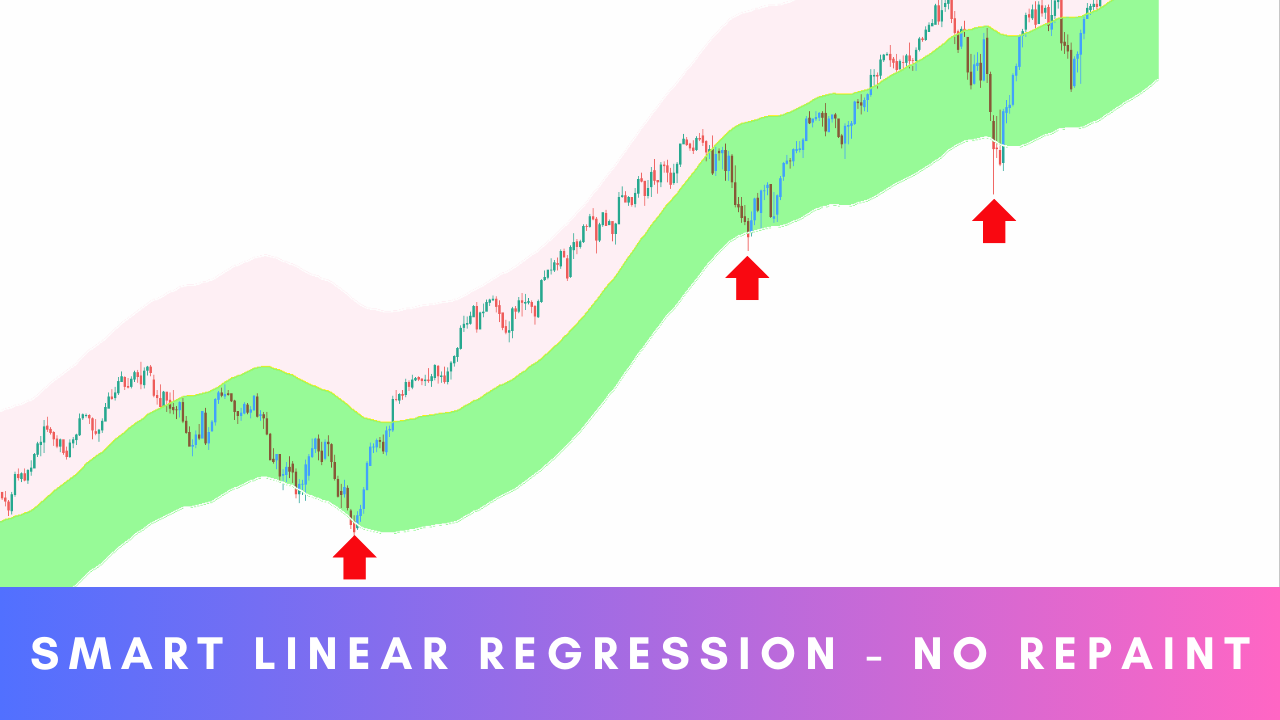

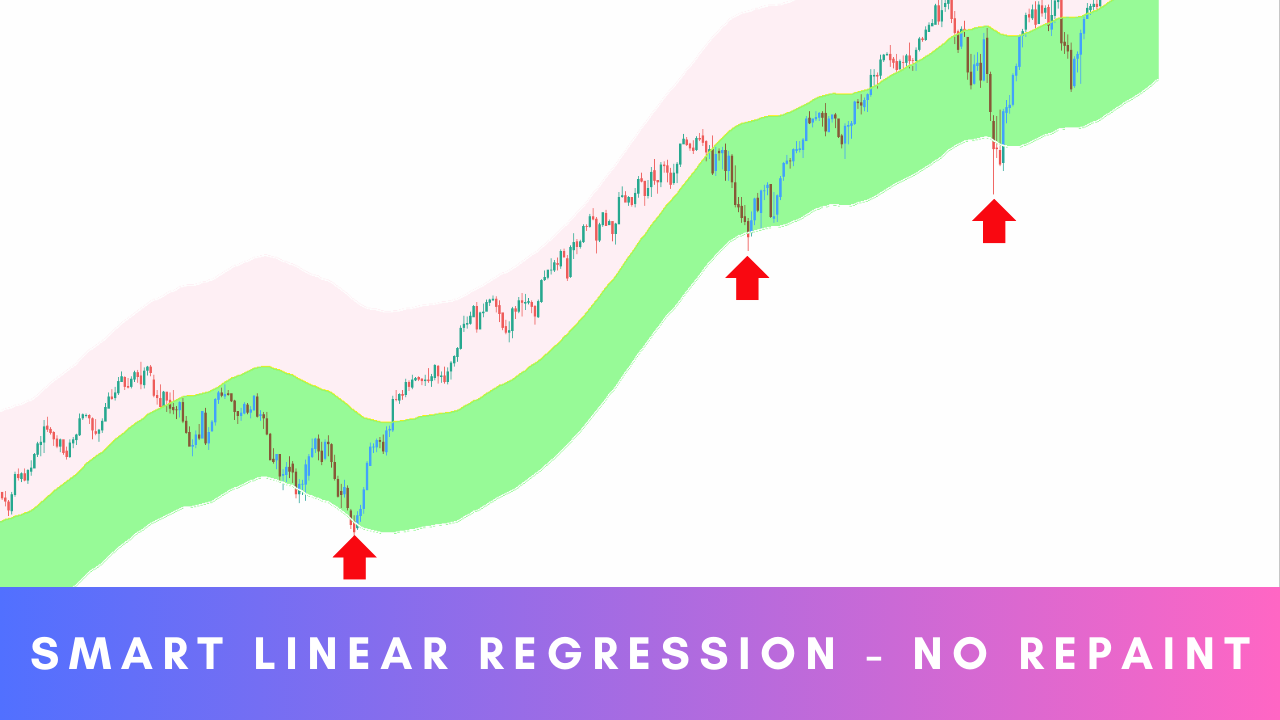

✅ Smart Linear Regression - No Repaint

✅ MT4 - https://www.mql5.com/en/market/product/124893/

✅ MT5 - https://www.mql5.com/en/market/product/124894/

✅ MT4 - https://www.mql5.com/en/market/product/124893/

✅ MT5 - https://www.mql5.com/en/market/product/124894/

소셜 네트워크에 공유 · 2

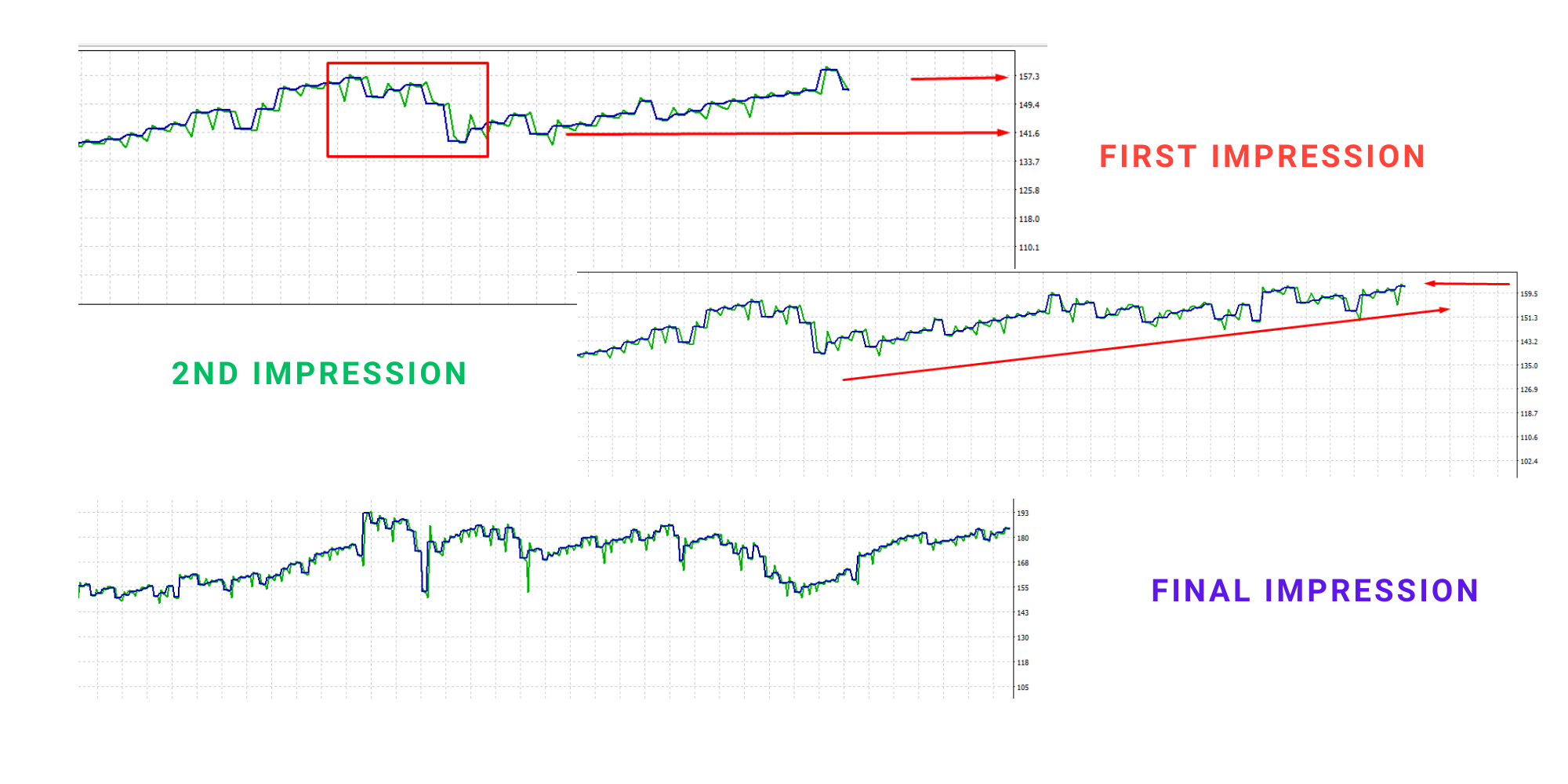

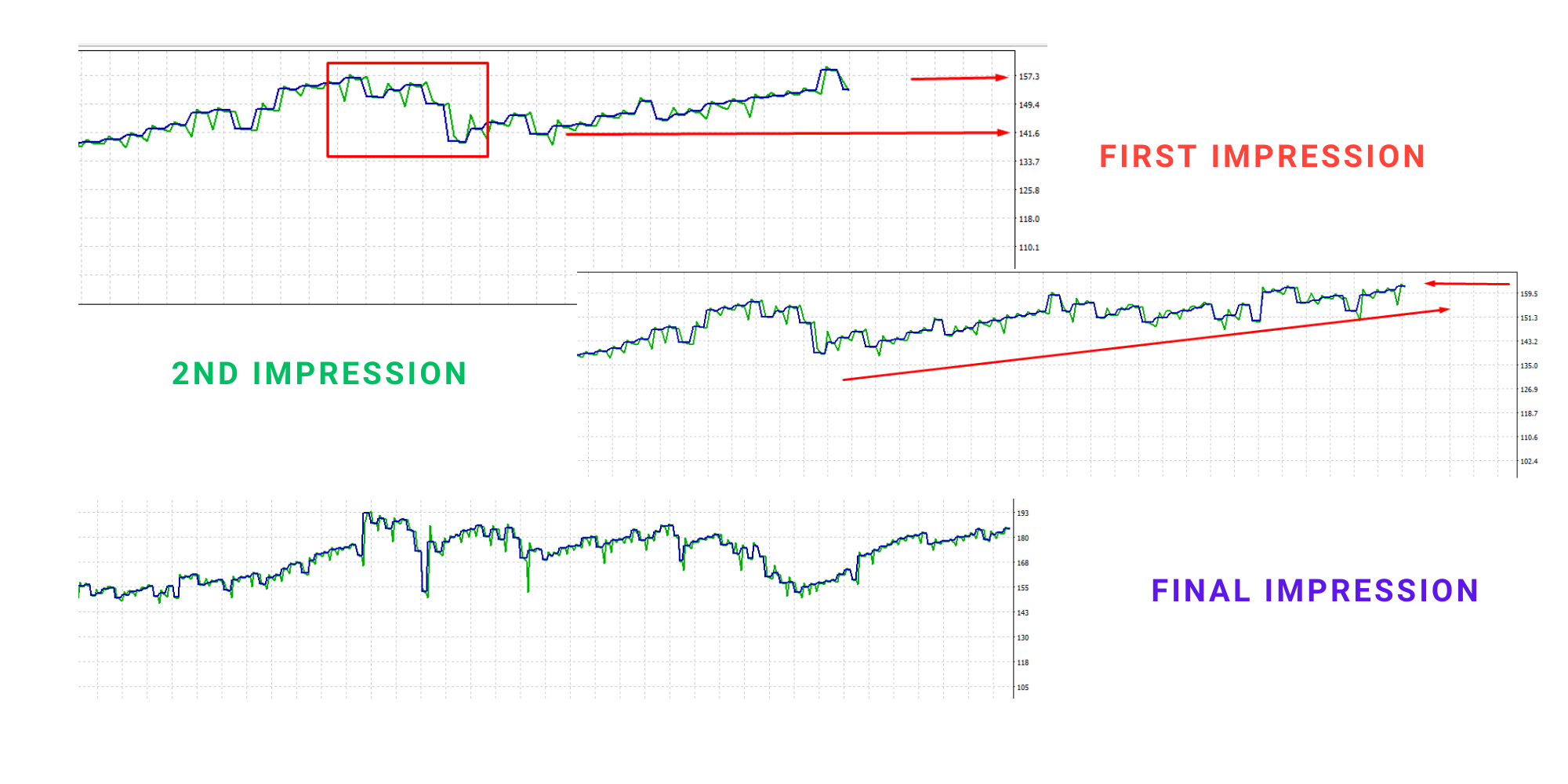

Suvashish Halder

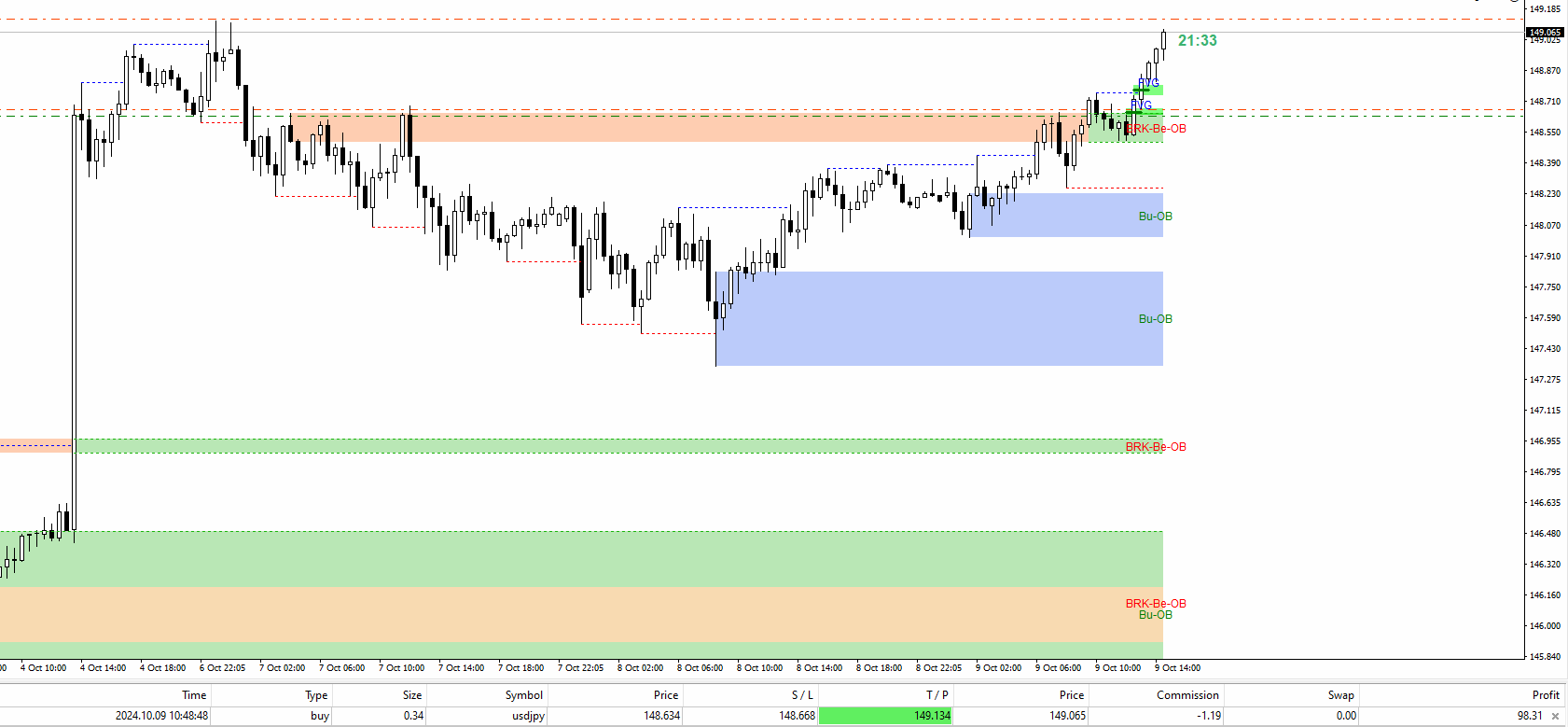

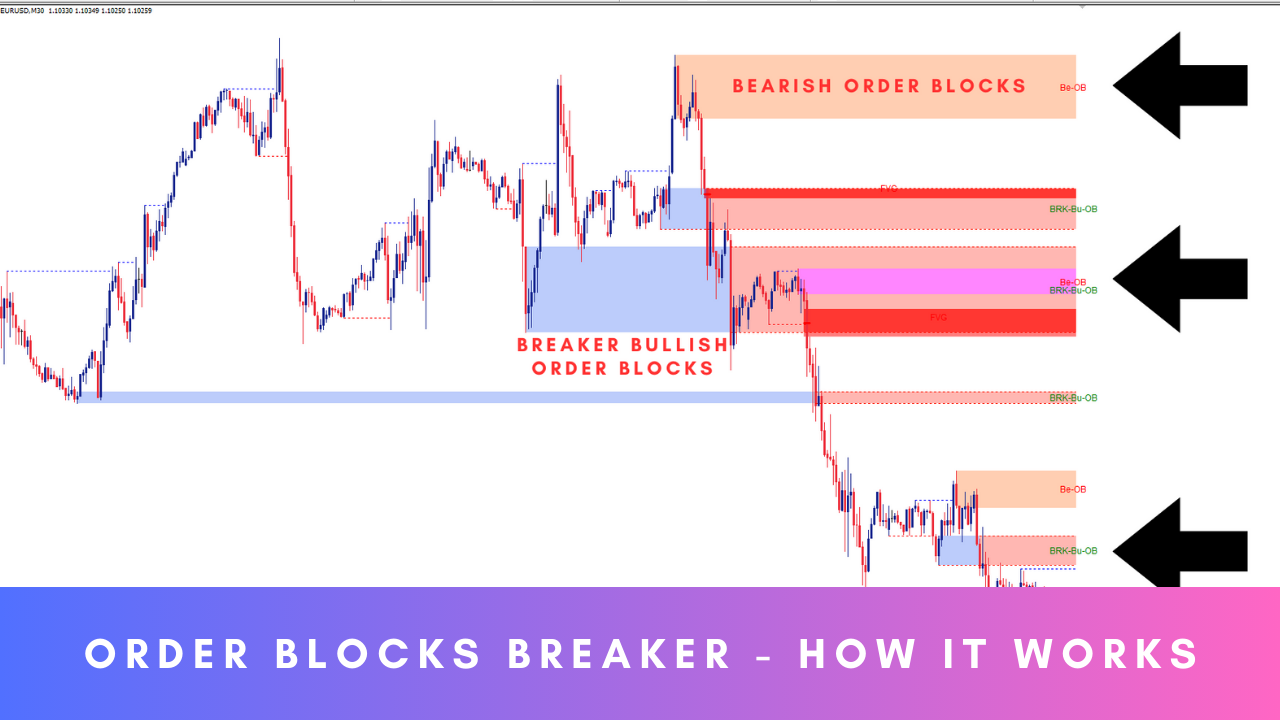

✅ Order Blocks Breaker

✅ MT4 - https://www.mql5.com/en/market/product/124101/

✅ MT5 - https://www.mql5.com/en/market/product/124102/

✅ MT4 - https://www.mql5.com/en/market/product/124101/

✅ MT5 - https://www.mql5.com/en/market/product/124102/

소셜 네트워크에 공유 · 1

Suvashish Halder

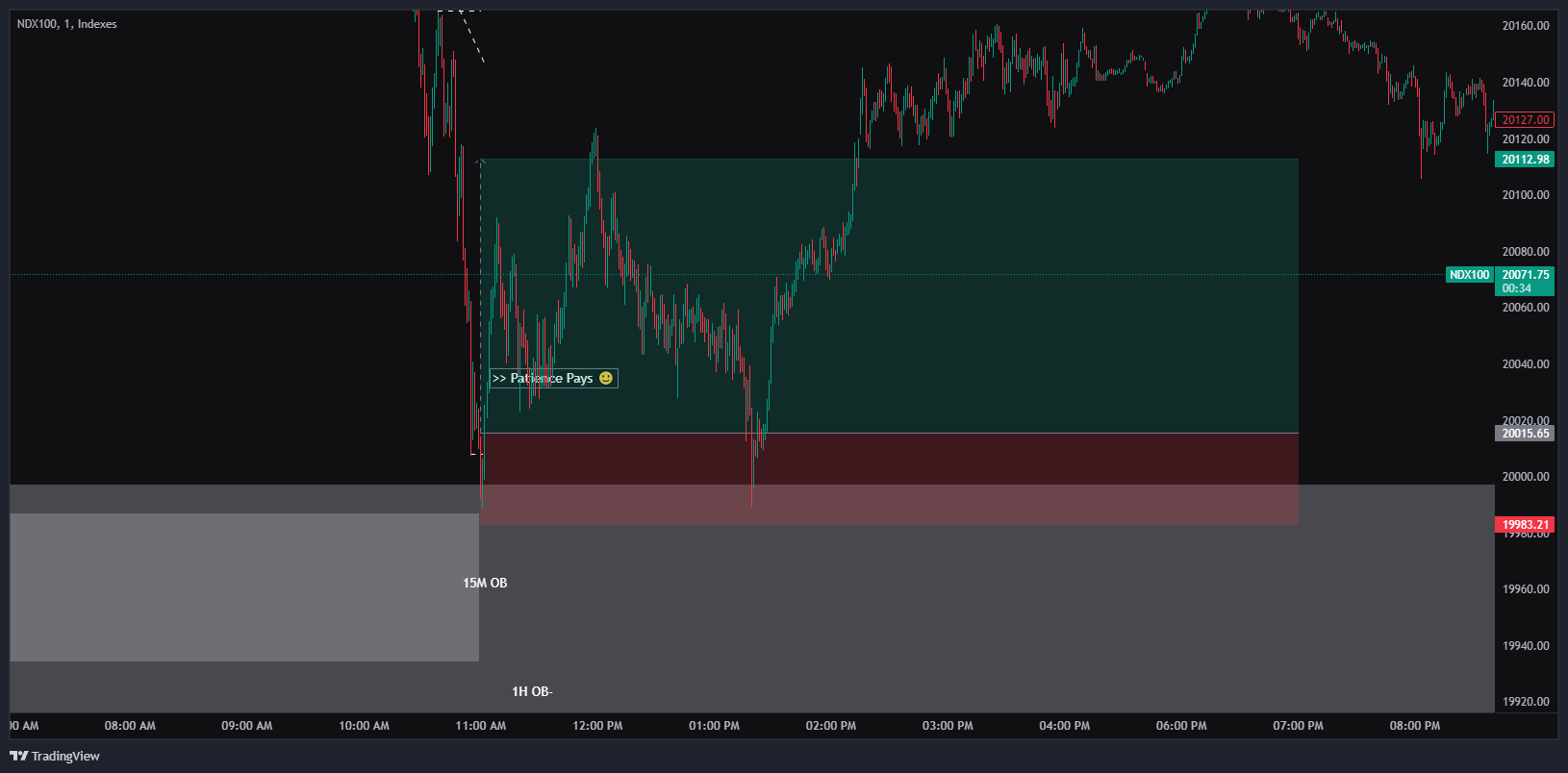

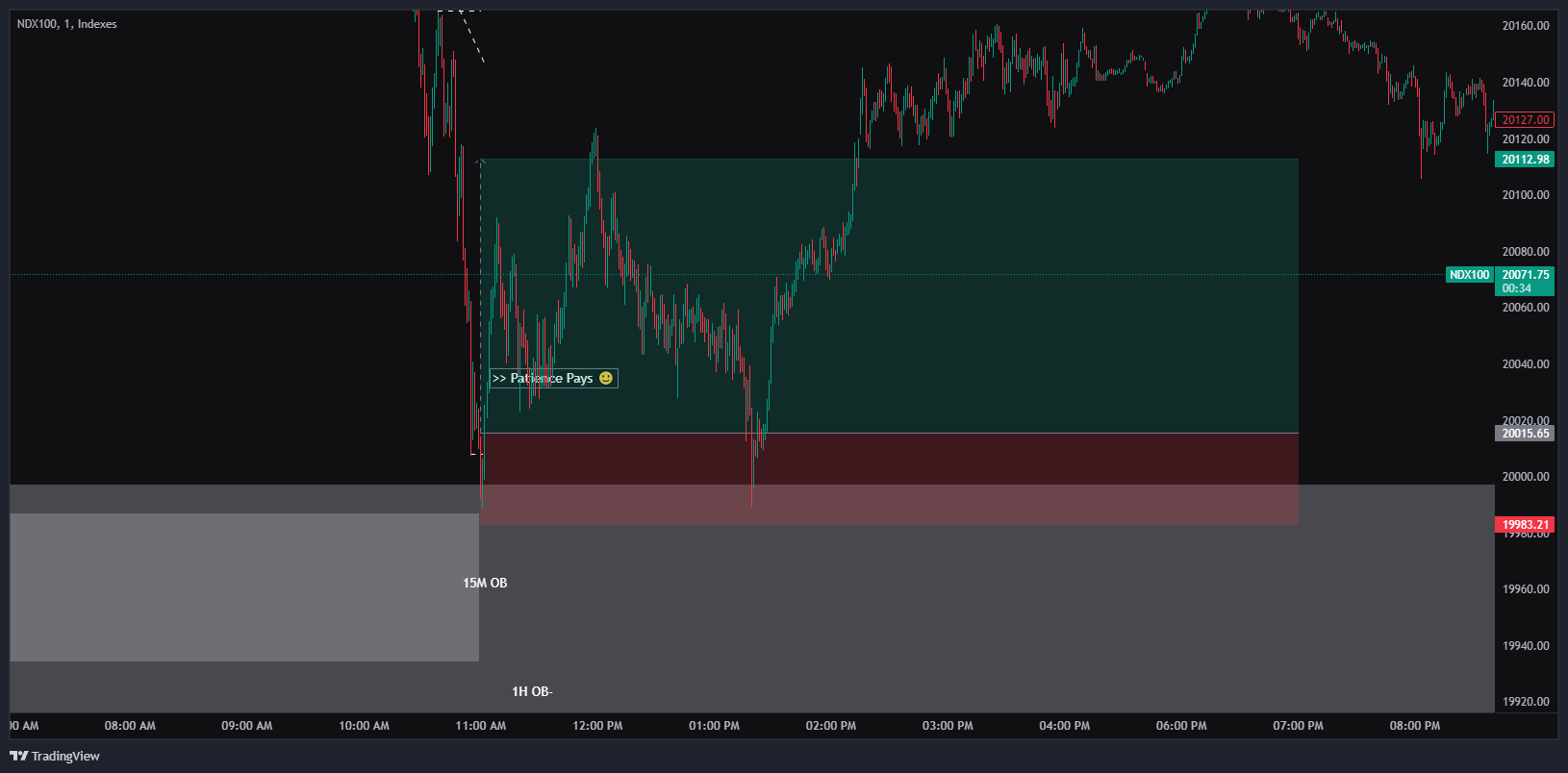

Today Setup that Hit Take Profit (TP) 📈

Risk-Reward Ratio (RR): 1:2.5 ⚖️

Asset: NAS100 💹

Analysis: Multi-Timeframe Analysis 📊

Entry Mode: 1Minutes Scalping ⏱️

Keep Eye On My YT Channel For Live 🎶

Risk-Reward Ratio (RR): 1:2.5 ⚖️

Asset: NAS100 💹

Analysis: Multi-Timeframe Analysis 📊

Entry Mode: 1Minutes Scalping ⏱️

Keep Eye On My YT Channel For Live 🎶

소셜 네트워크에 공유 · 1

Suvashish Halder

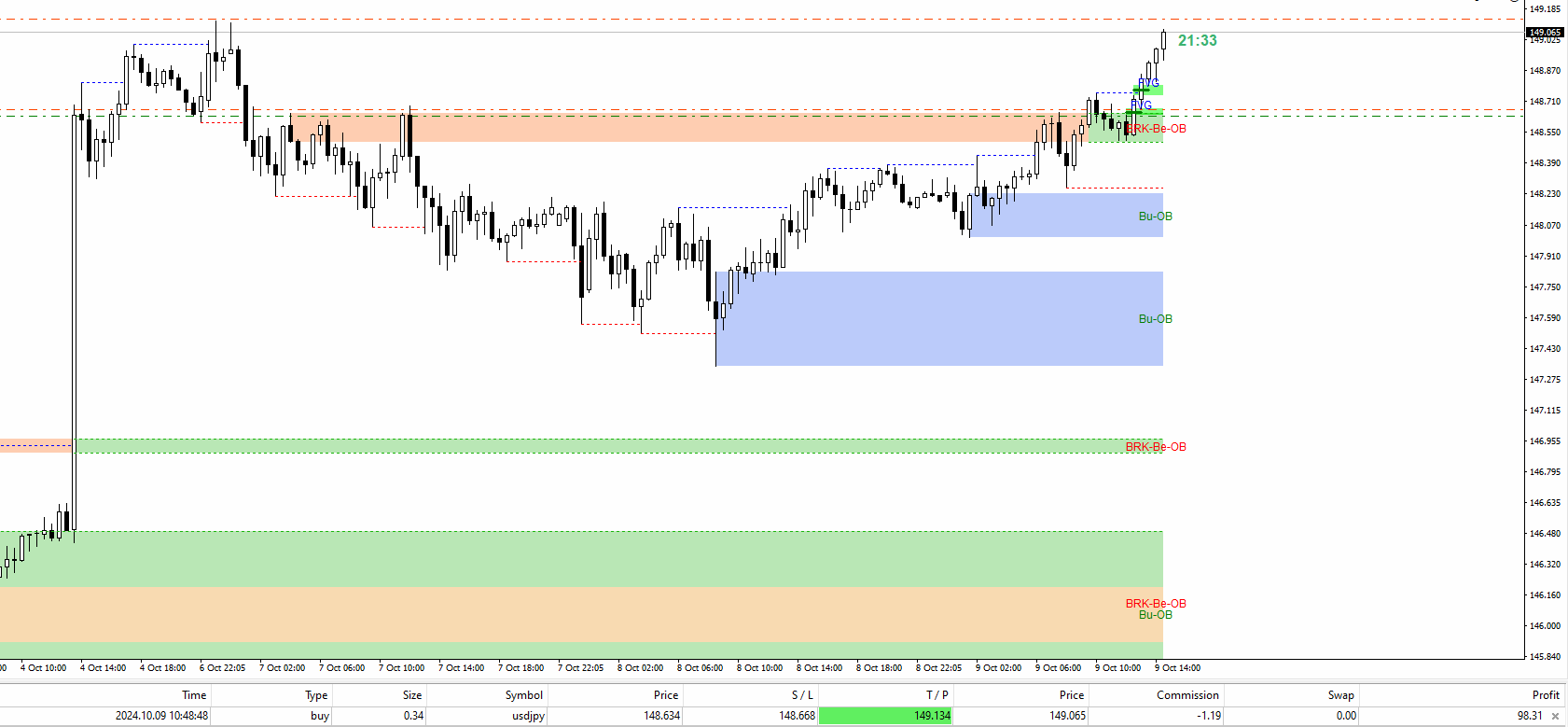

Last Night Setup that Hit Take Profit (TP) 📈

Risk-Reward Ratio (RR): 1:5 ⚖️

Asset: NAS100 💹

Analysis: Multi-Timeframe Analysis 📊

Entry Mode: 5/15 Minutes ⏱️

Strategy : Open Order Then Sleep 🙂

Risk-Reward Ratio (RR): 1:5 ⚖️

Asset: NAS100 💹

Analysis: Multi-Timeframe Analysis 📊

Entry Mode: 5/15 Minutes ⏱️

Strategy : Open Order Then Sleep 🙂

소셜 네트워크에 공유 · 2

Suvashish Halder

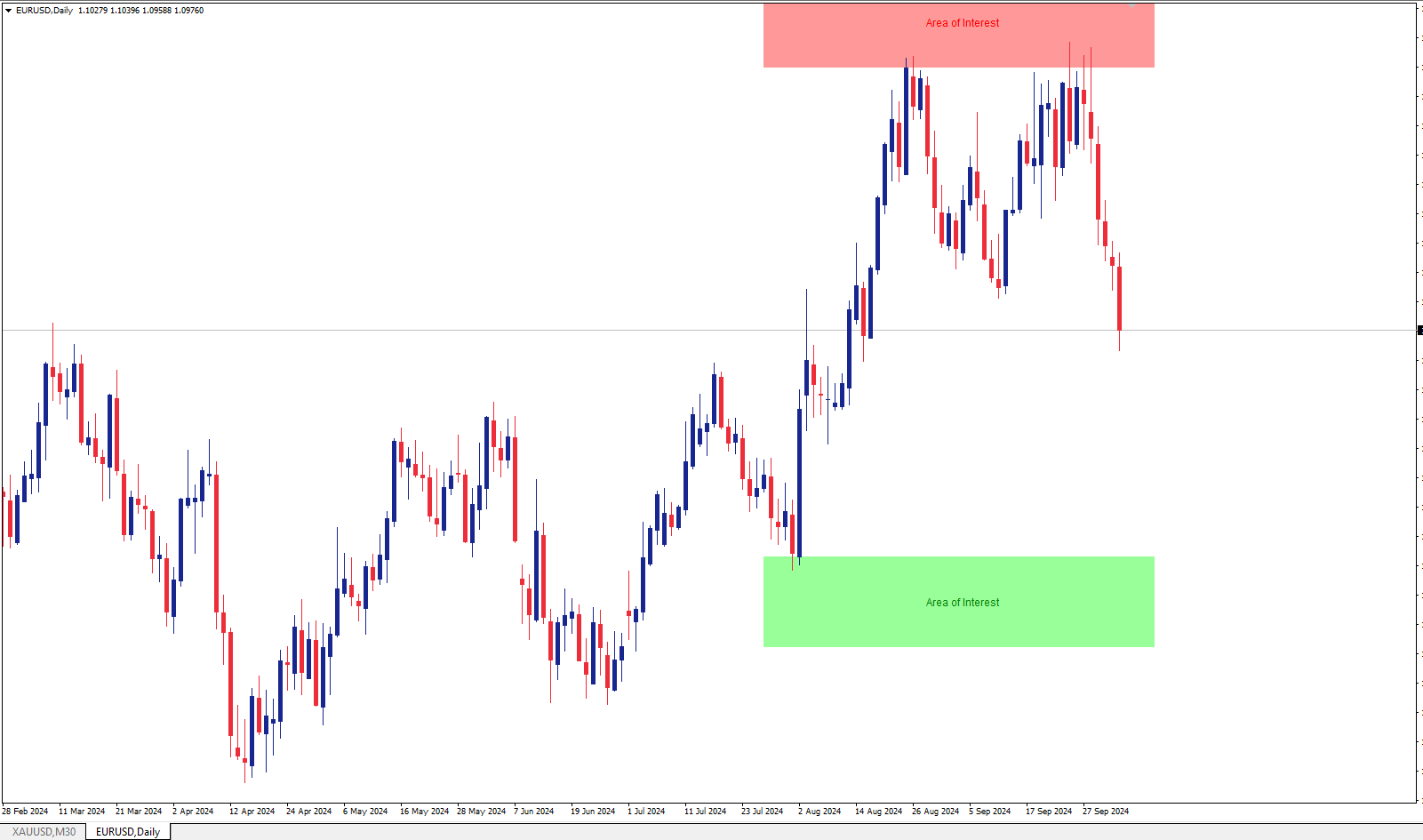

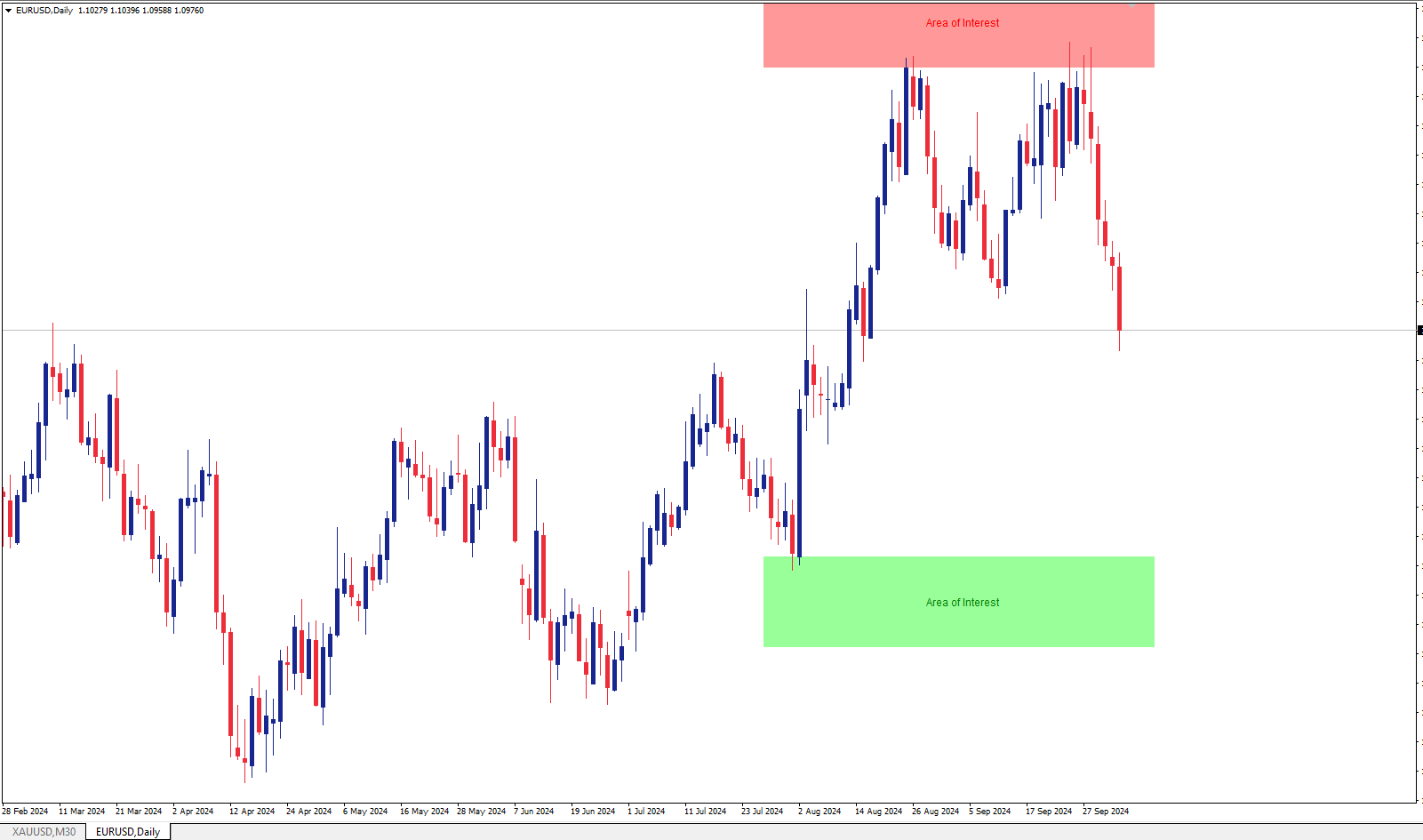

✅ Area of Interest - Completely Free Access 😎

✅ MT4 - https://www.mql5.com/en/market/product/124327/

✅ MT5 - https://www.mql5.com/en/market/product/124328/

✅ MT4 - https://www.mql5.com/en/market/product/124327/

✅ MT5 - https://www.mql5.com/en/market/product/124328/

소셜 네트워크에 공유 · 2

Suvashish Halder

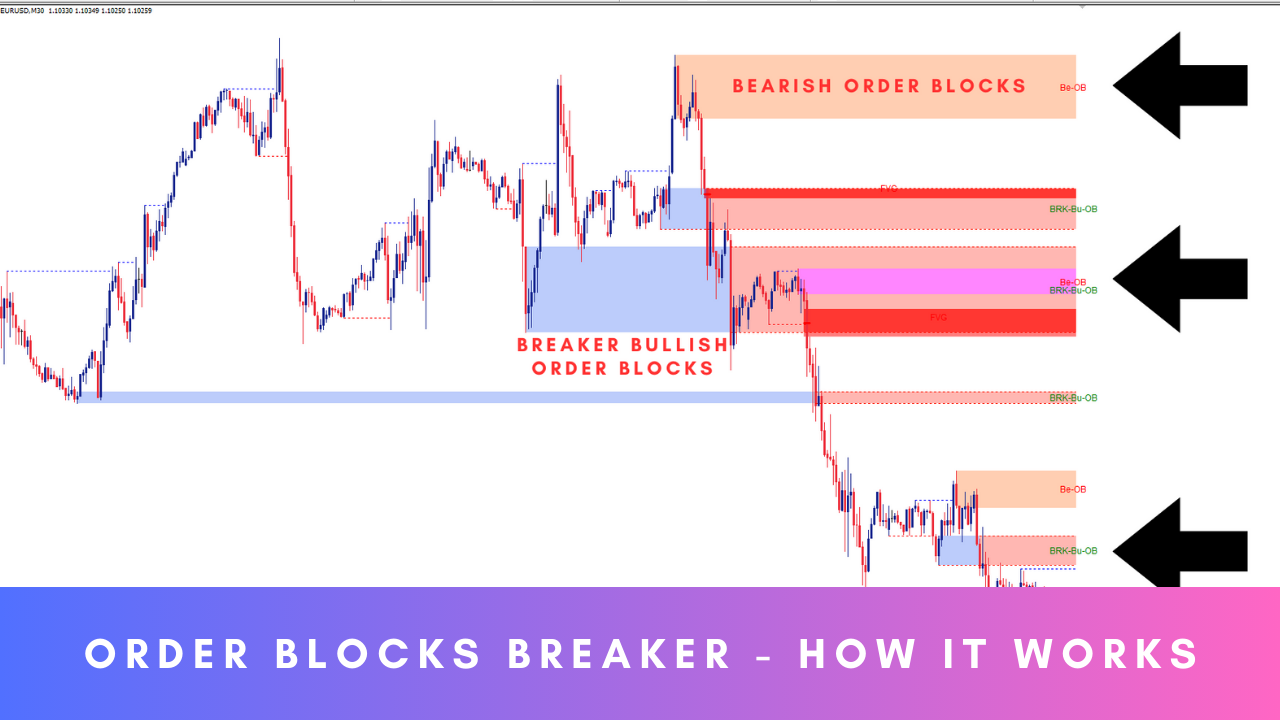

✅ Order Blocks Breaker

✅ MT4 - https://www.mql5.com/en/market/product/124101/

✅ MT5 - https://www.mql5.com/en/market/product/124102/

✅ MT4 - https://www.mql5.com/en/market/product/124101/

✅ MT5 - https://www.mql5.com/en/market/product/124102/

소셜 네트워크에 공유 · 2

Suvashish Halder

Yesterday's Setup that Hit Take Profit (TP) 📈

Risk-Reward Ratio (RR): 1:3 ⚖️

Asset: NAS100 💹

Analysis: Multi-Timeframe Analysis 📊

Entry Mode: 1-Minute (1M) ⏱️

Risk-Reward Ratio (RR): 1:3 ⚖️

Asset: NAS100 💹

Analysis: Multi-Timeframe Analysis 📊

Entry Mode: 1-Minute (1M) ⏱️

소셜 네트워크에 공유 · 2

Suvashish Halder

✅ Order Block Tracker

✅ MT4 - https://www.mql5.com/en/market/product/123358/

✅ MT5 - https://www.mql5.com/en/market/product/123362/

✅ MT4 - https://www.mql5.com/en/market/product/123358/

✅ MT5 - https://www.mql5.com/en/market/product/123362/

소셜 네트워크에 공유 · 1

Suvashish Halder

🚨 URGENT SCAM ALERT 🚨

It has come to my attention that a fake Telegram channel has been created using my name and logo, asking people to invest money. Please be aware that this is a SCAM. I am NOT asking for any investments, and I would never solicit funds through Telegram or any other platform.

To protect yourself:

✅ Do not send money to anyone claiming to be me or representing me.

✅ Report the fake account immediately.

✅ Always verify any communication directly through my official channels.

✅ Stay safe, and thank you for your continued support!

It has come to my attention that a fake Telegram channel has been created using my name and logo, asking people to invest money. Please be aware that this is a SCAM. I am NOT asking for any investments, and I would never solicit funds through Telegram or any other platform.

To protect yourself:

✅ Do not send money to anyone claiming to be me or representing me.

✅ Report the fake account immediately.

✅ Always verify any communication directly through my official channels.

✅ Stay safe, and thank you for your continued support!

소셜 네트워크에 공유 · 2

Suvashish Halder

✅ Volume Orderflow Profile

✅ MT4 - https://www.mql5.com/en/market/product/122656/

✅ MT5 - https://www.mql5.com/en/market/product/122657/

✅ MT4 - https://www.mql5.com/en/market/product/122656/

✅ MT5 - https://www.mql5.com/en/market/product/122657/

소셜 네트워크에 공유 · 2

Suvashish Halder

Two crucial things in trading that traders should be aware of:

✅ Market Zones: The market can often show you zones where you might feel compelled to open a trade. But beware—these areas can be deceptive.

✅ News Traps: Believe it or not, news can be one of the biggest traps, luring you in with forecasted outcomes that don’t always play out.

✅ How to Avoid These Traps:

👍 Think Differently: Don’t think like a typical retail trader. Flip your strategy—set your entry where you'd normally place your stop loss, and wait for a stop hunt or liquidity sweep.

👍 Avoid News Trading: Just don’t do it. While you may win a few times, in the long run, you're likely to lose. Stay clear of the hype.

✅ Market Zones: The market can often show you zones where you might feel compelled to open a trade. But beware—these areas can be deceptive.

✅ News Traps: Believe it or not, news can be one of the biggest traps, luring you in with forecasted outcomes that don’t always play out.

✅ How to Avoid These Traps:

👍 Think Differently: Don’t think like a typical retail trader. Flip your strategy—set your entry where you'd normally place your stop loss, and wait for a stop hunt or liquidity sweep.

👍 Avoid News Trading: Just don’t do it. While you may win a few times, in the long run, you're likely to lose. Stay clear of the hype.

소셜 네트워크에 공유 · 2

Suvashish Halder

✅ Finally Volume Delta Candles For MT5

🚩 https://www.mql5.com/en/market/product/122473

🚩 https://www.mql5.com/en/market/product/122473

소셜 네트워크에 공유 · 2

: