Many martingale EAs and scalping systems are working on this way.

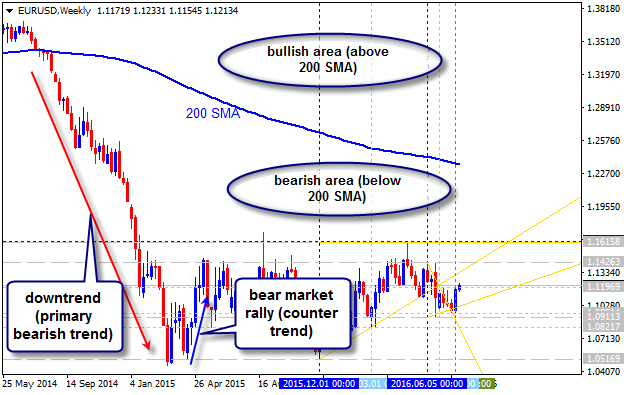

It means the following: trading the secondary trend (correction after good breakout, or rally after good breakdown for example).

This is the example:

I took SMA with period 200 as an example only (some people are using 21 EMA, Ichimoku, 55 MA, 34 SMA and more - depends on the system and timeframe).

Trading against trend is not dangerous. As not dangerous is martingale, grid and trend following. Problems starts when You strategy fails ;)

Trading against trend is not dangerous. As not dangerous is martingale, grid and trend following. Problems starts when You strategy fails ;)

How many pips do you want to trade against the trend ?

10 Pips ? 100 Pips ?

1000 Pips ?

Don't you think there's some importance to these things ?

Or to for example Lotsize ?

How large a position do you want to trade against the trend ?

0.01 Lot ?

100 Lots ?

I think many elements that combine into overall risk management make something dangerous or not.

Direction is (should be) neglect able.

BUY Low, SELL it High

How can we get Lows & Highs without countering the Trend ?

How many pips do you want to trade against the trend ?

10 Pips ? 100 Pips ?

1000 Pips ?

Don't you think there's some importance to these things ?

Or to for example Lotsize ?

How large a position do you want to trade against the trend ?

0.01 Lot ?

100 Lots ?

I think many elements that combine into overall risk management make something dangerous or not.

Direction is (should be) neglect able.

yes bro you are right . . . . .

and you are 101% true . . . . .

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use