The Scalpers Checklist (based on dailyfx article)

- Always identify market conditions prior to trading

- Your strategy and entries should reflect the market

- Plan your risk and write your trades down to stay accountable

Traders should have a checklist to consult prior to making any major

trading decisions. These steps are critical for Forex scalpers as they

often have to make these choices on a moment’s notice. To help with the

process it can be helpful to keep a checklist and determine your options

prior to approaching the market. Today we will review the scalper’s

checklist. Let’s get started!

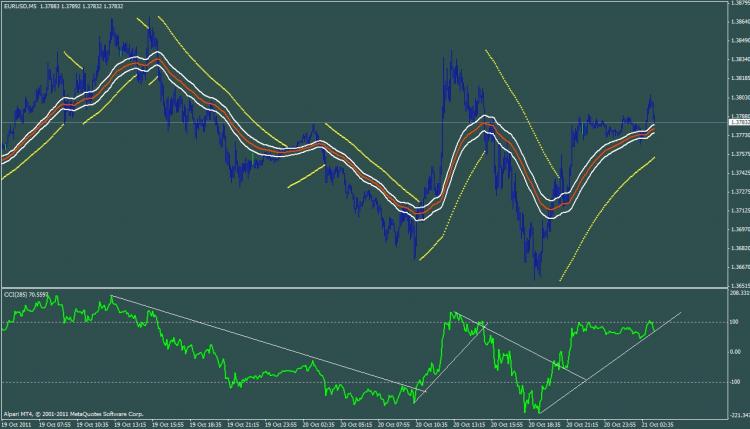

Identify Market Conditions

The first task assigned to day traders and scalpers is to identify market conditions. Is the market trending or ranging? Is the volatility of an asset low or high? These are both important questions that should be answered prior to entering into a new trade idea. Not only will this help Forex traders which currency pair to trade, but also help determine their strategy. Every scalper and day trader should check this off their list, prior to considering any market entries!

Choose a Strategy

Once market conditions are found, traders need to identify a strategy

that is congruent with the market. If you are trading a trend, you will

need to not only find market direction but also decide if you are going

to trade a retracement, momentum or breakout strategy. In lack of a

trend, traders again need to decide how to approach pricing patterns,

support & resistance values, as well as potential breakouts. With so

many strategies to choose from, it is worth taking your time and doing

your due diligence prior to checking this off your scalping list.

Plan Your Entry

Next traders need to select how they are going to enter into the market.

Typically traders need to first determine if they will trade with

market orders or entry orders. Market orders allow you to trade

immediately if conditions are met and you are immediately in front of

your trading terminal. Entry orders can be used and will execute at a

designated price even if you aren’t watching the market.

Once this is decided, traders need to evaluate which indicators if any

will be used for trading. In the event an indicator is added to the

graph, prior to execution, plan on its use and know its strengths as

well as limitations. When you are 100% certain on your entry triggers

then you can proceed to the next portion of the checklist.

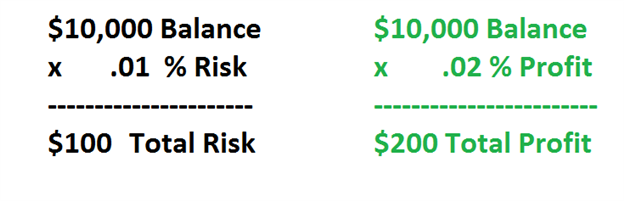

Manage Risk

This point of our check list goes beyond the simple placement of stop

and limit orders. Scalpers must carefully consider how much they should

risk on each trade. At this point specific questions should arise. How

many pips are you risking per trade? What is your average profit target

per trade? How does a stop order being executed equate to a loss on my

account?

While no trader wants to take a loss it is paramount to determine these values prior to scalping. Once these values are set, you can mark this point off your checklist. Now all you have left is to hold yourself accountable to your trading decisions.

Log the Results

Traders, especially short term scalpers, have a tendency to always be

looking for the next trade. While looking for trading opportunities

isn’t a bad thing, we should also remember to go back and review past

events. Keeping a trading log can help us establish market patterns and

reflect if your strategy is working in current conditions.

To help with this process, traders should note, why, when and how they

entered into a trade. If your strategy is working, stick with it and

keep your original strategy rules. If you’re trading is not working out

as planned, with a log you can identify what must be changed and make

appropriate adjustments.

While this checklist may seem daunting at first, these are all important steps to consider before scalping.

The way how risk and profit calculation is described for scalping is the best way to kill any account. Its statistically simple to understand that a closer SL is more often reached than a TP which is more far away. 100 USD risk and 200 USD chance mean nothing else than: The chance that your SL will be reached and not your TP is 2:1.

It also makes no difference if you catched the trend right, a relation of SL and TP as described will ALWAYS produce higher losses than wins. Its a total fairytale that one earns money that way and its also very easy to proof it in backtests.

Keep in mind: More than 95% of all traders are losers. Either its like that because 95% do not follow classical rules or because they do. Think about it.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Simple Scalping System:

Author: EA