Daily Market Analysis – 11th May, 2015

By FxGrow Research & Analysis Team

US Non-Farm Payrolls rose by 223K in April

US Non-Farm Payrolls rose by 223K in April which was just below market expectations for a 230,000 increase.

The unemployment rate was down to 5.4% and Participation Rate was at 62.8%. Following the NFP USD remained strong as the unemployment rate in the US plunged to a 7-year low.

EURUSD is trading lower in the Asian trading session at 1.1155 ahead of the Euro group Finance Ministers meeting in Brussels today.

The People’s Bank of China lowered interest rates to 5.1% as inflation figures fell short of expectations.

Asian markets are up after the PBOC cut its interest rates and a strong US NFP report on Friday.

Bank of England will announce its monetary policy decisions today with main focus on the quarterly inflation report.

In Canada Jobs report came with a loss of 19.7K jobs while the unemployment rate is at 6.8%.

WTI futures dropped to $59.22 per barrel on Monday on account of strong US dollar.

Gold is trading lower in the Asian trading session at 1187.20 after China rate cut while Silver is flat at 16.40

11th May 2015 – 06:36hrs GMT

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

Daily Market Analysis – 12th May, 2015

By FxGrow Research & Analysis Team

Euro lower as Greek crisis weighs on investor sentiment

On Monday Eurozone finance ministers confirmed that there has been progress in talks between Athens and its creditors but more work needs to be done over the next few days.

Greece said on Monday it repaid IMF €750 million, €1.5 billion payment is due in June and a further €3 billion to the ECB in July.

As the Greece situation continues Euro came under pressure and remains vulnerable to further downside risks.

In Australia, March housing finance data rose 1.6%, and as a result AUDUSD is trading above 0.7900, meanwhile Australia's business confidence remained unchanged in April.

The yield on the US 10-year is at 2.27%, Australia's 10-yr is yield is at 3% and Japan's 10-year yield is at 0.4%.

Japan's Nikkei is down 0.6 percent, amid concerns of volatility in bond markets.

Bank of England kept its interest rate unchanged at 0.5% in April and kept the size of its asset-purchases at 375 billion pounds.

Crude Oil is trading lower in the Asian trading session at 59.18

Gold has recovered its losses and is trading at 1184.56 while Silver is weak at 16.26

12th May 2015 – 07:28hrs GMT

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

Daily Market Analysis – 13th May, 2015

By FxGrow Research & Analysis Team

Bond Sell off weighs on Indices and Stocks Globally

A sharp sell-off in government bonds is dragging major global Indices lower. The global Bond sell off has left many investors nervous with FTSE100, S&P 500 and Nasdaq100 ending in red.

The 10-year US Treasury yield rose to 2.30%, German 10-year Bunds rose to 0.713%, Italian 10-year bonds rose to 1.867% while Spain's 10-year bonds rose to 1.819%

After Greece paid 750 million euros to the IMF on Monday, its financial condition remains weak. Following the news Euro rose more than 100 pips to cross 1.1260 yesterday.

In Australia wage price index fell to 0.5% AUDUSD is high on Australian yields and that the home loans approval rose to 1.6% in March.

In China Retail Sales fell to 10.0%, Industrial Production is at 5.9% while Fixed Assets Rural is at 12.0%

UK manufacturing production rose to 0.4% while analyst’s expectations were for a 0.3% increase. Following the news GBPUSD climbed to 1.5700

WTI Crude Oil rose to 60.75 amid Bond selloff and the news that Saudi has launched airstrike on Yemen again.

Gold is trading higher in the Asian trading session at 1194.70 after the slump in the global equity markets while Silver extends its gains at 16.63

13th May 2015 – 06:54hrs GMT

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

Daily Market Analysis – 14th May, 2015

By FxGrow Research & Analysis Team

Euro, Gold rally on disappointing US retail sales data

US Retail sales remained flat in April, while expectations were of a 0.2% growth. Weak retail sales hint trouble in the US Economy and that the US consumers were reluctant to spend.

Following the news Euro and Gold rallied amid weak US dollar across the board. EURUSD gained more than 100 pips to close above 1.1360

Data coming out of Greece shows that it went into a recession during the first quarter of the year, with problems of unemployment, deflation, and political uncertainty.

The Euro zone's economic output climbed to 0.4% in the first quarter of 2015. This reflects the Euro zone's efforts to recover from the debt crisis amid stimulus provided by the European Central Bank.

In New Zealand Retail sales rose to 2.9% indicating that the domestic market is strong. Following the news Kiwi rallied above 0.7540

In Germany GDP growth for first quarter of 2015 was 0.3% while analyst expected a 0.5% growth.

NYMEX Crude Oil is weak in Asia at 60.15$ a barrel on strong production outlook.

Gold climbed to a 5 month high after weak US retail sales data trading at 1215.44 in the Asian trading session, while Silver continues its bullish streak at 17.19

14th May 2015 – 06:40hrs GMT

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

Daily Technical Analysis by FxGrow

Dear Forum Members!

Here you can find Daily Technical Analysis of Major Currencies.

We hope that this information will be helpful for your trading.

Best Regards

FxGrow Support

--------------------------------------------------------------

Terms used in our Analysis

RSI (14) - Relative strength index 14 days Time frame

MACD (12, 26) - Moving Average Convergence Divergence 12 day EMA - 26 day EMA

EMA - Exponential moving average

ADX (14) - Average Directional Index 14 days

ATR (14) - Average True Range 14 days

SMA - Simple Moving Average

MA x - Moving Average where x is the number of days

STOCH RSI (14) - Stochastic RSI 14 days

William %R - Momentum Indicator

CCI(14) - Commodity Channel Index

ROC - Rate of Change

--------------------------------------------------------------

Daily Technical Analysis – 14th May, 2015

By FxGrow Research & Analysis Team

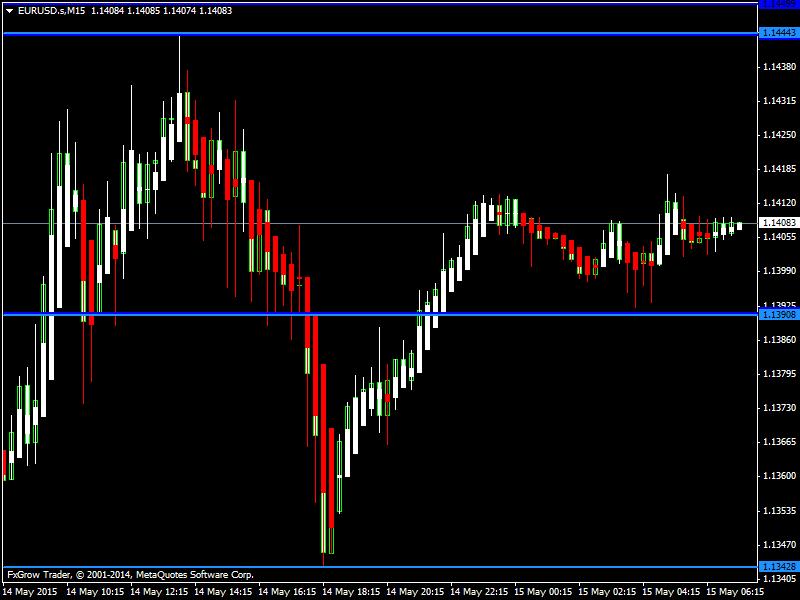

EURUSD

EURUSD rose sharply yesterday and is strong in the Asian trading session. Unable to cross 1.1400 indicates a short term correction in the prices. The near term bias is neutral to bullish within the range of 1.1350 to 1.1400

RSI (14), MACD (12, 26), CCI (14) indicate a BUY; STOCH (9, 6) is Neutral; STOCHRSI (14) is oversold; while Average True Range (14) indicates Less Volatility.

Support is at 1.1265 while Resistance is at 1.1382 and 1.1391

14th May 2015 – 04:57hrs GMT

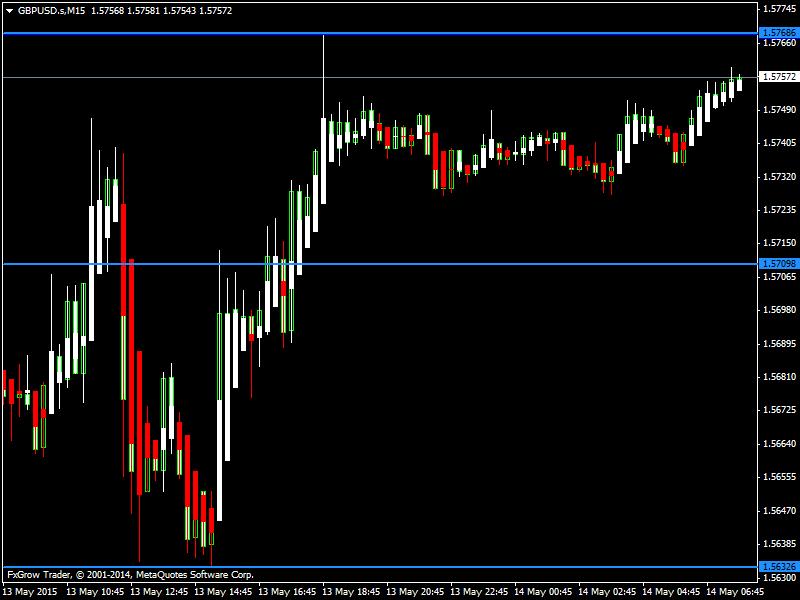

GBPUSD

GBPUSD retains its bullish tone trading above the 1.5750 and the near term bias is bullish to neutral in the range of 1.5750 to 1.5800 with sideways movements possible in the European trading session.

RSI (14), MACD (12, 26), CCI(14) indicate a BUY; ADX(14) is Neutral; while Average True Range (14) indicates Less Volatility.

Support is at 1.5632 while Resistance is at 1.5768

14th May 2015 – 05:00hrs GMT

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

Daily Technical Analysis – 14th May, 2015

By FxGrow Research & Analysis Team

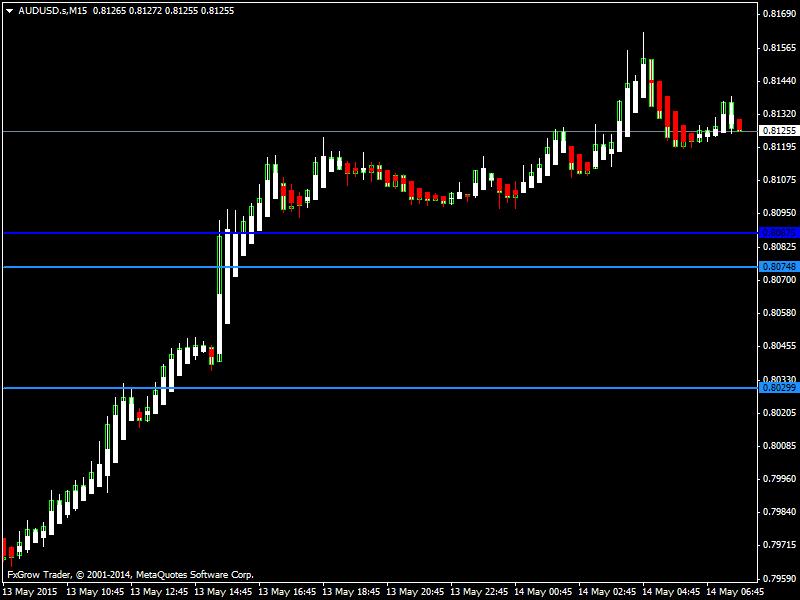

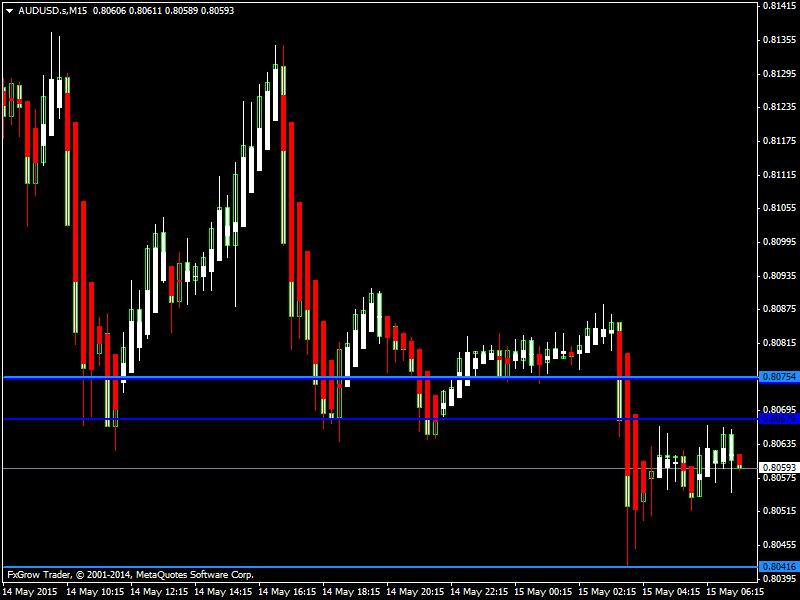

AUDUSD

AUDUSD is in a strong bullish momentum surging ahead of 0.8100 and the near term bias is bullish with targets of 0.8200 to 0.8230

RSI (14), MACD (12, 26) and CCI (14) indicate a BUY while STOCHRSI (14) is oversold. Average True Range (14) indicates Less Volatility.

Support is at 0.8029 while Resistance is at 0.8162

14th May 2015 – 05:04hrs GMT

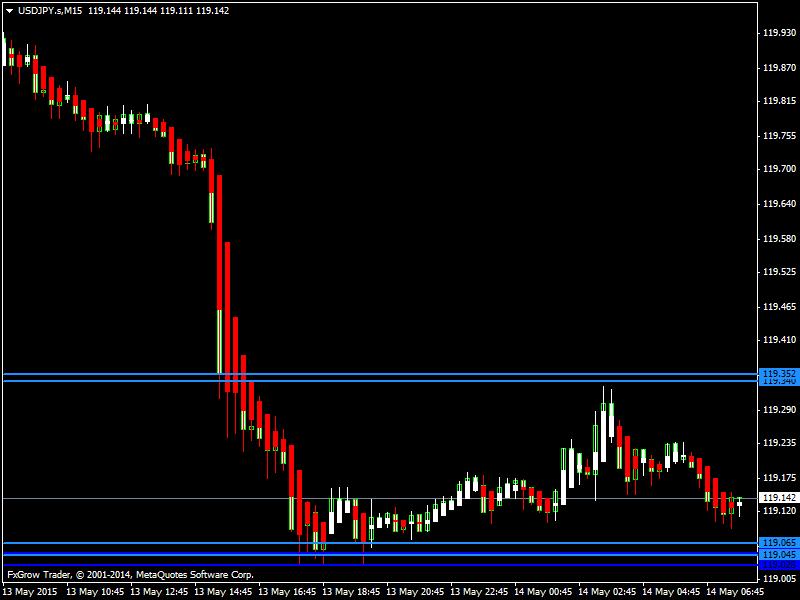

USDJPY

USDJPY remains bearish trading at 119.18 in the Asian trading session. The near term bias is bearish to Neutral with targets of 118.50

RSI (14), MACD (12, 26) indicate a SELL; STOCH (9,6) is Neutral; STOCHRSI(14) is overbought; while Average True Range (14) indicates Less Volatility.

Support is at 119.04 while Resistance is at 119.35

14th May 2015 – 05:07hrs GMT

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

Daily Market Analysis – 15th May, 2015

By FxGrow Research & Analysis Team

Stock markets surge as US Initial Jobless Claims drop to 264K

US unemployment claims unexpectedly dropped to 264,000 which reflect that the labor market condition is strong. Following the news Stock markets surged and ended in Green, while Euro pulled away from its 3 month peak.

European Central Bank president, Mario Draghi said that QE will remain in place and ECB will continue its monthly 60 billion euro bond buying programme.

In Greece there is a potential risk that it will default on its debt which could create panic in the currency markets. Meanwhile talks about the €7.2 billion bailout funds that Greece needs will continue today.

In China Premier Li Keqiang said there are signs of economic growth following which Asian markets surged. Hang Seng index was up 0.52% while Nikkei 225 was up 0.53%

In Canada new home prices remain unchanged in March while sales of existing homes surged 4.1%.

Bank of Japan Governor Haruhiko Kuroda said the underlying trend in inflation has improved steadily and saw no need for further easing now.

Crude Oil is down in Asia at 60.50$ amid news that IEA expects Oil supply to remain High.

Gold remains bullish trading at 1219.33 in the Asian trading session, while Silver is flat at 17.35

15th May 2015 – 07:38hrs GMT

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

Daily Technical Analysis – 15th May, 2015

By FxGrow Research & Analysis Team

EURUSD

EURUSD continues its bullish momentum crossing 1.1440 yesterday. The near term bias is bullish with targets of 1.1500 to 1.1540

RSI (14), MACD (12, 26), CCI (14), STOCH (9, 6) indicate a BUY; STOCHRSI (14) is Overbought; while Average True Range (14) indicates Less Volatility.

Support is at 1.1342 while Resistance is at 1.1444 and 1.1449

15th May 2015 – 04:34hrs GMT

GBPUSD

GBPUSD continues its bullish tone crossing 1.5800 yesterday. Some correction is expected in the European trading session and the near term bias is Neutral to bullish with targets of 1.5850

RSI (14), CCI (14) is Neutral; MACD (12, 26), STOCH (9, 6) indicate a BUY; while Average True Range (14) indicates Less Volatility.

Support is at 1.5763 while Resistance is at 1.5814

15th May 2015 – 04:40hrs GMT

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

Daily Technical Analysis – 15th May, 2015

By FxGrow Research & Analysis Team

AUDUSD

AUDUSD came down yesterday and is presently in the bearish tone trading below 0.8100 the near term bias is bearish with targets of 0.8000 to 0.7950

RSI (14), MACD (12, 26), CCI (14), ADX (14) indicate a SELL while STOCHRSI (14) is Oversold. Average True Range (14) indicates Less Volatility.

Support is at 0.8041 while Resistance is at 0.8162

15th May 2015 – 04:47hrs GMT

USDJPY

USDJPY is in Bullish trend crossing 119.40 in the Asian trading session. The near term bias is bullish with targets of 120.00

RSI (14), MACD (12, 26), STOCH (9, 6), STOCHRSI (14) indicate a BUY; while Average True Range (14) indicates Less Volatility.

Support is at 118.97 while Resistance is at 119.46

15th May 2015 – 04:53hrs GMT

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Dear Forum Members!

Here you can find Daily Market Analysis of Currencies, Indexes, Metals, Oil and others.

We hope that this information will be helpful for your trading.

Best Regards

FxGrow Support

----------------------------------------------------------------