newdigital, 2013.11.09 11:00

Technical Analysis - AUDUSD (adapted from dailyfx article)

- Bigger picture, the market broke from a symmetrical triangle the week that ended 5/17/2013. The recent top is just pips from that close level (with an outside day reversal on 10/23) and right at channel resistance.

- The rally from the June low forms 2 converging lines and can be called a pennant. These patterns are often seen in the early stages of large bear markets.

Trading Strategy: Currently short. Original stop was .9550. Stop has been lowered to .9375. .9190-.9300 could produce consolidation / corrective activity.

AUDUSD Weekly :

newdigital, 2013.11.09 19:12

Australian Dollar Looks to China Plenum to Inform RBA Outlook

Fundamental Forecast for Australian Dollar: Neutral

- Aussie Dollar Looks to China Plenum Outcome to Set Tone for the Week Ahead

- Risk Sentiment a Key Aussie Catalyst as “Fed-Speak” Drives QE “Taper” Outlook

newdigital, 2013.11.11 07:50

2013-11-11 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - Home Loans]

- past data is -4.0%

- forecast data is 4.0%

- actual data is 4.4% according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

==========

Australia Home Loans Jump 4.4% In September

The total number of housing loans in Australia climbed a seasonally adjusted 4.4 percent in September compared to the previous month, the Australian Bureau of Statistics said on Monday, standing at 51,480.

That beat forecasts for an increase of 3.5 percent following the downwardly revised 4.0 percent contraction in August (originally -3.9 percent).

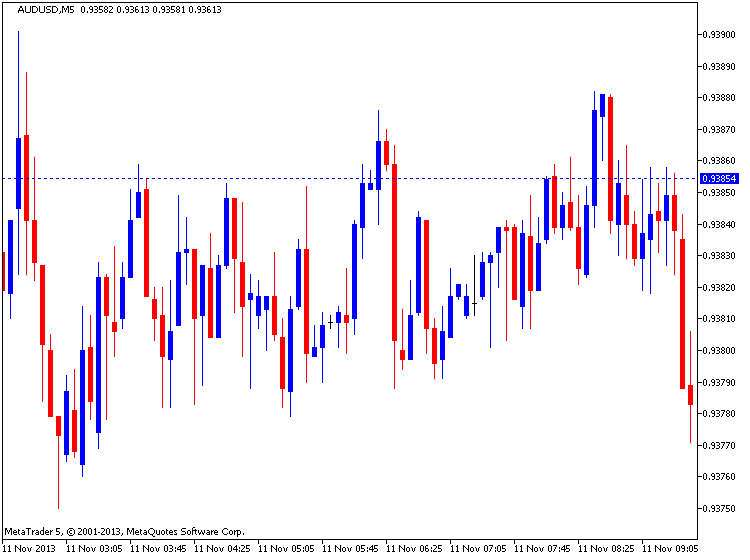

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 9 pips down and 14 pips up by AUD - Home Loans

Market Condition Evaluation based on standard indicators in Metatrader 5

newdigital, 2013.11.11 13:03

There are some bank holidays in some countries :

- French Bank Holiday

- Canada Bank Holiday

- The US Bank Holiday

and the market may be very volatile nbecause of that (because of lack of liquidity). This is an example :

For today : 0.9421 support was broken - new daily bar was opened below this level. The next support is 0.9352. So, the correction is started :

newdigital, 2013.11.12 08:11

2013-11-12 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - NAB Business Confidence]

- past data is 12

- forecast data is n.a

- actual data is 5 according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

==========

Australia Business Confidence Falls Sharply, NAB Survey Shows

Confidence among Australian businesses fell sharply in October as firms started to reassess their future plans in the wake of continued weakness in operating conditions and changed political climate, a monthly survey by the National Australia Bank revealed Tuesday.

The business confidence index fell to 5 in October from September's three-and-a-half year high reading of 12.

The pull back in confidence suggests businesses may have reassessed their expectations about the future activity in the changed political environment given the continued weakness in actual business conditions, NAB chief economist Alan Oster said.

"Nonetheless, the relatively elevated level of business confidence, compared to early 2013 readings, suggests businesses may still be feeling buoyed by positive housing price trends and low borrowing rates," Oster pointed out.

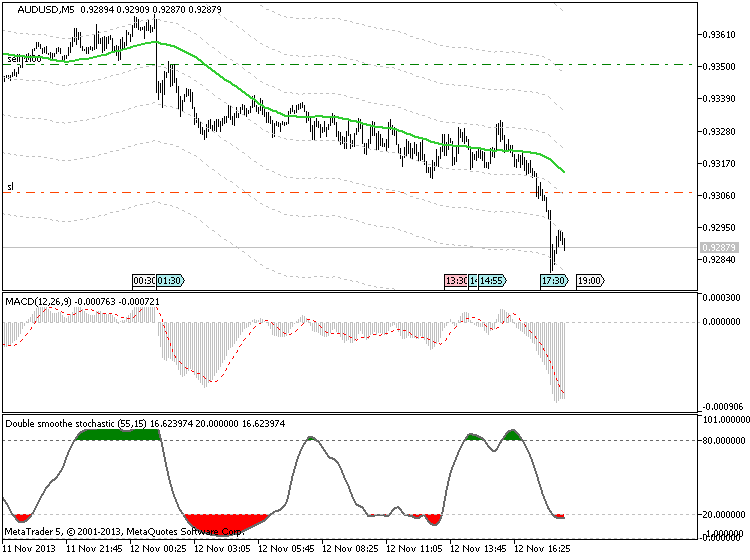

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 41 pips price movement by AUD - NAB Business Confidence

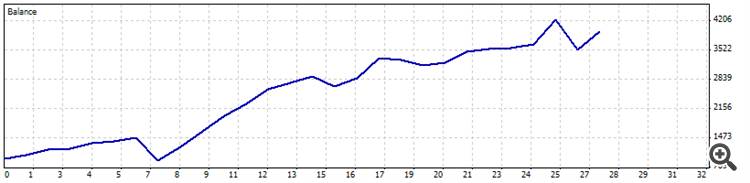

So, it was finally 65 pips (4 digit pips) in profit by euity based on last news for AUD for example :

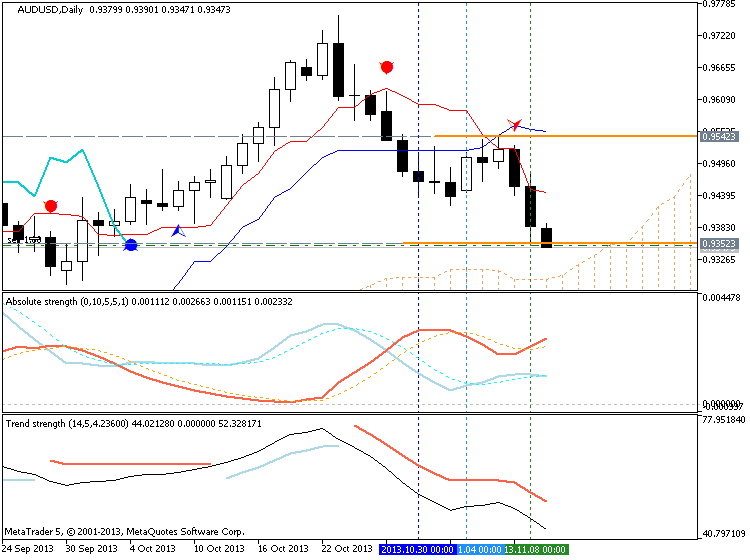

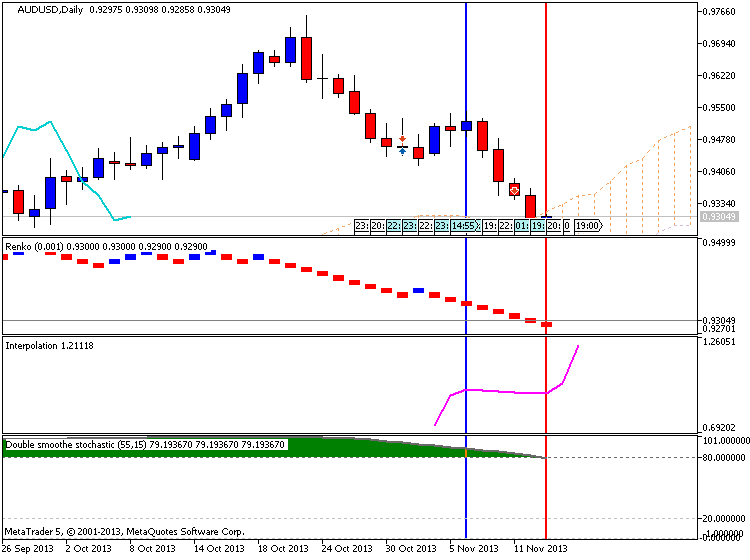

The price is trying to cross Sinkou Span A line on close D1 bar - this line is the border of Ichimoku cloud/kumo and the border between bullish and bearish on high timeframes such as W1, D1 and H4). But as we see - ranging market condition is already started on D1 :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD D1 Renko forecasting

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 trades

About M5 timeframe - as we see from MACD system - the price is on the second profit level. It means that I opened sell trade too late. But anyway - it is in profit with sl moved to breakeven :

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

It is started a secondary correction for AUDUSD D1 timeframe under primary bullish in the end of this week : Chinkou Span line came to be very close to historical price indicating possible breakdown in the near future; and price is crossing 0.9421 support level from above to below on open bar.

If the price will cross 0.9421 support level on close bar so the correction will be continuing up to the border of ichimoku cloud (Sinkou Span A line which is the border between bullish and bearish on the chart).

If the price will break 0.9546 resistance level from below to above to the primary bullish trend will be continuing.

Otherwise - we will get ranging market condition and the price will be floating between 0.9421 and 0.9546 for example.

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2013-11-11 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - Home Loans]

2013-11-12 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - NAB Business Confidence]

2013-11-12 23:30 GMT (or 00:30 MQ MT5 time) | [AUD - Westpac Consumer Sentiment]

2013-11-13 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - Wage Price Index]

2013-11-14 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - New Motor Vehicle Sales]

2013-11-14 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movement

SUMMARY : correction

TREND : bullish

Intraday Chart