WEEKLY DIGEST 2014, October 05 - 12 for Neural Networks in Trading & Everywhere

There are not so many news events related to Neural Networks in the past week but anyway I found some of them: one analytical article and 3 business news.

============

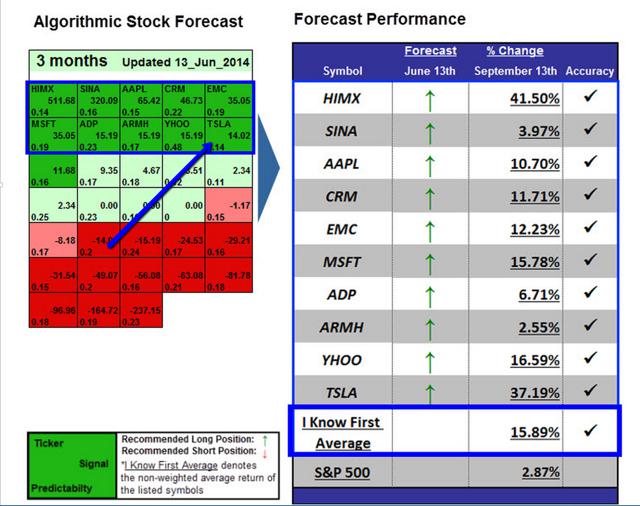

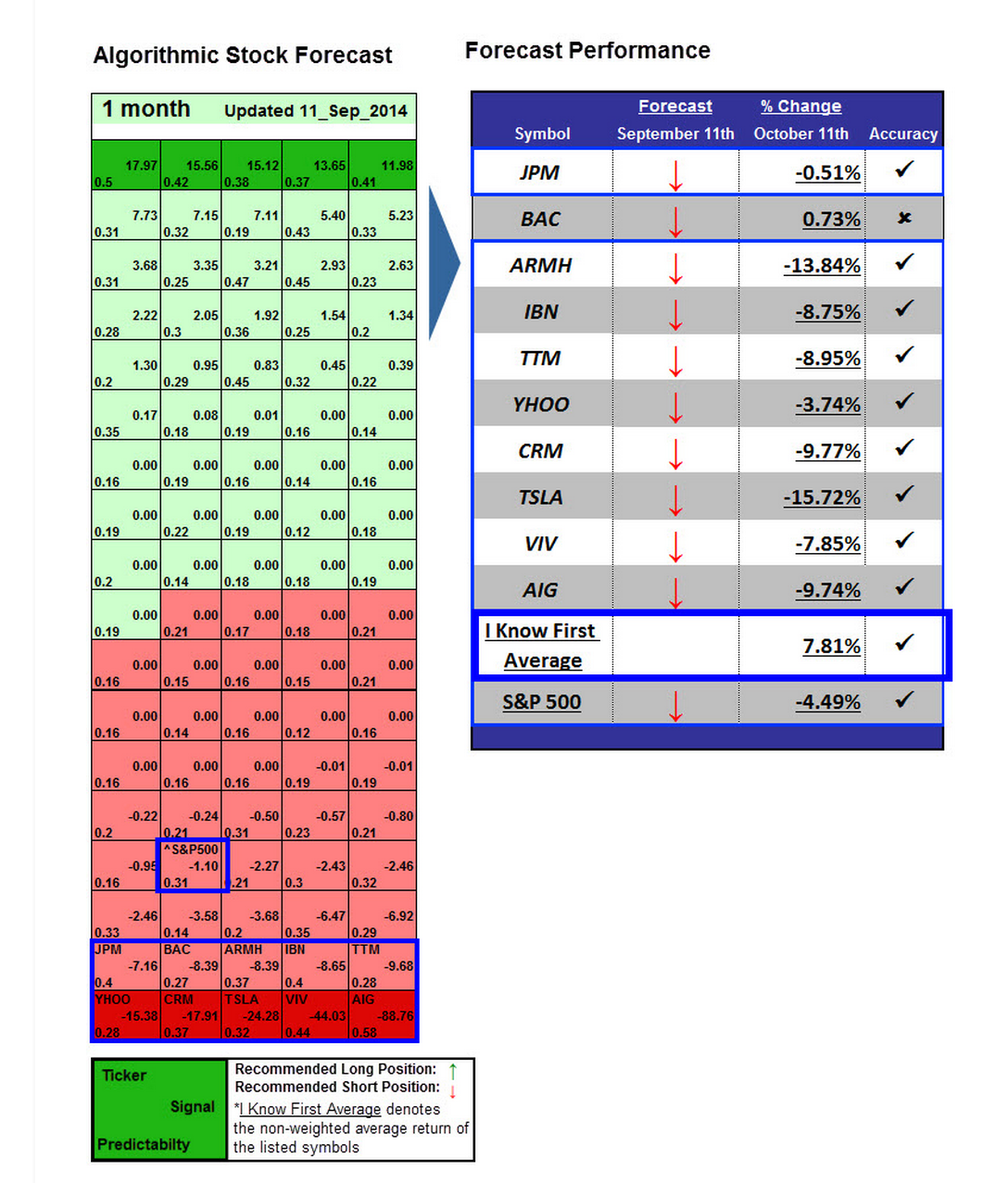

Algorithmic Prediction Is Bullish On Tesla

- Tesla Motors, an American manufacturer of high-end electric cars, has long been a very popular, reliable stock.

- Despite the fact that it is almost always a worthy stock to invest in, certain current business developments make Tesla even more of a bull at present.

- Specifically, TSLA’s branching into self-driving cars, varyingly priced models, international markets, deals with Toyota, and gigafactory construction could increase the stock’s success in the short and long terms.

- First predicts a bullish forecast for TSLA in the 1-month and 3-month time frames.

============

Some Interesting Details about Capital Market Trading and Alfatrade

============

ING Group Reaffirms Buy Rating for Neuralstem (CUR)ING Group reaffirmed their buy rating on shares of Neuralstem (NYSE:CUR) in a report released on Thursday.

ING Group has also modified their ratings on a number of other healthcare stocks in the few days. The firm raised its price target on shares of Silicon Motion Technology Corp. (ADR) to $37.00. Also, ING Group initiated coverage on shares of Teva Pharmaceutical Industries Ltd (ADR). They issued a positive rating on that stock. Finally, ING Group raised its price target on shares of Silver Standard Resources Inc. to $10.94. They have an outperform rating on that stock.

============Neuralstem Short Interest Up 3.1% in September

Neuralstem (NYSE:CUR) saw a large growth in short interest during the

month of September. As of September 30th, there was short interest

totalling 10,397,017 shares, a growth of 3.1% from the September 15th

total of 10,087,668 shares, American Banking & Market News

reports. Based on an average daily volume of 486,039 shares, the

days-to-cover ratio is currently 21.4 days. Approximately 12.5% of the

company’s shares are short sold.