The Inputs Instructions

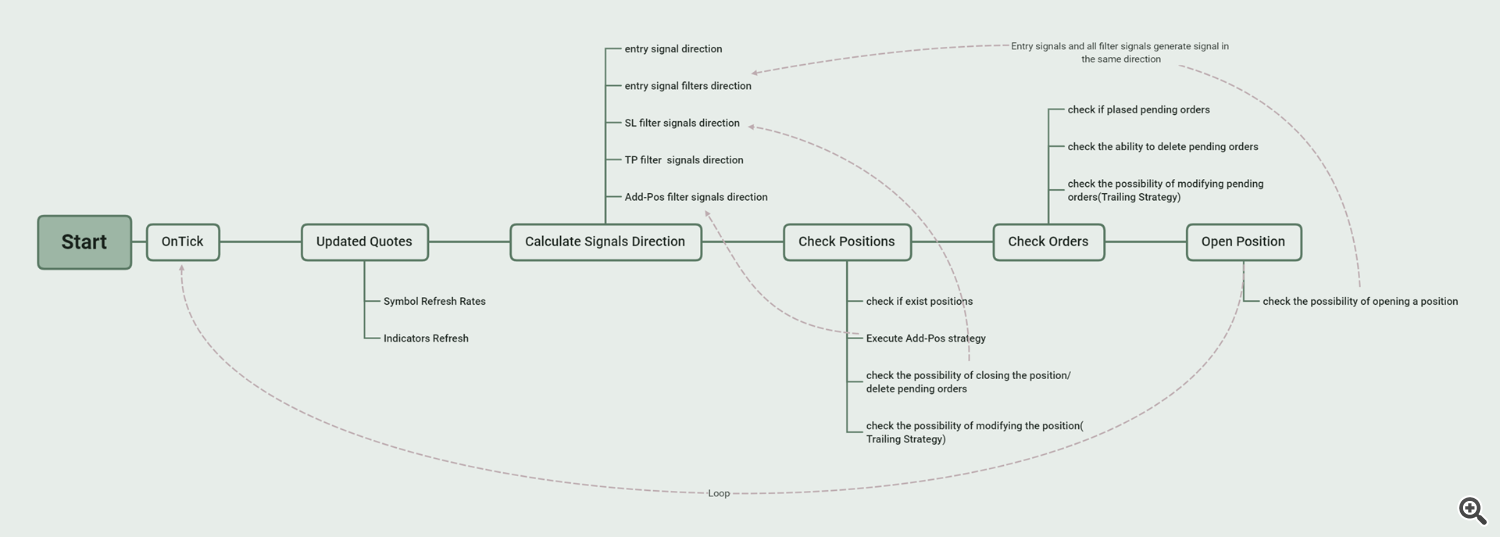

When you first use SMC EA, please remember its basic logic.

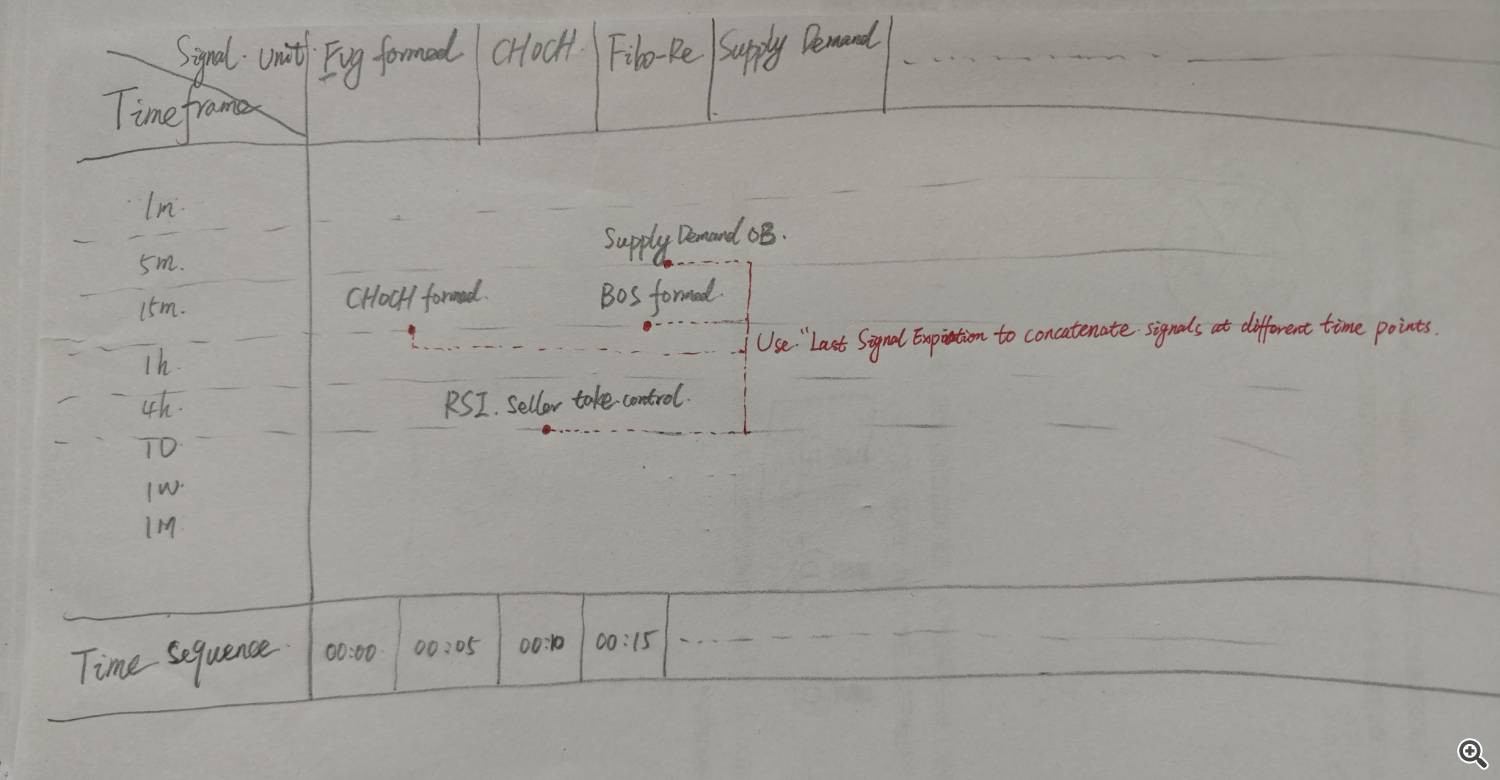

Choose one and only one entry signal can be selected in the Current Period Time Frame. When the entry signal outputs a long direction, if no filtering signal is added, the order will be placed immediately. If multiple filtering signals are added, all of these filtering signals must generate a long direction at the same time before placing an order. As long as one filtering signal does not generate a long direction, it does not meet the conditions for placing an order. The program allows adding filtering signals under multi-TFs, and multiple filtering signals can be added under each TF. Special attention should be paid here to the option setting of signal validity period(Last Signal Expiration) for each filter signal. This option is to extend the time of a certain signal, as many signals are only generated on a certain bar.

For example:

If my strategy is to place an order if FVG appears within 10 bars after the main line and signal line of MACD intersect in the Current Period (assume 15m). Meanwhile, in HTF (assuming 1 day), Price needs to be above MA and MA is upward. So I should set it this way:

- First, select FVG as the entry signal, and set the desired bull/bear signal mode and entry mode in the FVG Signal Parameters area. Here, we want to enter the market immediately after FVG appears, so we choose "FVG Formed" for the "Signal Bull/Bear Pattern Usage" and "Trade at Market Price" for the "Signal Entry Pattern Usage".

- The second step is to set the required SL and TP. You can choose fixed Pips or ATRs, or choose to use the SL and TP provided by the entry signal or filter signal.

- The third step, turn on MACD filter on Current Period, and set "Signal Bull/Bear Pattern Usage" to "Look for an intersection of the main and signal line". Set "Last Signal Expiration" to 10.

- At last, turn on MA filter on Timeframe Day1, and set "Signal Bull/Bear Pattern Usage" to "Close Price Above/Below the indicator, MA is upwards/downwards". We did not set the "Last Signal Expiration" for the filtered signal of MA filter because it is a continuous signal and not a signal generated only at a certain bar.

===========INPUTS FOR EXPERT===========

-

EA name: The title of this EA.

-

EA Magic Number: a unique identifier that distinguishes between different orders or trades placed by an Expert Advisor (EA). Make sure each EA you are using has a different magic number.

-

EA Run in Every Tick: This parameter is used to decide on price action checks if it will be done on tick or on the formation of a 1 minute. Currently, all signals do not require an On Tick level, so the default setting is false. In the latest updated version, if there is a (tick level) annotation before the signal name, then this signal requires setting this option to true.

-

Deviation for trading in adjusted points: Set the slippage for this EA. Default value is 3 pips.

-

Max spread allowed for trading in points(0 mean No restrictions): Every time an Open new trade is processed, it will detect the spread and only when the conditions are met can an order be placed.

===========INPUTS FOR ENTRY SIGNAL===========

-----------General Settings-----------

-

Select Entry Signal for trade in Current Period: Here, we select the entry signals for trading. The program has 10+ built-in entry signals for selection, and the entry signals can be further expanded according to user needs in the future. After selecting the entry signal, you need to set the parameters of the signal in the corresponding signal parameter setting area.

-

ATR Peroid for SL/TP/Offset in Current Period:

-

Select SL Type: There are 6 types to choose.

- No SL: No stop loss is set for orders.

- SL in Points: Set a fixed number of points as the stop loss for the order.

- SL in ATRs: Set a fixed multiple ATRs as the stop loss for the order.

- Swing High/Low: Use the recent swing high as a stop loss for short orders and the recent swing low as a stop loss for long orders.

- SL Provided by Entry Signal: Use the stop loss type set by the entry signal as the stop loss for the order. Each entry signal may provide multiple stop loss types, which can be set in the entry signal parameter setting area.

- SL Provided by Filter: We may have added multiple filtering signals to the entry signal, each of which can provide a different stop loss type. Here, we can choose the stop loss type provided by the filtering signal as the stop loss for the order. Each filtering signal may provide multiple stop loss types, which can be set in the filtering signal parameter setting area.

-

---Stop Loss level (in pips/ATR): Set specific numerical values for SL in Pips or SL in ATRs. If the number of decimal digits of the price is 3 or 5, 1Pips = 10Points, else 1Pips = 1Point.

-

---MS Length(Depth) for Swing High/Low: This is used for the smc indicator that is implemented to analyze market structure, and it has an impact on where to set the SL/TP if the option Swing High/Low is used.

-

---Set SL Offsets(in ATR): Add an offset to the standard SL selected above. Positive value will increase SL, negative value will decrease SL.

-

Select TP Type: There are 7 types to choose.

- No TP: No take profit is set for orders.

- TP in Points: Set a fixed number of points as the take profit for the order.

- TP in ATRs: Set a fixed multiple ATRs as the take profit for the order.

- "X" SL: Use a fixed multiple of SL as the take profit for the order.

- Swing High/Low: Use the recent swing high as a take profit for long orders and the recent swing low as a take profit for short orders.

- TP Provided by Entry Signal: Use the take profit type set by the entry signal as the take profit for the order. Each entry signal may provide multiple take profit types, which can be set in the entry signal parameter setting area.

- TP Provided by Filter: We may have added multiple filtering signals to the entry signal, each of which can provide a different take profit type. Here, we can choose the take profit type provided by the filtering signal as the take profit for the order. Each filtering signal may provide multiple take profit types, which can be set in the filtering signal parameter setting area.

-

---Take Profit level (in pips/ATR): Set specific numerical values for TP in Pips or TP in ATRs. If the number of decimal digits of the price is 3 or 5, 1Pips = 10Points, else 1Pips = 1Point.

-

---TP "X" Value: Set the "X" values for "X" SL selected above.

-

---Set TP Offsets(in ATR): Add an offset to the standard TP selected above. Positive value will increase TP, negative value will decrease TP.

-

-

-

Order Price Offset(in ATRs) to execute a deal: Add an offset to the open price. Positive value will increase price, negative value will decrease price.

-

Expiration of pending orders (in bars): This parameter will allow you to set an expiration time for your orders, 0 means no expiration time is set, 2 indicates that the expiration time of the order is 2 bars. For example, when trading on the 1 hour, 2 means that the expiration time of the order is 2 hours.

-

Maximum number of orders: The maximum number of orders allowed by EA, which will include the existing positions.

-

Maximum number of orders for daily: The maximum number of orders allowed by EA within one day, which will include the existing positions.

-

Minimum Distance between two pos(in pips)(0 means No restrictions): Limit the distance between the nearest two positions in the same direction.

-

Breakeven when previous positions are in loss: When the float loss of the previous position exceeds the specified value, the current order to be entered and the previous order execute a breakeven strategy. Simply put, it means adding positions against the trend, and then the goal is break even.

-

---"X" value for Loss Threshold(in ATRs): If the above selection is true, set the floating loss value here.

-

---"X" value for Offset(in ATRs): To balance the transaction fees, we need to add an offset that can break even and generate some profits.

-

Close Positions When opposite signal: When the entry signal shows a signal in the opposite direction, Close Position.

-

Allow Buy:Only allow EA to execute Buy trades.

-

Allow Sell: Only allow EA to execute Sell trades.

-

-

-

Trade Only in Defined Trading Window: Trading Window, If set to false, the trades will run the entire day. If set to true, you need to set the starting and ending hours of your kill zone. The time set here is based on your server time or broker time. You can use this setting to optimize one or more tradingwindows in the optimizer. If you want to execute multiple trading windows simultaneously, you need to set it in the "INPUT FOR HOURS FILTER" area at the end.

-

---Killzone Begin Hour(0-23): Starting hour of the kill zone

-

---Killzone Begin Minute(0-59): Starting minute of the kill zone

-

---Killzone End Hour(0-23): Ending hour of the kill zone

-

---Killzone End Minute(0-59): Ending minute of the kill zone

-

-

-

-Turn On ICT Bias Filter: Using ICT Bias indicators for trend filtering

-

---Select ICT Bias Timeframe: Select TF for ICT Bias

-

Use Artificial Bias Filter: You can choose to manually input the current trend here.

-

---Select Action On Artificail Bias: How does EA respond to situations where we choose to follow the trend, go against the trend, or have no trend.

-

---"X" ratio for Increase position: Set X ratio, if it is negative, the position will be reduced. Basic lots are determined by the Money strategy.

-

---Close Positions When opposite AF Bias:

-

-

Close Positions at Certain Time: If true, the EA will close all sell or buy trades at the defined close position time.

-

---Hour to Close Positions(0-23): Closing Hour of all open positions

-

---Minute to Close Positions(0-59): Closing Minute of all open positions

-

Cancel Orders at Certain Time: If true, the EA will delete all pending orders at the defined delete orders time.

-

---Hour to Cancel Orders(0-23): Deleting Hour of all open orders

-

---Minute to Cancel Orders(0-59): Deleting Minute of all open orders

-

-

-

Use Daily Profit Limit: This will allow you to activate the daily profit limitation.

-

---Max Daily Profit %:

-

Use Daily Drawdown Limit: This will allow you to activate the daily drawdown limitation.

-

---Max Daily DD %:

-

-

Partial TP1 type: You can select x pips, x ATRs, x Risk, or Exit provided by Exit Signal(set in “INPUT FOR EXIT FILTER SIGNAL”).

-

Partial TP1 Trigger 'X' value:

-

Partial TP1 Percentage from current volume: The percentage of current remaining positions.

-

Partial TP2 type:

-

Partial TP2 Trigger 'X' value:

-

Partial TP2 Percentage from current volume: The percentage of current remaining positions.

-

Partial TP3 type:

-

Partial TP3 Trigger 'X' value:

-

-

Partial Exit1 with loss type: You can select x pips, x ATRs, x Risk, or Exit provided by Exit Signal(set in “INPUT FOR EXIT FILTER SIGNAL”).

-

Partial Exit1 with loss Trigger 'X' value:

-

Partial Exit1 with loss Percentage from current volume: The percentage of current remaining positions.

-

Partial Exit2 with loss type:

-

Partial Exit2 with loss Trigger 'X' value:

-

Partial Exit2 with loss Percentage from current volume: The percentage of current remaining positions.

-

Partial Exit3 with loss type:

-

Partial Exit3 with loss Trigger 'X' value:

-----------Composite-Candle Signal Parameter settings-----------

-

Turn On/Off Candles Signal as filter On Specified Period: If this signal is not selected as an entry signal, it can be used as a filter signal. If selected, then this option cannot be true, even if set to true, it will not work.

-

Select Timeframe for Signal: If you want to use this signal as a filtering signal, please set its TF.

-

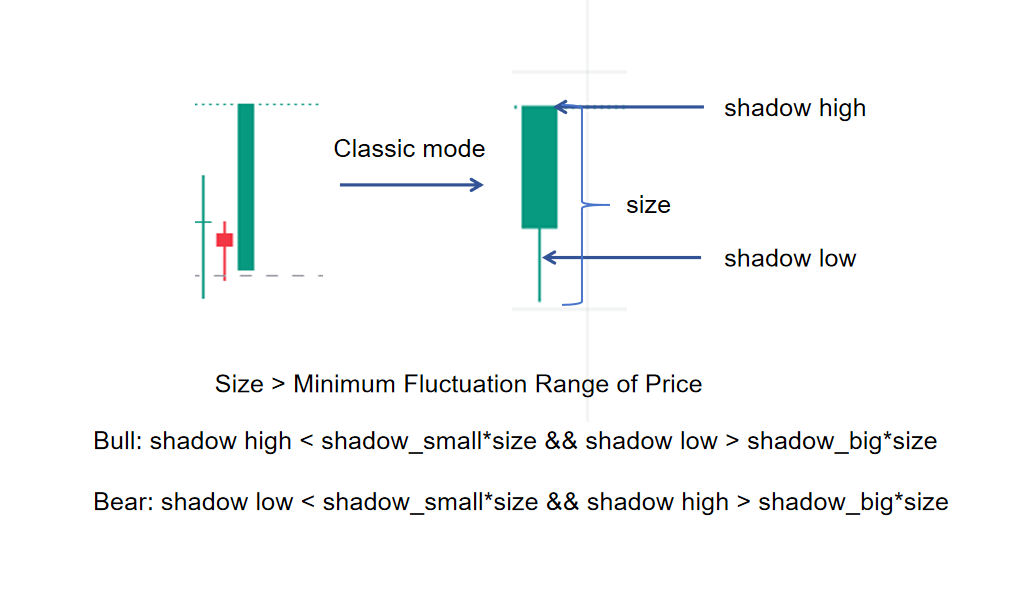

Signal Bull/Bear Pattern Usage: Each signal provides several pattern modes for users to choose from. Composite-Candle Signal offers two pattern modes to choose from.

- Composite-Candle is bull/bear: The program detects the candles of the latest ' Min Range for Pattern Search ' to ' Max Range for Pattern Search '. If their price fluctuation is greater than the set ' Minimum Fluctuation Range of Price (in ATR) ', these candles are combined into one Candle. If the upper shadow of this combined Candle is less than the 'Shadow Small' and lower shadow of this combined Candle is greater than ' Shadow Big', it will generate a long signal. If the lower shadow of this combined Candle is less than the 'Shadow Small' and upper shadow of this combined Candle is greater than ' Shadow Big', it will generate a short signal.

- Composite-Candle is bull/bear and Price near the Swing High/Low: When a combined Candle that meets the conditions appears and it appears near Swing High/Low, it generates a bull/bear signal.

-

Signal Entry Pattern Usage:

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

-

---Max Range for Pattern Search(in bars): Set the maximum search number of candles.

-

---Min Range for Pattern Search(in bars): Set the minimum search number of candles.

-

---Minimum Fluctuation Range of Price(in ATR): Set the minimum price fluctuation range for Composite-Candle.

-

---ATR Period for Candles: Set the ATR Period to determine the magnitude of price fluctuations.

-

---Shadow Big for Candles Pattern: Multiply this value by the difference between the high and low of the combined candle.

-

---Shadow Small for Candles Pattern: Multiply this value by the difference between the high and low of the combined candle.

-

---Candles Mode Usage: 3 modes to choose from. By default, select Classic mode.

- Classic: shadow_h=high-((open>close)?open:close); shadow_l=((open<close)?open:close)-low;

- Modern 1: shadow_h=high-close; shadow_l=((open<close)?open:close)-low;

- Modern 2: shadow_h=high-close; shadow_l=open-low;

- Signal Inverting: When we need to trade in the opposite direction of the entry signal, we can set this option to True. For example, when our entry signal selects MarketStructurue, we sell when a Bull BOS occurs, and buy when a Bear BOS occurs. When used as a filter signal, this parameter causes it to output a reverse signal.

-

Last Signal Expiration(Candles nums):This option only takes effect when this signal is used as a filter signal. Some signals are only generated on a certain candle, and when using them as filters, we want them to generate signals on several consecutive candles, so we need to set Signal Expiration for them. For example, we use FVG as the entry signal, Timeframe1 selects Current, Turn on MACD signal as the filter, and select "Look for an intersection of the main and signal lines" as the signal mode. The MACD signal is only generated when the main and signal lines intersect. If there is no FVG formed signal at this time, the trading conditions will not be met. Therefore, we need to set the Signal Expiration for the MACD signal. Assuming it is set to 7, in the 7 candles after the main and signal lines intersect, if there is an FVG formed signal, it can be generated a Trading signal.

-

Select SL Type Provided by the Signal: If the SL TYPE is set to "SL Provided by Entry Signal" in the general settings section, then the SL Type set here will be used for the order.

- Not Set:

- High/Low of the Composite-Candle: Use the high and low points of the combination candle as a stop loss.

-

Select TP Type Provided by the Signal: If the TP TYPE is set to "TP Provided by Entry Signal" in the general settings section, then the TP Type set here will be used for the order.

-

-

-----------MA Signal Parameter settings-----------

-

Turn On/Off MA Signal as filter On Specified Period: The principle is the same as above.

-

Select Timeframe for Signal:

-

Signal Bull/Bear Pattern Usage:

- Close Price Above/Below the indicator

- CloseP above MA, OpenP below MA, MA is upwards

- CloseP and OpenP above MA, LowP below MA, MA is upwards

-

Signal Entry Pattern Usage

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

-

---MA Period

-

---MA Shift

-

---MA Method

-

---MA Applied

-

Signal Inverting: The principle is the same as above.

-

Last Signal Expiration(Candles nums): The principle is the same as above.

-

-

-----------MACD Signal Parameter settings-----------

-

Turn On/Off MACD Signal as filter On Specified Period : The principle is the same as above.

-

Select Timeframe for Signal:

-

Signal Bull/Bear Pattern Usage:

- MACD line is upwards

- MACD line has a reverse

- Look for an intersection of the main and signal line

- Look for an intersection of the main line and the zero level

- Look for the "divergence" signal

- Look for the "double divergence" signal

-

Signal Entry Pattern Usage:

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

-

---MACD Period for fast

-

---MACD Period for slow

-

---MACD Period for signal

-

---MACD Applied

-

Signal Inverting:

-

Last Signal Expiration(Candles nums): The principle is the same as above.

-

-

-----------RSI Signal Parameter settings-----------

-

Turn On/Off RSI Signal as filter On Specified Period : The principle is the same as above.

-

Select Timeframe for Signal:

-

Signal Bull/Bear Pattern Usage:

- Oscillator is directed upwards/downwards

- Search for a reverse of the oscillator upwards/downwards behind the level of overselling(RSI<30)/overbuying(RSI>70)

- Search for the "failed swing" signal

- Search for the "divergence" signal

- Search for the "double divergence" signal

- Search for the "head/shoulders" signal

-

Signal Entry Pattern Usage:

- Trade at Market Price : When there is a bullish or bearish signal, immediately enter at the market price.

-

---RSI Period for fast: The "period of calculation" parameter of the oscillator.

-

---RSI Applied: The "prices series" parameter of the oscillator.

-

Signal Inverting:

-

Last Signal Expiration(Candles nums): The principle is the same as above.

-

-

-----------WPR Signal Parameter settings-----------

-

Turn On/Off WPR Signal as filter On Specified Period: The principle is the same as above.

-

Select Timeframe for Signal:

-

Signal Bull/Bear Pattern Usage:

- the oscillator is directed upwards

- search for a reverse of the oscillator upwards behind the level of overselling

- search for the "divergence" signal

-

Signal Entry Pattern Usage:

- Trade at Market Price : When there is a bullish or bearish signal, immediately enter at the market price.

-

---WPR Period for fast: The "period of calculation" parameter of the oscillator.

-

Signal Inverting:

-

Last Signal Expiration(Candles nums): The principle is the same as above.

-

-

-----------BreakerBlocks Signal Parameter settings-----------

-

Turn On/Off BreakerBlock Signal as filter On Specified Period: The principle is the same as above.

-

Select Timeframe for Signal:

-

Signal Bull/Bear Pattern Usage:

- BB formed and LowP above BB bottom or HighP below BB top

-

Signal Entry Pattern Usage:

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

- Trade at Block Price: Trade at Breaker Block Price.

- Mean threshold Price: Trade at the mean threshold price of the Block.

-

---BB iStructure Algo: Internal MS algorithm select.

-

---BB iStructure Break Type: Break Type for Internal MS.

-

---BB iStructure Length: Depth for indicator to analyze internal market structure.

-

---BB sStructure Algo: Swing MS algorithm select.

-

---BB sStructure Break Type: Break Type for swing MS.

-

---BB sStructure Length: Depth for indicator to analyze swing market structure.

-

Signal Inverting:

-

Select SL Type Provided by this Signal: If the SL TYPE is set to "SL Provided by Entry Signal" in the general settings section, then the SL Type set here will be used for the order.

- Not Set

- Breaker Block High/Low: Use the high and low points of the breaker block as a stop loss.

- N-Shape High/Low: Use the high and low points of the N-Shape as a stop loss.

-

Select TP Type Provided by this Signal:

-

-

-----------BSL/SSL Signal Parameter settings-----------

-

Turn On/Off BSL/SSL Signal as filter On Specified Period: The principle is the same as above.

-

Select Timeframe for Signal:

-

Signal Bull/Bear Pattern Usage:

- BSL/SSL formed,LowP above BSL or HighP below SSL

- BSL/SSL formed

-

Signal Entry Pattern Usage:

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

- Mean threshold Price:

-

---BSL/SSL iStructure Algo: Internal MS algorithm select.

-

---BSL/SSL iStructure Break Type: Break Type for Internal MS.

-

---BSL/SSL iStructure Length: Depth for indicator to analyze internal market structure.

-

---BSL/SSL sStructure Algo: Swing MS algorithm select.

-

---BSL/SSL sStructure Break Type: Break Type for swing MS.

-

---BSL/SSL sStructure Length: Depth for indicator to analyze swing market structure.

-

Signal Inverting:

-

Select SL Type Provided by the Signal: If the SL TYPE is set to "SL Provided by Entry Signal" in the general settings section, then the SL Type set here will be used for the order.

- Not Set

- BSL/SSL Region High/Low

-

Select TP Type Provided by this Signal:

-

-

-----------FiboRe Signal Parameter settings-----------

-

Turn On/Off FiboRe Signal as filter On Specified Period: The principle is the same as above.

-

Select Timeframe for Signal:

-

Signal Bull/Bear Pattern Usage:

- FiboRe exceeding set value: Fibo-Re level exceeding 'FiboRe MinRe' and less than 'FiboRe MaxRe'.

-

Signal Entry Pattern Usage:

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

- The Price of Max FiboRe Pre-set: Maximum level price of Fibo-Retracement.

- The Price of Min FiboRe Pre-set: Minimum level price of Fibo-Retracement.

-

---FiboRe iStructure Algo: Internal MS algorithm select.

-

---FiboRe iStructure Break Type: Break Type for Internal MS.

-

---FiboRe iStructure Length: Depth for indicator to analyze internal market structure.

-

---FiboRe sStructure Algo: Swing MS algorithm select.

-

---FiboRe sStructure Break Type: Break Type for swing MS.

-

---FiboRe sStructure Length: Depth for indicator to analyze swing market structure.

-

---FiboRe FBR Type: Choose Internal MS or Swing MS for Fibo-Re.

-

---FiboRe MinRe for Signal: Minimum level for Fibo-Re.

-

---FiboRe MaxRe for Signal: Maximum level for Fibo-Re.

-

Signal Inverting:

-

Select SL Type Provided by the Signal: If the SL TYPE is set to "SL Provided by Entry Signal" in the general settings section, then the SL Type set here will be used for the order.

- Not Set

- Market Structure High/Low

- User Set Fibo-Re Level for SL: Set the specified Fibo-Re level value in the following settings.

-

---FiboRe Level for SL: Set the specified Fibo-Re level value for SL.

-

Select TP Type Provided by this Signal

-

-

-----------FVG Signal Parameter settings-----------

-

Turn On/Off FVG Signal as filter On Specified Period: The principle is the same as above.

-

Select Timeframe for Signal:

-

Signal Bull/Bear Pattern Usage:

- FVG formed

- FVG formed and 3 bull/bear candles in a row pattern

-

Signal Entry Pattern Usage:

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

- Mean threshold Price of the FVG:

- FVG Top/Btm Price: Top/Btm Price of the FVG Block.

-

---FVG Period: The time frame parameter of the FVG.

-

---FVG Filled Type: Select FVG filled type.

-

---FVG MiniSize Filter: FVG Threshold (minval=0.1, step=0.1).

-

Signal Inverting:

-

Select SL Type Provided by the Signal: If the SL TYPE is set to "SL Provided by Entry Signal" in the general settings section, then the SL Type set here will be used for the order.

- Not Set

- FVG Block High/Low:

- FVG 3 Candles High/Low: The high and low points of the three candles that form FVG.

-

Select TP Type Provided by this Signal

-

-

-----------Killzone Signal Parameter settings-----------

-

Turn On/Off KZ Signal as filter On Specified Period: The principle is the same as above.

-

Select Timeframe for Signal:

-

Signal Bull/Bear Pattern Usage:

- Price break KZ: Within the set KILLZONE time, the price will form a rectangular area. When the price breaks through the high and low points of this rectangular area, a signal is generated. For example, we can set the time of KZ for AsiaRange and enter long or short positions when the price breaks through the high and low points of AsiaRange.

- Prohibited trade outside the KZ time: This mode is mainly used to set the time interval for trading, without trading outside the interval.

-

Signal Entry Pattern Usage:

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

- Mean threshold Price: Use the middle price of Killzone as the open price.

-

---Killzone Begin Hour: Starting hour of the kill zone

-

---Killzone Begin Minute: Starting minute of the kill zone

-

---Killzone End Hour: Ending hour of the kill zone

-

---Killzone End Minute: Ending minute of the kill zone

-

---Killzone Label Text: This parameter specifies the KZ label text that would let easy to view on the chart.

-

---Killzone Show Last: This parameter is set to display the maximum number of KZ rectangles on the chart.

-

---Killzone Show Predict: This parameter is set to display the predicted Level on the chart.

-

Signal Inverting:

-

Select SL Type Provided by the Signal: If the SL TYPE is set to "SL Provided by Entry Signal" in the general settings section, then the SL Type set here will be used for the order.

- Not Set

- KZ ZONE High/Low: Use the high and low points of the KZ region as stop loss for orders.

-

Select TP Type Provided by this Signal

-

-

-----------Market Structure Signal Parameter settings-----------

-

Turn On/Off MarketStructure Signal as filter On Specified Period: The principle is the same as above.

-

Select Timeframe for Signal:

-

Signal Bull/Bear Pattern Usage:

- MS formed: CHOCH(MSS) and BOS formed signal.

- CHOCH formed: CHOCH(MSS) formed signal.

- BOS formed: BOS formed signal.

-

Signal Entry Pattern Usage:

- Trade at Market Price: When there is a bullish or bearish signal, immediately enter at the market price.

- Mean threshold Price: Middle price of MS structure

- MS Top/Bottom Price: The high and low points of MS structure

-

---MS Structure Algo: MS algorithm select.

-

---MS Structure Break Type: Break Type for MS.

-

---MS Structure Length(Depth): Depth for indicator to analyze market structure.

-

Signal Inverting:

-

Select SL Type Provided by the Signal: If the SL TYPE is set to "SL Provided by Entry Signal" in the general settings section, then the SL Type set here will be used for the order.

- Not Set

- Market Structure High/Low

-

Select TP Type Provided by this Signal

-

-

-----------NWOG/NDOG Signal Parameter settings-----------

-

Turn On/Off NWOG/NDOG Signal as filter On Specified Period: The principle is the same as above.

-

Select Timeframe for Signal:

-

Signal Bull/Bear Pattern Usage:

- NWOG formed and CloseP above/below NWOG

- Price callback to NWOG region

- NDOG formed and CloseP above/below NDOG

- Price callback to NDOG region

-

Signal Entry Pattern Usage:

- Trade at Market Price

- Meanthreshold Price

-

Signal Inverting:

-

Select SL Type Provided by the Signal: If the SL TYPE is set to "SL Provided by Entry Signal" in the general settings section, then the SL Type set here will be used for the order.

- Not Set

- NWOG/NDOG Block High/Low

-

Select TP Type Provided by this Signal

-

-

-----------OrderBlock Signal Parameter settings-----------

-

Turn On/Off OrderBlock Signal as filter On Specified Period: The principle is the same as above.

-

Select Timeframe for Signal:

-

Signal Bull/Bear Pattern Usage:

- OB/iOB formed: Swing OrderBlocks and Internal OrderBlocks formed signals.

- OB/iOB touched: Swing OrderBlocks and Internal OrderBlocks touched signals.

- OB/iOB break: Swing OrderBlocks and Internal OrderBlocks break signals.

- OB formed

- iOB formed

- OB touched

- iOB formed

- OB break

- iOB break

-

Signal Entry Pattern Usage:

- Trade at Market Price

- Meanthreshold Price: Meanthreshold Price of the Order Block

- OB Top/Btm Price: Top or Bottom Price of the Order Block

-

---OB iStructure Algo: Internal MS algorithm select.

-

---OB iStructure Break Type: Break Type for internal MS.

-

---OB iStructure Length: Depth for indicator to analyze internal market structure.

-

---OB sStructure Algo: Swing MS algorithm select.

-

---OB sStructure Break Type: Break Type for swing MS.

-

---OB sStructure Length: Depth for indicator to analyze swing market structure.

-

Signal Inverting:

-

Select SL Type Provided by the Signal: If the SL TYPE is set to "SL Provided by Entry Signal" in the general settings section, then the SL Type set here will be used for the order.

- Not Set

- OB Block High/Low

-

Select TP Type Provided by this Signal

-

-