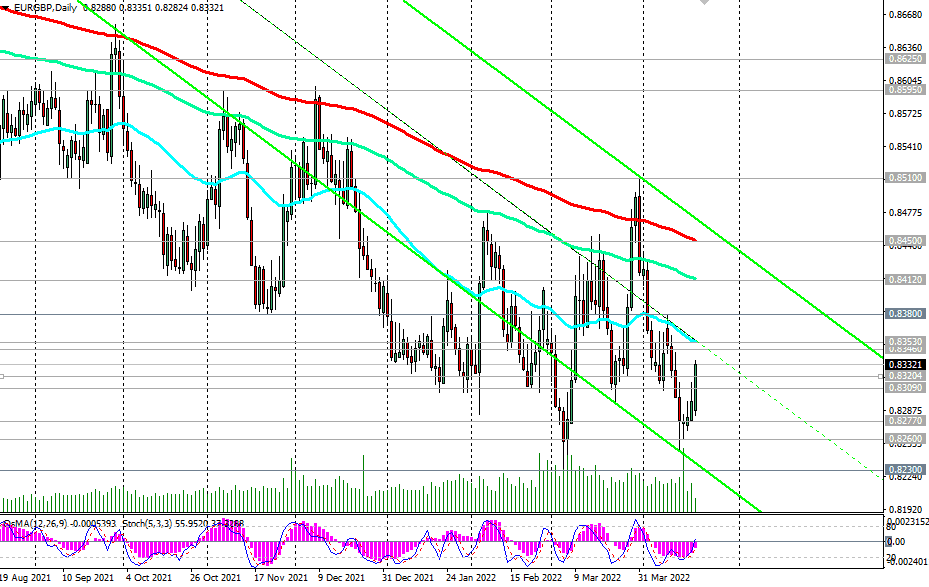

Despite the sharp rise at the beginning of today's European session, EUR/GBP remains in the zone below the important long-term resistance levels 0.8450, 0.8625, maintaining a tendency to further decline. However, at the moment there is an upward correction after reaching last week's local 5-week low 0.8249, and the current growth can be viewed as a convenient moment to enter short positions, both "by-the market" and when reaching resistance levels 0.8340, 0.8346, 0.8353.

For more cautious traders, a sell signal will be a breakdown of the support level 0.8309.

Events in Ukraine could be a stagflationary shock for Europe, slowing economic growth while pushing up prices. This, according to many economists, makes it harder for the ECB to roll back stimulus measures taken during the pandemic in order to regain control of inflation without undermining the economic recovery.

At the same time, the euro may come under additional pressure if the second round of voting in France (April 24) is won by Marie Le Pen. Macron's widely anticipated victory could probably reassure the markets somewhat. However, it will not be a turning point in the dynamics of the euro, which will be prone to further weakening, including due to the above factors (further deterioration of the geopolitical situation in the Eurozone and the rapid growth of inflation).

Support levels: 0.8309, 0.8300, 0.8277, 0.8260, 0.8230, 0.8200, 0.8145

Resistance levels: 0.8340, 0.8346, 0.8353, 0.8380, 0.8400, 0.8412, 0.8450

*) see also “Technical analysis and trading recommendations” -> Telegram

**) Get no deposit StartUp bonus up to 1500.00 USD

Source: InstaForex