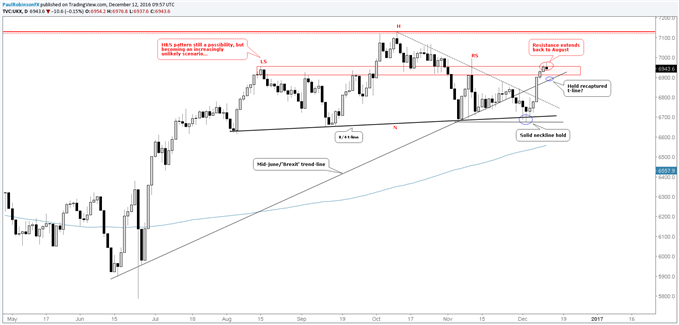

FTSE 100: Resistance in the Way, BoE Later in the Week

FTSE 100: Resistance in the Way, BoE Later in the Week

Welcome to my products:

https://www.mql5.com/en/users/soubra2003/seller

What’s inside:

- The FTSE 100 trading around key resistance zone

- Lagging nature of the index makes it a target for selling, less appealing as a buy

- GBP bucking USD strength isn’t helping

Not a lot has changed since Thursday morning when we last focused on the FTSE 100. The big rip from neckline support has the index challenging a key area of resistance at this time. As we said the other day, a head-and-shoulders formation is still a possibility, but odds of it triggering are diminishing as general global risk trends are helping the lagging UK index stay buoyed.

Make no mistake about it though, along the curve of performance the FTSE isn’t acting nearly as well as indices in Europe (DAX & CAC), Asia (Nikkei 225), and North America (S&P 500). Strength in GBP isn’t helping, as it bucks USD strength for the most part. Given the extent of international exposure the companies of the 100 index have, a stronger pound reduces profits from abroad as they are turned back into the local currency.

If we see a softening of general risk appetite and/or more GBP strength, the FTSE would be the index we would expect weakness to set into most pervasively. A firm push above the ~6917/55 barrier on a closing bar basis and hold as support may help increase odds of seeing the UK index make a strong run at record highs over the 7100 mark.

On a dip watch how the recaptured June trend-line is able to hold. The FTSE may consolidate between support and resistance before trying to move higher.

Heads up: The BoE meets on Thursday and will release its decision on monetary policy at 12:00 GMT.

FTSE 100: Daily