Nonfarm Payrolls Preview: Wages Again in the Spotlight

Heading into a new US Nonfarm Payroll release, the American dollar has lost the momentum triggered a couple of week ago by the FED, suggesting a rate hike is possible this June. Yet as the days went by, macroeconomic data coming from the world's largest economy showed that the economic developments are not enough to support such economic policy move. The manufacturing sector continues to lag, inflation remains subdue, and only the services sector gives some signs of life.

The initial enthusiasm over a rate hike next June has been fading during these past two weeks. Can US NFP revive them? Well, that would be only possible if wages give a strong upward surprise, alongside with a much better-than-expected headline reading. Expectations are of 162,000 new jobs added in May, whilst the unemployment rate is expected to have fallen to 4.9% from current 5.0%. Wages, yearly basis have printed 2.5% in April, so anything above this level should be understood as dollar-supportive.

The ADP private survey released this Thursday showed that the private sector added 173,000 new jobs in May, slightly below expected, but above April's figures. Weekly unemployment claims fell to 267K, whilst the 4-week moving average was 276,750, a decrease of 1,750 from the previous week's unrevised average of 278,500, marking the 65 consecutive week of initial claims below 300,000, the longest streak since 1973.

Anyway, the employment sector is not an issue. It's always inflation what stands in the way of a FED rate hike. That's why a continued growth in wages is required to support a FED move, as higher wages will mean higher consumption, and more consumption should support growing inflation.

EUR/USD levels to watch

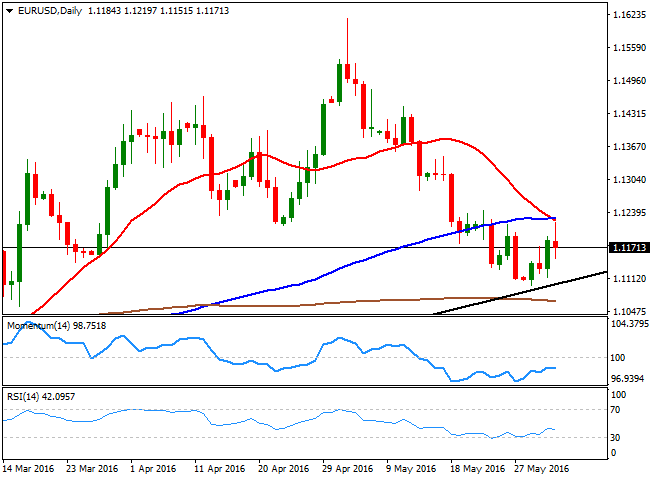

The EUR/USD pair has spent this week consolidating between the 1.1100 and the 1.1200 levels, after falling over 500 pips in the last May. The technical picture keeps favoring the downside, as in the daily chart, selling interest has surged on approaches to the 1.1230 region, where the 20 DMA heads sharply lower and converges with the 100 DMA. This is then, the level to beat to see the pair gaining additional ground post-Payrolls, with the immediate technical resistance then in the 1.1290/1.1300 region. Further gains beyond this level seem unlikely and if those occur, are meant to be short-lived, given that the EUR is overall weak. If the dollar fades with NFP better options will be the AUD or even the JPY.

On the other hand, the

pair has an immediate support at 1.1120, but a more relevant one at

1.1090, a daily ascendant trend line coming from November 2015 low. An

outrageously positive NFP should trigger stops below this last, and see

the pair extending initially towards 1.1040, to end up testing the

1.1000 critical support.