Yellen’s Comments Boost USD

Market Brief

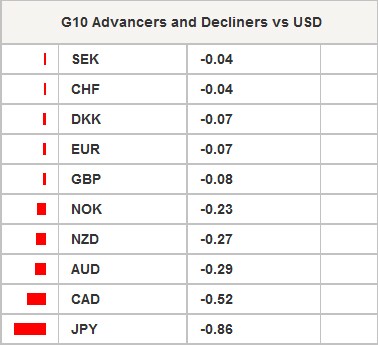

In the wake of another batch of disappointing economic data from the US, Janet Yellen said on Friday that an interest rate hike should be appropriate in the coming months but did not give further details about the timing. As a result, traders pushed the dollar higher in anticipation of a summer rate hike in spite of the fact that the second estimate of Q1 personal consumption printed flat at 1.9%q/q versus 2.1% consensus and that the annualised GDP for Q1 came in at 0.8%q/q, missing the median forecast of 0.9% but up from 0.5% first estimate. The US dollar rose the most against the Japanese yen (+0.86%) and the commodity currencies as crude oil dipped roughly 1%.

We think that the market is getting ahead of itself by aggressively pricing in a summer rate hike. In our view, “in the coming months” does not mean that the Fed will hike in June, or in July but rather after the summer. We therefore expect the dollar rally to lose steam in the coming months as the Fed remains sidelined.

On Monday in Tokyo, the rally in USD/JPY accelerated another notch amid Yellen’s speech as the pair reached 111.39, up from 109.48 on Friday, in spite of relatively encouraging data from the retail sector. Retail printed flat in April, beating market’s forecast for a 0.6%m/m contraction. On the technical side, a first resistance can be found at 111.91 (high from April 24th), while on the downside a support lies at 109.11 (low from May 23rd).

In the equity market, Asian regional indices were almost all trading in positive territory. Japanese equities were leading the rise with the Nikkei up 1.39% and the broader Topix index up 1.19% amid comments from Prime Minister Abe that the government plans to (again) delay an increase in sales tax until late 2019. This decision should bring the question of a cut in Japan’s credit rating back under the spotlight as the government struggles to balance the budget.

In mainland China, the CSI 300 edged up 0.08%, while Hong Kong’s Hang Seng rose 0.56%. In Taiwan, the TWSE surged 0.85%. Thailand’s BGK was up 0.82%, while in India the Sensex edged up 0.25%. In Europe, most equity futures are blinking green on the screen, following the Asian lead. US futures are also pointing to a higher open.

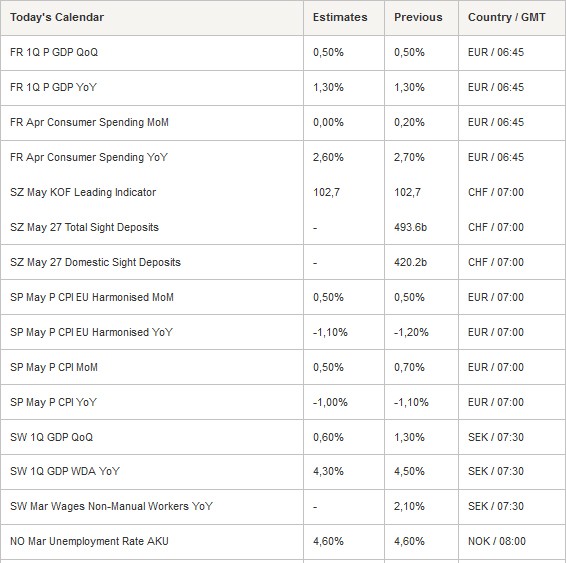

Today traders will be watching GDP from France and Sweden; KOF economic indicator and sight deposits from Switzerland; CPI from Spain and Germany; PPI from Italy; consumer confidence from the Eurozone; industrial product price from Canada.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 17068.02 | 1.39 |

| Hang Seng Index | 17068.02 | 0.56 |

| Shanghai Index | 20692.11 | 0.28 |

| FTSE futures | 2828.929 | -0.03 |

| DAX futures | 6251 | 0.6 |

| SMI Futures | 10334 | 0.3 |

| S&P future | 8315 | 0.22 |

| Global Indexes | Current Level | % Change |

| Gold | 1202.15 | -0.89 |

| Silver | 15.95 | -1.73 |

| VIX | 13.12 | -2.31 |

| Crude wti | 49.2 | -0.26 |

| USD Index | 95.92 | 0.42 |

Currency Tech

EURUSD

R 2: 1.1349

R 1: 1.1243

CURRENT: 1.1118

S 1: 1.1058

S 2: 1.0822

GBPUSD

R 2: 1.4969

R 1: 1.4770

CURRENT: 1.4608

S 1: 1.4404

S 2: 1.4300

USDJPY

R 2: 113.80

R 1: 111.91

CURRENT: 111.27

S 1: 108.23

S 2: 106.25

USDCHF

R 2: 1.0257

R 1: 1.0093

CURRENT: 0.9950

S 1: 0.9751

S 2: 0.9652

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot