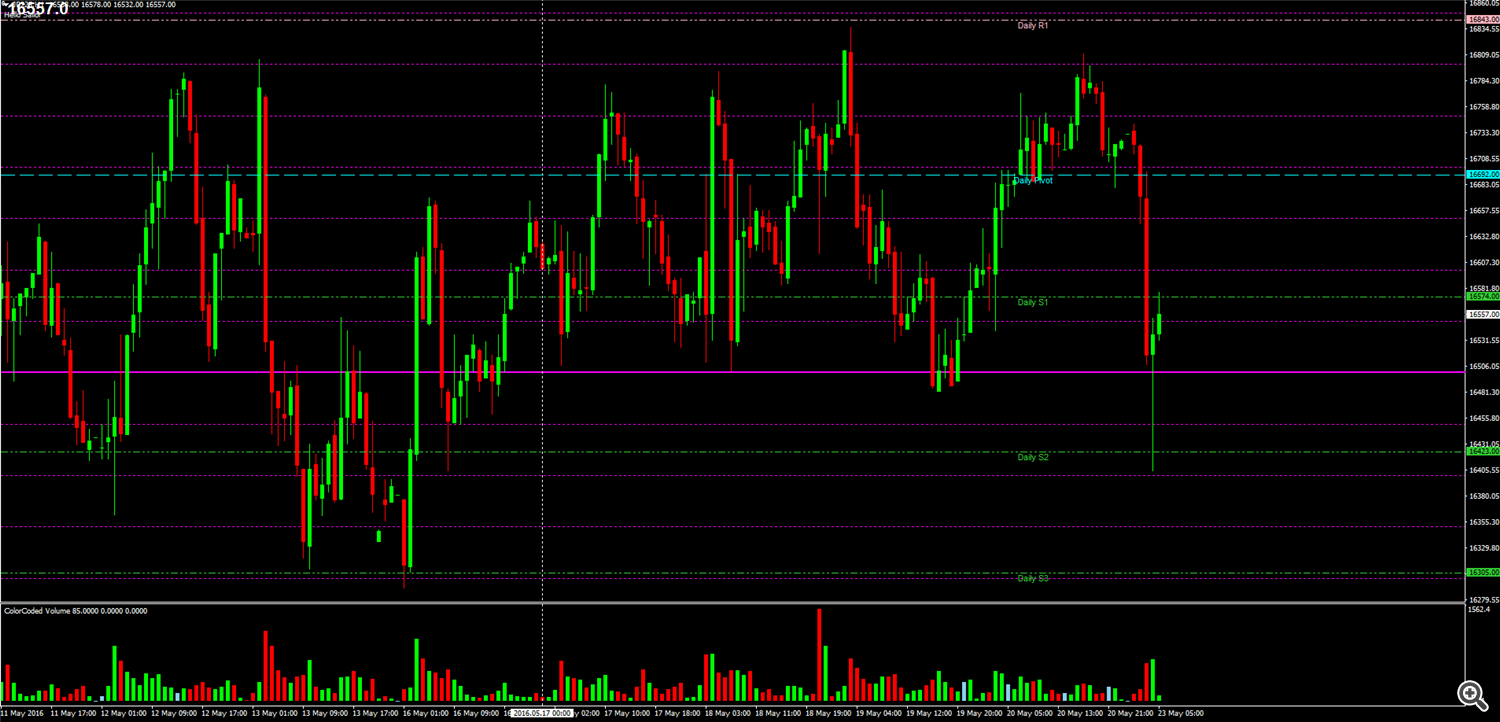

Nikkei 225 Under Pressure, Bargain Hunting at Lows

The Japanese benchmark index Nikkei 225 has been under constant pressure

ever since the Tokyo open, and after trading at a day low circa

16,450.00, falling as much as -1.40%, the index is now on recovery mode,

down 1%. The hourly chart showsa sizeable bullish reversal bar in what

appears some bargain hunting action.

Japanese trade balance reinvigorates equity sellers

Ahead of today's Tokyo open, Japan published its latest trade balance,

which came at 823.5B vs.540.0B estimate and 754.2B prior, a much better

than expected trade surplus, although when looking further into the

details, one can notice that the increased surplus was due to a larger

than expected fall in imports (-23.3% YoY vs -19.2%), which was

accompanied by declining exports as well, coming at -10.1% vs -9.9%.

The data has been perceived as a sign of domestic weakness by investors,

and despite shares outside Japan held steady (see MSCI's index of

Asia-Pacific), the Nikkei 225 decoupled from the steadier performance in

regional shares indexes.

Japanese data taken at face value?

In order to understand why Japanese equity investors might have been

selling out shares quite aggressively today, it is worth reminding

readers of the case made last week follwing improved Japanese growth

figures.

As I wrote, one of the key takeaways from a much better-than-expected Q1 preliminary Japanese GDP,

was that, "while in the past poor Japanese data has been attributed to

buying opportunities domestically in anticipation of further BOJ action,

the fact that the Eurozone and US are starting to also show improving

growth data, might suggest that Japanese investors may now treat

good/bad news in Japan at face value, as catalyst for further

upside/downside in equities."

Nikkei key levels

The sharp decline in the Nikkei 225 found a temporary bottom just ahead

of 16,400.00 (daily S2), with immediate resistance now located around

16575/16.600.00 (Daily S1). A further recovery may see the index target

16,700 level, a round number that coincides with today's daily pivot.

Should the downside pressure resume, past today's day lows, 16,300.00

look like the next major intraday target for the bears.