Analytical Review of the Stocks of Microsoft Corporation

Microsoft Corporation, #MSFT [NASD]

Technologies, Software & Services, USA

Financial performance of the company:

Index – DJIA, S&P 500; Beta – 0.93;

Capitalization – 411.28;

Return on asset — 6.50%;

Income – 25.7 В;

Average volume – 39.67 М;

P/E – 37.14;

ATR — 1.52.

Analytical review:

- The company ranks the fourth on capitalization among the issuers traded in the American stock market;

- On Friday 22 April the company issued a report for Q3 of the fiscal year of 2016. According to the press-release, company’s revenue fell by 5.5% to 20.50 billion USD, Microsoft stated that net profit in the reporting period was 0.47 USD per share against 0.61 USD per share a year earlier;

- At the press-conference the company stated that company’s performance was below market expectations. Poor result was caused by strong USD and decline in sales of PC. However, performance in the other segments of Microsoft was positive: revenue of the cloud service Azure and in the sector of Productivity has increased by 3.3% and 1% respectively;

- Operating growth profit in the sector of Personal Computing (Windows, Xbox and Surface tablets) has grown by 50%. The number of users of Windows 10 has exceeded 250 million people – the highest number in the history of the corporation;

- The company will divert business activity from the traditional software and focus on cloud computing and mobile applications. The company plans to invest significant funds in the development of promising sectors, such as Azure, Office 365 and Dynamics CRM Online. In the coming quarters Microsoft expects the rise in revenue and net profit.

Summary:

- The results demonstrated in the last report were worse than expected. Nevertheless, revenue and net profit of Microsoft were higher than those of the nearest competitors. Company has strong growth potential;

- The company continues to diversify business, investing to high-tech companies and to development of new technologies;

- It is likely that in the near future company’s quotes will go up.

Trading tips for CFD of Microsoft Corporation

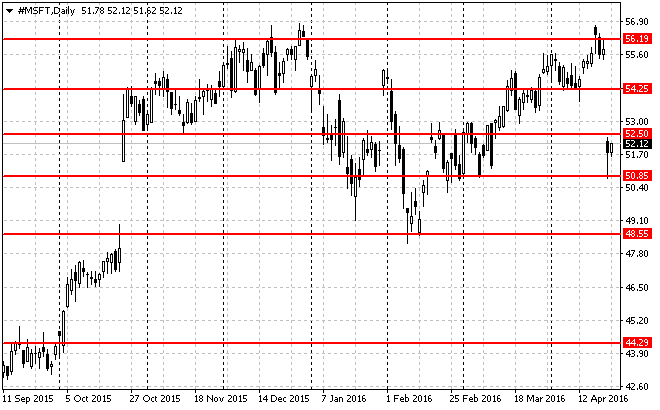

Long-term trading: the moment the issuer is traded between support and resistance levels of 50.85 - 52.50 USD. After breaking out and testing of the resistance level of 52.50 USD and in case of the respective confirmation (such as pattern Price Action), we recommend to open long positions. Risk per trade is not more than 2% of the capital. Stop order can be placed slightly below the signal line. Take profit can be placed in parts at the levels of 54.25 USD, 56.00 USD and 58.00 USD with the use of trailing stop.

Short-term trading: on Friday, 22 April the issuer started trading with the gap down, which was caused by poor results demonstrated in the company’s report. After breaking out and testing of the local resistance level of 52.25 USD, it will be advisable to open long positions. Risk per trade is not more than 3% of the capital. Stop order can be placed slightly below the signal line. Take profit can be placed in parts of 53.00 USD, 53.80 USD and 54.50 USD with the use of trailing stop.