Analytical Review of JPMorgan Chase & Co.'s Shares

JPMorgan Chase & Co., #JPM [NYSE]

Finances, Banking, USA

Financial performance:

Index –DJIA, S&P 500; Beta – 1.65;

Capitalization -212.84В

Assets profitability - 0.90%;

Revenue - 22.41B; Average volume – 19.56 М;

P/E - 9.64; ATR – 1.86

Analytical review:

- The company has the 4th biggest capitalization in the financial sector among the issuers listed on the US stock market.

- Yesterday, the company provided a report into the 1st quarter 2016. According to the company's press release, its net profits dropped by 6.7% from 5.91 billion USD to 5.52 billion USD during the period under report. The EPS factor amounted to 1.35 USD against a year-ago value of 1.45 USD.

- The company's management announced at the press conference that the financial results were better than expected due to a growth of lending in the consumer business sector. The company’s revenue amounted to 24.1 billion USD against a forecast of 23.8 billion USD. The EPS projected value equalled 1.26 USD.

- JPMorgan is planning to cut its private asset management workforce by more than 5% in Singapore and Hong Kong. The company intends to focus on more important clients whose investment volumes exceed $10 million.

- Large investment funds and banks (Atlantic Equities, Argus, Keefe Bruyette) forecast that the company's quotes will grow up to 70 USD.

Summary:

- Despite the decrease in net profit, the company's results are better than expected and the growth potential is quite significant. Restructuring the company's departments will contribute to better financial performance. Large investment funds forecast a positive trend for the company's shares.

- Thus, we expect that the company's quotes will be rising in the nearest future.

Trading tips for JPMorgan Chase & Co.'s CFDs

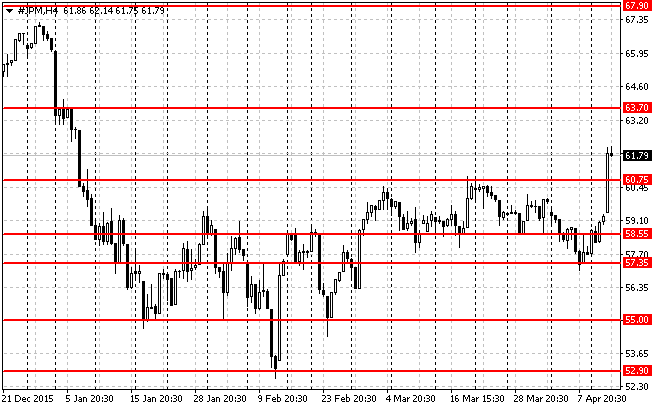

Medium-term trading: the issuer has broken a powerful resistance level of 60.75 USD and steadied above. Once a mirror support level of 60.75 USD is tested and relevant confirming signals appear (PriceAction patterns, for example), we recommend searching for market entry points to open long positions. Risk per trade: no more than 2% of equity. Stop order shall be placed a bit below the signal line. We recommend that prospective profits should be fixed partly at the levels of 63.50 USD, 65.00 USD and 67.00 USD, with Trailing Stop applied.

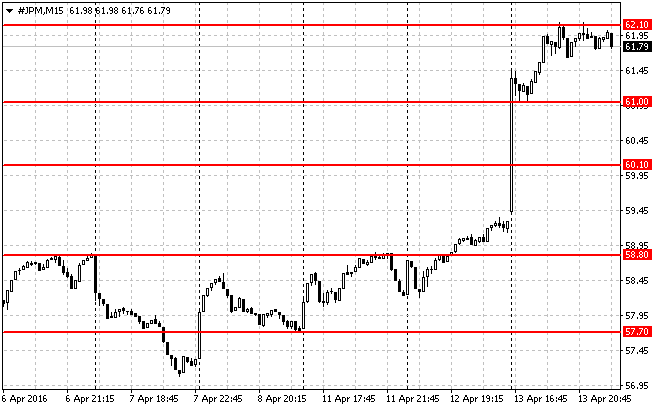

Short-term trading: the publication of the report into the 1st quarter 2016 lead to a market upturn. JPMorgan's shares grew in price by over 4% during yesterday's trading session. On the 15M time-frame, the issuer is currently trading near a local resistance level of 62.10 USD. Once the level is broken and tested, we advise you to search for market entry points to open long positions. Risk per trade: no more than 3% of equity. Stop order shall be placed a bit below the signal line. We recommend that prospective profits should be fixed partly at the levels of 62.50 USD, 63.00USD and 63.50 USD, with Trailing Stop applied.

The material has been provided by LiteForex - Finance Services Company - www.liteforex.com