Nonfarm Payrolls: Who Cares?

A new month starts and with it we get a

new US Nonfarm Payroll report. The US economy is expected to have added

205K new jobs in March, the unemployment rate is expected to remain

steady at 4.9%, while wages are expected to pick up after the decline

seen in February.

But honestly, who cares about the Nonfarm Payroll report? It has been clear that over the past year the release has done little to affect FED's decision.

US policy makers are clearly comfortable on how the employment sector

is doing and is hardly a factor these days when it comes to consider the

upcoming economic policy. Of course, if the reading is extremely

disappointing, it will play against the greenback. But a reading in line

with expectations, or even better, let's say, with 240K new jobs added,

will hardly help the American dollar to change its bearish bias.

The once considered most relevant part

of the report, the headline, won't be as relevant as wages, as salaries

are directly correlated with consumption and therefore inflation. And

this last is the one and only concern of the FED, regardless whatever

they say on the matter. In February, US wages declined 0.1%

compared to the previous month, resulting in a 2.2% annual gain. Data

released this Monday showed that personal income rose 0.2%, but the

gains came in areas that won’t do much to boost consumption, with the

largest add in rental income that rose 1%. Government social benefits

rose by 0.5%, while employer contributions to employee pensions and

insurance rose 0.3%.

And without consumption inflation will remain depressed and the FED will maintain the on-hold stance.

The most likely scenario is that the

report will come in line with expectations, given that the ADP survey

released on Wednesday showed that the private sector added roughly

around 200,000 new jobs in March. Weekly unemployment claims have

resulted slightly higher this past week, reaching 276K, but the 4-week

average decreased to 2.173M, quite encouraging.

Anyway a positive reading may boost the greenback in the short term,

particularly if wages beat expectations, but won't be enough. Dollar's

trend depends on the FED and this last depends on inflation. Payrolls

are no longer the main market mover, and is time to say it.

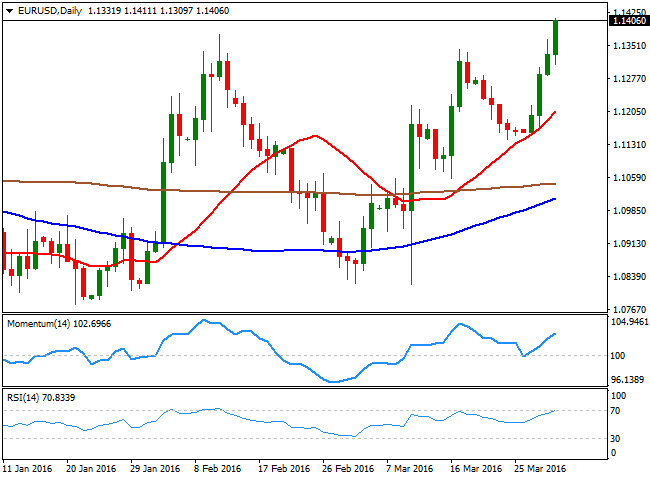

EUR/USD levels to watch

The EUR/USD pair trades around 1.1400, a

fresh year high as the market keeps selling the greenback. The daily

chart shows that the technical indicators are reaching overbought

territory, whilst the 20 SMA has offered a strong support earlier this

week and currently stands 200 pips below the current level, supporting

the ongoing bullish trend, although too far away to be relevant on

Friday. There is a major static resistance in the 1.1460, as the pair

retreated from it multiple times during the past 2015. Should the price

break above it, large stops will be triggered, fueling the advance up to

1.1530, February 2015 monthly high. A weekly close above the 1.1500 level, should leave doors open for an advance up to 1.1710 next week.

The immediate short term support is at 1.1375, last February high, followed then by the 1.1280/90 region. A break below this last can signal a deeper downward corrective movement towards 1.1200, where buying interest is expected to resume.

USD/JPY levels to watch

The Japanese yen holds to its recent

strength and trades firmly lower, with selling interest surging on

approaches to the 113.00 level, which means that a strong report and a

break above this level is required to begin thinking on a bullish move.

The daily chart shows that the technical readings are far from

supporting a recovery, but more likely signaling a retest of the 111.00

region, given that the 100 and 200 SMAs have accelerated their declines

far above the current level, while the RSI heads south around 42.

Below 111.90, the pair has little in the way until 111.00

while below this last, the decline can extend another 100 pips before

the week is over, particularly if the US employment report disappoints

big. Some sort of intervention coming from the BOJ could be expected in

this case, as the level is probably the line in the sand for policy

makers.

Above 113.00 on the other hand, the price can extend up to 113.70 first and 114.60 later, but it will take a recovery beyond 115.00, something quite unlikely at this point, to see an u-turn in the pair.

by

Valeria Bednarik

|

FXStreet

(Market News Provided by FXstreet)